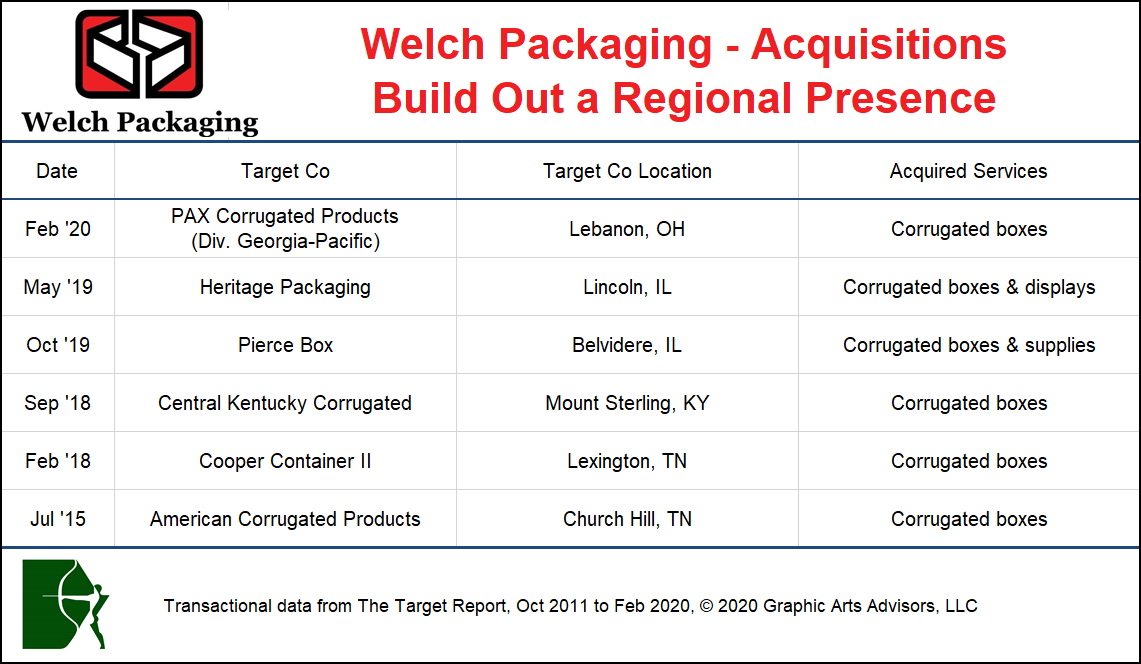

The Welch Packaging Group stepped up and acquired PAX Corrugated Products from Georgia-Pacific. The acquired company’s product line, corrugated cartons, is consistent with every company that Welch has acquired in the 35 years since the owner established the company with only four employees and rudimentary box making equipment. With this latest acquisition, Welch Packaging now serves the Midwest market from 16 locations and three distribution centers with over 1,300 employees.

The Welch Packaging Group stepped up and acquired PAX Corrugated Products from Georgia-Pacific. The acquired company’s product line, corrugated cartons, is consistent with every company that Welch has acquired in the 35 years since the owner established the company with only four employees and rudimentary box making equipment. With this latest acquisition, Welch Packaging now serves the Midwest market from 16 locations and three distribution centers with over 1,300 employees.

The steady drum beat of acquisitions executed by Welch may very well represent one of the clearest and most highly focused growth-by-acquisition strategies in the printing and related industries: corrugated products, custom production, all within 550 miles of the home base in Elkhart, Indiana. Not once has the owner veered off the path of building a super-regional powerhouse connected by one common thread, corrugated products.

While this acquisition was not in any way a strategic departure for Welch, it does represent a change in tactic as this seller was not a family or entrepreneur, rather the seller was a large privately owned company. Georgia-Pacific, owned by Koch Industries, acquired the PAX Corrugated Products company not so long ago, in August 2017. However, at the time, PAX was family owned, and presumably has retained the feel of a cohesive “family-like” unit within the short hold time by Georgia-Pacific. In any event, the deal is still on point strategically for Welch Packaging Group.

In addition to representing excellence in executing a growth-by-acquisition strategy, the Welch Packaging Group is another example of the emerging trend we noted a few months ago; financially healthy and operationally efficient regional companies leapfrog to an adjacent metro market and build out an additional geographic market position via a series of strategically sound acquisitions. (See The Target Report: Commercial Printing: Consolidation or Regional Expansion?)

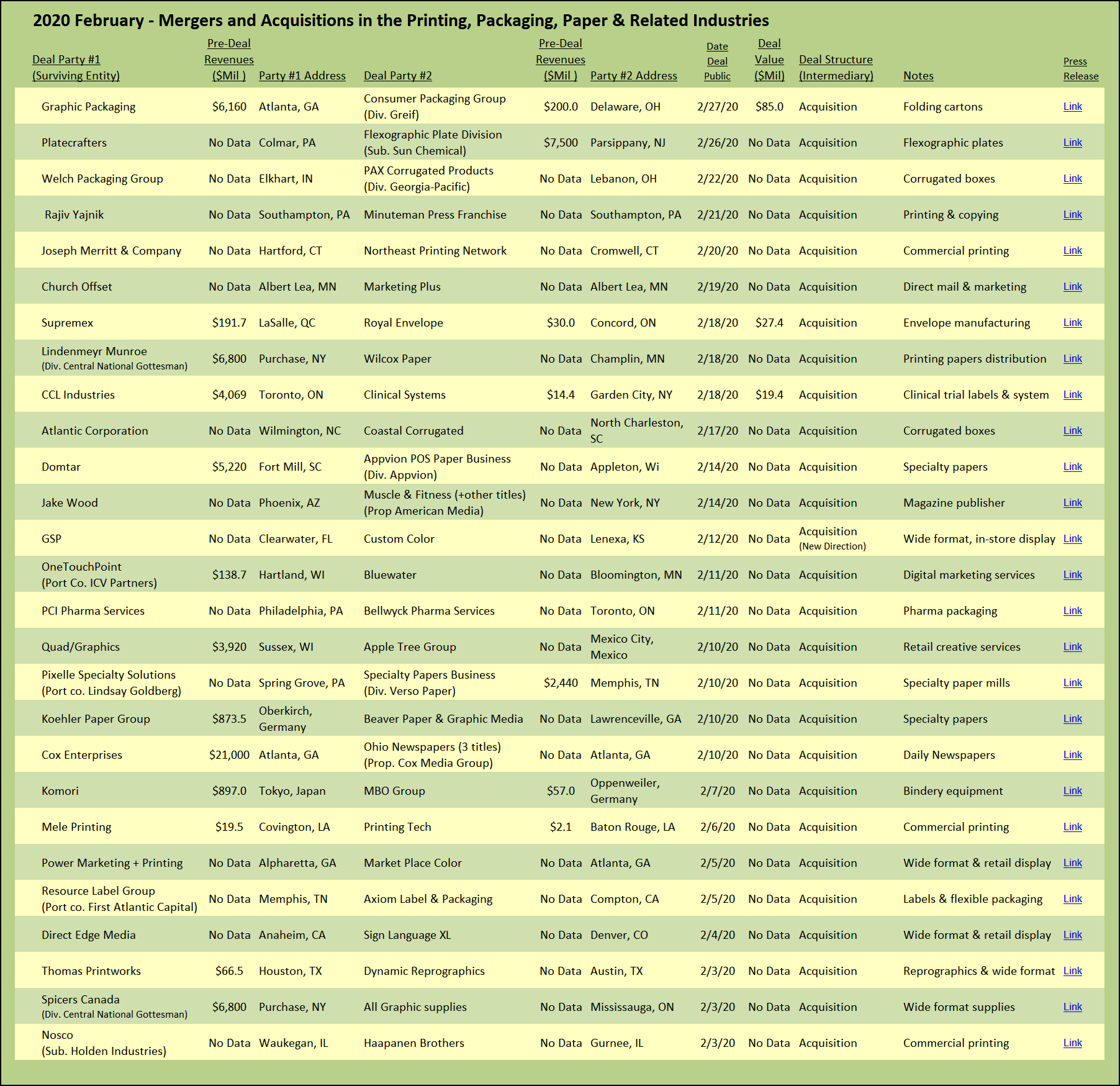

Activity Picks Up in Wide Format Segment

We have noted in our last two annual recaps that the landscape is changing in the wide format segment (see The Target Report Annual Recap: August 2019and The Target Report: It’s Back to School Time, August 2018). Taken together, a multitude of transactions, including a notable number of bankruptcy filings, non-bankruptcy plant closures, and a steady number of acquisitions, indicated that the market for wide format printing services was getting more competitive. Digital wide format printing equipment is now ubiquitous, including installations at many commercial printing establishments that flocked to the higher margins promised by wide format services. Change is afoot in wide format.

As pricing pressure increases at the lower end of the product offerings (e.g. small signs, banners, etc.), the larger and more sophisticated wide format providers are increasingly focused on providing value-added services such as image enhancement, image repurposing, onsite installation and managing the logistics required for large campaign launches.

GSP, a multi-location wide format service provider headquartered in Clearwater, Florida, acquired Custom Color, based in Lenexa, Kansas. The merged companies provide retail marketing graphics and in-store displays. GSP announced plans to continue operating at the acquired facility in Kansas, adding to its other locations in Utah and Wisconsin. Much more than simply a wide format printing company, GSP is positioned to provide a full range of services dedicated to retail environments, from photography to managing complete in-store installation.

Power Marketing + Printing, an Alpharetta, Georgia-based diversified graphics company, acquired Atlanta-based Market Place Color. The acquired company brings extensive wide format production capabilities to the combined entity, including production of backlit transparent displays. The transaction strategically expands the buyer’s breadth of services via an acquisition, versus the other option of developing the new services internally. In one fell swoop, Power Marketing + Printing acquires decades of experience in analog and digital wide format printing services.

Direct Edge Media, headquartered in Anaheim, California, announced the purchase of Sign Language XL, located in Denver, Colorado. The acquired company specializes in the production of event venue signage, out-of-home billboards and point-of-purchase signage. Unlike the Power Marketing + Printing transaction, this deal represents the more common rationale behind most acquisitions in the printing industry; consolidating competing operations into a unified more efficient whole. Direct Edge Media will be moving its existing Denver team into the Sign Language XL location. The previous owner of Sign Language XL was AEG, a sports and live entertainment company that owns, manages or consults with arenas, stadiums, convention centers and performing arts centers to produce music, sports and other events. Previously providing in-house graphic support to AEG, the spun-off company will continue to provide services to AEG, now a customer.

Thomas Printworks, a multi-location reprographic, printing and wide format company based in Houston, has picked up Austin-based Dynamic Reprographics. Both companies started as providers of blueprints and plan documents to the AEC market (architects, engineers and construction companies). The blueprinting business evolved from traditional (and noxious) ammonia-based analog blueprints into digital technologies that produce wide format black and white plan documents, accompanied by toner-based bid and specification books. As digital technologies took hold and color was introduced into products serving the AEC market, it was a small leap for reprographic shops (as blueprint shops became known) to jump into the commercial printing business while maintaining their core focus on the AEC market. (Another example of the much-discussed “convergence” occurring in the printing industry.) Mirroring the nature of the AEC professions, reprographic shops have been essentially a local business. Consistent with this, roll-ups in the reprographic business are characterized by many locations, each serving a local clientele. Thomas Printworks, now boasting in excess of $66 million of revenue, maintains this locality-based characteristic, with 28 locations across four states.

Spicers Canada, a division of Central National Gottesman, announced the acquisition of All Graphic Supplies, a distributor of wide format supplies headquartered in Mississauga, Ontario. All Graphic Supplies brings seven locations across Canada and the Caribbean to the Spicers distribution network. In another trend we see in the printing industry, paper distributors, faced with declining demand for their core products, are acquiring distributors that supply multiple printing segments in addition to their traditional printing company customers, including sign graphics, textiles, digital label and industrial printing companies.

View The Target Report online, complete with deal logs and source links for February 2020

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free