The demand for luxury packaging across the world continues to increase, driven by the rising popularity of premium goods in the cosmetics and fragrances, alcoholic drinks, and watches and jewelry sectors. Sustainability, e-commerce, and material trends are driving the luxury packaging market and will continue to shape it over the next five years.

These trends and additional market influences are explored in Smithers Pira’s new market report, The Future of Luxury Packaging to 2024. According to Smithers report data, the global market for luxury packaging is valued at $15.38 billion in 2019, having risen by almost 4% from 2018. Growth is forecast at a rate of 3.0% year-on-year to 2024, yielding a market worth $17.83 billion in that year.

Sustainability’s Role in Packaging

Impactful changes to luxury packaging are expected due to factors such as environmental concerns. These concerns are leading to declining demand for plastic packaging, as well as increased consumption of goods from online sources, and decreased consumption of products such as tobacco.

More stringent legislation aimed at curbing packaging waste and encouraging greater recycling is appearing across much of the world. This trend is expected to continue, driven by growing consumer concerns over issues such as recyclability, biodegradability, and use of natural resources. Because of this, sustainability has become a core element of strategy for packaging manufacturers, in both the mainstream and luxury sectors.

The luxury packaging industry has been addressing the sustainability issue by reducing the amount of materials used (i.e., lightweighting), as well as striving to include more recycled material in its products.

An Increase in E-Commerce Sales

Due to the enormous consumer shift to online shopping, packaging companies will increasingly be required to develop solutions tailored to the e-commerce industry. Suppliers must also address consumer concerns, such as a perceived use of excessive packaging by many online retailers, as well as the growing need for returnable packaging options to improve convenience for the consumer.

Smithers’ data shows that in 2018, online sales of luxury goods were worth an estimated $31 billion, up by 13% from the previous year and equivalent to 9% of the overall luxury goods market, a figure projected to increase to almost 12% by the middle of the next decade. The expansion of e-commerce continues to impact the global packaging industry, driven by the ongoing growth of companies such as Amazon and Alibaba.

Materials Trends

Paperboard, glass, plastic, and metal are the key materials in luxury packaging. Plastic growth was highest in 2018 with an increase of 5.7% in value terms, forecast to increase by an annual average of 5.5% during the 2019–24 period. Paperboard will dominate in 2019 with value sales worth well over $6 billion, followed by glass and plastic. In volume, glass currently accounts for a leading 57.5% of the global market due to its heavy nature. The paperboard sector accounts for an additional 25.6% of global market volume, ahead of plastic (8.2%) and metal (6.4%).

The dominance of these materials is reflected in the widespread use of key packaging products used in the luxury market—notable examples include folding cartons (paperboard), glass and plastic bottles, glass jars, and metallic gift tins.

Applications

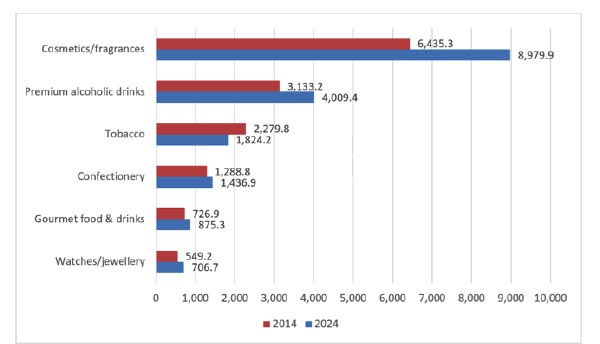

When designing packaging for luxury items, the products must be taken into account, as well as other factors, including high-quality materials, finishes, decoration, and innovative shapes. Major luxury packaging industries include cosmetic and fragrance, tobacco, confectionery, premium alcoholic drinks, gourmet food and drinks, and watches and jewelry. Some of the largest sectors in both value and volume terms are those which appeal to a wide range of consumers.

In value terms, the cosmetics and fragrances sector is the market’s largest segment, with sales worth $7.15 billion in 2019 and a market value forecast to average 4.7% in the years leading up to 2024. In 2019, the cosmetics and fragrances sector accounts for a leading 46.5% of global market value. Also noteworthy, the market value for premium alcoholic drinks grew by almost 4% in 2018, but along with the tobacco industry, it is expected to decrease over the next five years.

Global Interest in Luxury Goods

Due to growing consumer interest in luxury products supported by the growing middle class, all regions except South and Central America experienced growth in volume sales of luxury packaging between 2014 and 2019. Western Europe experienced the most growth, ending 2019 as the largest market. With sales worth $4.87 billion, the world’s second largest regional market in 2019 is Asia-Pacific where affluent urban consumers in Chinese and Indian markets are turning in greater numbers towards products such as premium cosmetics and fragrances, often via e-commerce channels. Western Europe is set to slip to second place, behind Asia Pacific, by 2024.

Sales growth is expected to remain more restrained in Western Europe and North America within the next five years. North America is dominated by the US, which remains the world’s largest single market for luxury packaging at present—however, between 2019 and 2024, growth is set to lag well below many less developed countries, slipping to second place, behind Asia Pacific.

China remains the world’s most dynamic performer, with sales presently increasing by an annual rate of more than 20%. As a result, China’s share of global sales is forecast to increase to almost half by 2025. Many of the world’s leading brands of luxury goods are tapping into increased demand from younger Chinese consumers, often with the aid of social media and online purchasing.

Global luxury packaging market by region ($ million), 2014 and 2024

Source: Smithers Pira

For more information about the Smithers Pira market report The Future of Luxury Packaging to 2024, including a dedicated analysis of the impact of sustainability criteria and e-commerce trade on luxury packaging design, visit https://www.smitherspira.com/industry-market-reports/packaging/future-of-luxury-packaging-to-2024.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free