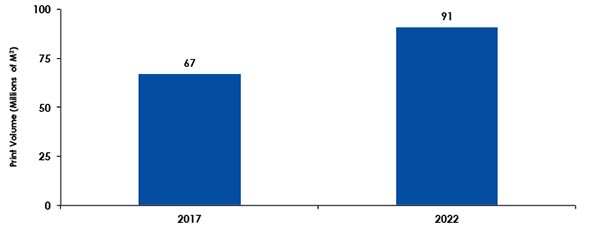

- InfoTrends expects the soft signage market to achieve a CAGR of 6% between 2017 and 2022, reaching 91.3 million square meters of output by the end of the forecast period.

- InfoTrends believes that the DTG market will experience a strong CAGR of 13% between 2016 and 2021, reaching a global value of nearly $10 billion.

- Soft signage and DTG applications tend to have higher profit margins than most applications in commercial printing.

By Ryan McAbee

Introduction

The commercial printing market is big, but the market for textiles is huge—and growing with the population. From the clothes we wear to home décor in the places we live, textiles are all around us. In fact, industry data aggregator MarketLine estimated the value of the global textile market at $970.4 billion in 2016. Nearly half of the market (44%) is apparel, a third is décor, and the rest is industrial applications.

Although most textiles are still printed conventionally, a small but growing percentage are adopting digital production to accommodate short runs, fast turnarounds, or new products. The market is supported by a complex and well-established textile supply chain, and printers (known as “fabric finishers” in industry speak) are only a very small component. For the most part, commercial printers are locked out of the existing supply chain. Commercial printers should therefore focus on more accessible textile segments that are similar to applications they already produce, such as textile-based sign and display graphics and direct-to-garment (DTG).

Textile Sign and Display Graphics

Often referred to as soft signage, textile sign and display graphics represent a solid opportunity for commercial printers. According to Keypoint Intelligence – InfoTrends’ wide-format consulting service, the soft signage market is expected to achieve a compound annual growth rate (CAGR) of 6% between 2017 and 2022, reaching 91.3 million square meters of output by the end of the forecast period. While more than 70% of the market’s output is produced using sublimation, latex and UV printing technologies are increasingly being used to create sign and display applications on textiles. To take advantage of this market opportunity, print service providers must match their offerings to the demand within their existing customer base or their target markets.

Figure 1. Growth Expectations for Soft Signage

Source: Wide Format Value of Print Forecast: 2017 - 2022, Keypoint Intelligence – InfoTrends 2018

The first step is evaluating the vertical markets served to determine which applications are most appropriate and which ones establish the production requirements. For example, universities are more likely to need banners and backlit signs, which do not require complex contour cutting and tend to be smaller in size. Meanwhile, trade events are often a mix of small and large format signs that require more finishing, from silicon edging to contour cutting, along with a wide range of mounting options.

One important bonus of soft signage applications is that they tend to have higher profit margins in relation to most other commercial printing applications. Based on the 2017 estimated street price of $60.2/m from InfoTrends’ Wide Format Application Forecast, PSPs can expect a profit margin in the range of 40% to 60%. These margins are difficult to find in commercial applications.

Direct-to-Garment

At this time, digital DTG production is a transfer process where the image is printed on a carrier and fixed to the fabric using heat. The use of pigmented inks that are printed via inkjet technology directly onto a finished garment, like a T-shirt, is becoming increasingly common. Most dark garments will be pre-treated first, then the piece will be printed. After that, the ink will require a few minutes of heat to adhere to the garment. The process is very similar to other print technologies that commercial printers have perfected, as it requires putting ink on a substrate with just the additional step of fixation. Nevertheless, there are other printing methods too. With heat transfer, for example, the image is first printed on paper or a carrier material and then transferred to the fabric using a heat press. InfoTrends believes that the DTG market will experience a strong CAGR of 13% between 2016 and 2021, reaching a global value of nearly $10 billion. Roughly 36% of this value will be attributable to North America.

New developments in this segment are also on the horizon. As the use of synthetic fibers (e.g., polyester) grows, suppliers have been seeking ways to print directly into these materials. At one time, this was only possible using sublimation on light fabrics. This past fall, however, the market saw the introduction of new pigment-based technology that enables the printing of white ink, followed by CMYK. Although it will take some time for this new technology to mature, it opens the door for DTG production in cotton, cotton blends, as well as synthetic materials.

When penetrating the DTG market, it is best to take a horizontal approach rather than a vertical market approach since it is primarily just a single application that is being customized and sold to everyone. Any group with a collective mission, spirit, or identification can be an ideal audience, including corporations, religious groups, and team sports. The challenge lies in managing the order intake process and shipping activities to maintain accurate order counts, size, color, and design information by customer and group.

Like soft signage, DTG printing can also be more profitable than many commercial print applications. For example, retail sales prices of custom t-shirts can range from about $15 to $25. Assuming the cost of the shirt is $5 and the printing costs are $1.50, the cost of goods sold becomes $6.50. Profit per shirt will likely be over 100%, even on the lower end of the profit projection spectrum.

The Bottom Line

Although digital textile printing represents a promising area of opportunity, it is not without some challenges. There is a bit of a learning curve associated with understanding the different substrates, inks, software, equipment, and finishing requirements. Knowing which markets are addressable based on business current expertise and resources can increase the chances of success. For commercial printers that are hoping to expand into the tempting world of textiles, it is best to start by focusing on applications with similar printing processes that can be sold to existing or adjacent customers.

Ryan McAbee is an Associate Director for Keypoint Intelligence – InfoTrends' Production Workflow Consulting Service, which focuses on providing technology, business, and market insights to clients in the Digital Marketing & Media and Production Workflow markets. In this role, he is responsible for conducting market research, market analysis and forecasting, content development, industry training, and consulting with print service providers.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free