- Graphic arts software vendors and print service providers (PSPs) have been cautiously and systematically changing how software is developed and purchased.

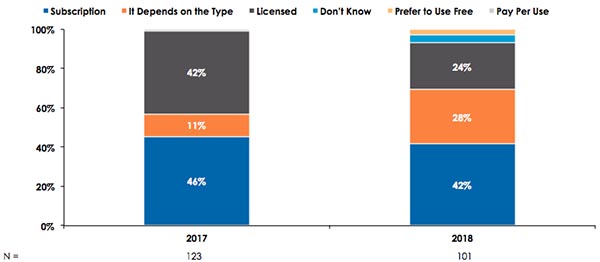

- According to Keypoint Intelligence – InfoTrends’ research, 42% of PSPs prefer to purchase their software through a subscription. Meanwhile, the preference for licensed software declined significantly year-over-year.

- The overwhelming criticism of cloud-based software is the inability to delay or control when software updates are pushed.

By Ryan McAbee

Introduction

Back in 2011, the software market changed forever. That was the year when Adobe introduced its Creative Cloud software suite, which was purchased as a subscription. Two years later, Adobe announced that Creative Cloud would be its only choice moving forward. This marked the beginning of the end for licensed software—at least for Adobe.

Since that time, both graphic arts software vendors and print service providers (PSPs) have been cautiously and systematically changing how software is developed and purchased. Subscriptions (the payment method) and the cloud (the delivery method) do not have to be mutually exclusive, and most efforts have used both to deliver software-as-a-service (SaaS). At the same time, however, the path has not been easy on either side.

Signs of Change

Although the industry has not yet hit a “flash point” that would result in significant change, there are indications that this spark may not be far away. There are more SaaS solutions entering the market every year, so PSPs have more choices than ever before. Cloud-based solutions, which typically have a simplified user interface (UI), have steadily added sophisticated functionality to rival on-premises solutions. Most importantly, the attitudes and perceptions of PSPs have improved. According to research conducted by Keypoint Intelligence – InfoTrends earlier this year, 42% of PSPs prefer to purchase their software through a subscription. Meanwhile, the preference for licensed software declined by almost half in relation to just a year before.

Figure 1. How do you prefer to purchase graphic arts software today?

Source: North American Production Software Investment Outlook Surveys; Keypoint Intelligence – InfoTrends

Obstacles Remain

Some things will still need to happen before cloud software adoption reaches its flash point and experiences some significant growth. Based on InfoTrends’ research and our conversations with printers, we believe that the following challenges must still be addressed:

- Purchasing methods for the software are still “old school.” SaaS solutions are used over the Internet, so why can’t you sign up for the solution and pay for it the same way?

- PSPs prize flexibility in pricing, and SaaS solutions still need to pass an ROI test. Beyond that, PSPs like having the ability to ramp service levels up and down on a month-to-month basis based on peak times and volumes. This can also benefit their cash flow.

- PSPs want to regain mission-critical controls. The overwhelming criticism of cloud-based software is the inability to delay or control when software updates are pushed. The importance and risk are higher when the solution has points of integration to other software components that can “break.”

- SaaS solutions are meant to be different, and PSPs will not migrate away from on-premises versions unless there is an added value associated with doing so. For example, Adobe increased the value of its Creative Suite over the years by developing an offline/online/app ecosystem around its core products.

The Bottom Line

Print service providers have shown that they are able and willing to purchase cloud-based software subscriptions from vendors if they see the value. Although vendors haven’t given them all the reasons they need to make the switch, cloud software has quite a bit of potential once the challenges to adoption have been addressed.

Ryan McAbee is an Associate Director for Keypoint Intelligence – InfoTrends' Production Workflow Consulting Service, which focuses on providing technology, business, and market insights to clients in the Digital Marketing & Media and Production Workflow markets. In this role, he is responsible for conducting market research, market analysis and forecasting, content development, industry training, and consulting with print service providers.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free