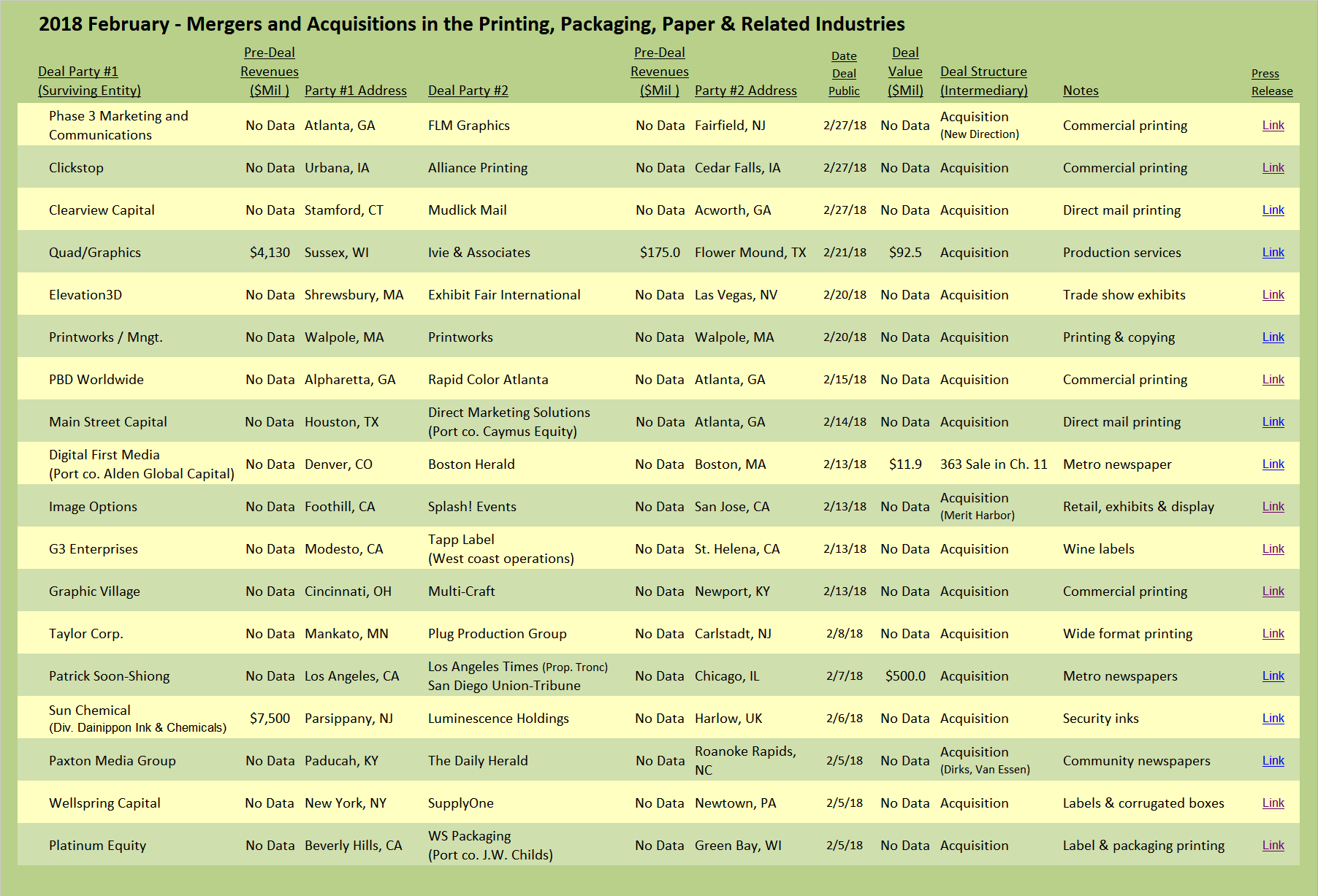

Quad/Graphics has been on a self-declared transformational heading as far back as 2012. In its latest iteration, “Quad 3.0” as the company calls it, Quad declares that its goal is to leverage its strong “print foundation as part of a much larger and more robust integrated marketing platform.” Quad took a major step in that direction with the acquisition of Ivie & Associates, a Texas-based marketing production services and marketing execution company. The acquired company boasts creative studios, post-production suites, room-size sets for photo shoots, CGI retouching, audio and video editing capabilities, all designed to originate and re-purpose creative content for the multiple channels that clients demand in today’s complex marketing mix.

Ivie embeds its employees onsite at their clients, a model of personnel deployment similar to that used by the highly successful print management outsourcing companies. Ivie also takes this strategy to the next level, staffing and acting as a client’s internal captive marketing department, fulfilling both agency and executional roles. Ivie will also serve its clients as a traditional external advertising agency, or work alongside the traditional creative agencies to provide support executing campaigns across multiple media channels.

Quad embarked on this latest transformational path in a very deliberate manner in 2015 when it combined its Quad Media Planning division with its Nellymoser mobile marketing division, merging both into its creative production boutique, BlueSoHo. With the addition of Ivie, Quad now has more than 1,200 employees dedicated to content creation and marketing execution embedded at more than 70 client sites. (Quad landed the Nellymoser business as a bonus when it acquired Brown Printing in 2014; for our initial take on both Quad and Brown’s foray into digital technology see The Target Report – March 2013).

Quad’s focus on placing its employees at its clients would seemingly put the company in direct competition with the industry-disrupting print management companies, the masters of embedding employees into client locations: Innerworkings, Williams Lea Tag and HH Global. Nor is Quad alone in attempting to add stickiness to its print offering by heading upstream into creative services. Innerworkings appeared headed in this direction in 2013 when it completed back-to-back acquisitions of two companies that provide creative services (Innerworkings may have changed course, as the company has been quiet on this front ever since). Williams Lea, the original inventor of the current print management outsourcing model, moved aggressively into the creative and production execution services in a big way in 2011 when it acquired Tag Worldwide, changing the company name to Williams Lea Tag in recognition of the importance of the creative component of the merged entity. (for more about Advent International’s recent investment in Williams Lea Tag, see The Target Report – August 2017).

Large printing companies buy creative marketing execution companies and embed employees at client locations. Print management outsourcing companies acquire creative marketing execution companies and embed employees at client locations. Not exactly parallel business models. Nonetheless, there is enough similarity here to make us wonder if future integration (i.e. mergers or acquisitions) between the big printing companies and the print management companies is inevitable as they appear to be headed down the same lane. If they don’t come together, exactly which model will prove most sustainable over the long run?

Commercial Printing and Diversified Services

Deals for standalone commercial printing companies are back. Graphic Village in Cincinnati, Ohio acquired its local competitor Multi-Craft, across the river in Newport, Kentucky. Graphic Village has grown through several acquisitions over the past year, including a content marketing and creative services firm, and a promotional products company specializing in branded apparel.

Diversified holding company Clickstop, headquartered in Urbana, Iowa, acquired Alliance Printing in Cedar Falls, Iowa. The company is being rebranded as Leverage Digital Imaging and will be offering marketing services and creative design in addition to its core printing services.

PBD Worldwide in Alpharetta, Georgia, acquired Atlanta-based Rapid Color Atlanta, which will be rebranded as Rapid Ink. The acquired company adds offset, wide format, and additional variable data printing capability to PBD Ink, the existing printing company owned by PBD Worldwide.

Phase 3 Marketing and Communications, the wide-format roll-up based in Atlanta, acquired FLM Graphics in Fairfield, New Jersey. FLM has itself been an active acquirer, having tucked-in several New York metro area competitors. Notably, one of the companies acquired by FLM was Trucolor, formerly a photo lab which became FLM’s wide format division. Trucolor appears to fit nicely into Phase 3’s focus on the wide format printing segment. In addition to the New York metro location it gains with the acquisition of FLM Graphics, Phase 3 has locations in Charleston, South Carolina, Nashville, Tennessee, and in Dallas, Texas where it acquired Gigantic Color. Primarily a commercial printing operation, FLM Graphics brings offset and digital printing capabilities to Phase 3.

Wide Format & Display

Privately-owned Taylor Communications, with over $2 billion in revenue, expanded its presence in the New York metro wide-format market. Taylor announced the acquisition of Plug Production Group, a New Jersey-based printing company providing wide format graphics, window displays and grand format outdoor graphics. Plug’s website is now displaying the Vectra Visual banner, Taylor’s name for its national provider of wide- and large-format graphics. Vectra Visual was formed when Taylor merged Vectra and PhotoCraft, later adding Blue Ocean Worldwide to the group in 2015. In addition to the acquired New Jersey location, the Vectra unit has facilities in Ohio, Nevada, Oregon and Long Island City, New York.

Image Options, the Foothill, California-based marketing communications company that specializes in retail display, out-of-home advertising, event graphics, and fleet markings, acquired Splash! Events. The acquired company designs and produces unique corporate environments with extensive use of graphic elements, as well as event graphics and trade show exhibits.

Elevation 3D, a trade show exhibit company based in Massachusetts, has acquired Exhibit Fair International in Las Vegas, producer of large-scale trade show exhibits. Both Companies provide the full range of exhibit services, including creative design, engineering, graphic production, fabrication, warehousing, logistics, and rental of the multi-media equipment needed in today’s trade show environments.

Packaging

Platinum Equity acquired WS Packaging from PE fund J.W. Childs in a secondary buyout (for more, see The Target Report – Moving Pieces Around on the PE Chessboard). WS Packaging is headquartered in Green Bay, Wisconsin and operates 17 manufacturing facilities throughout the US and Mexico. The acquired company produces a wide range of packaging products, including pressure sensitive labels, cut & stack labels, folding cartons, and flexible packaging. We have not noted any acquisitions by WS Packaging for quite some time; however, with new PE ownership, we expect that we’ll soon see WS on the buy-side.

Wellspring Capital, a New York City-based PE firm, acquired SupplyOne in Newtown, Pennsylvania. In addition to its industrial supplies distribution business, SupplyOne is a manufacturer of custom corrugated products, plastic thermoforming trays and clamshells, and custom pressure-sensitive labels.

G3 Enterprises acquired the west coast operations of Tapp Label in California and Oregon, all within short distance to the wine vineyards, G3’s primary customers. G3 Enterprises offers a diverse mix of packaging products in addition to printed labels, including bottles, corks, screwcaps, as well as logistical services for transporting grapes and storage of finished beverages. G3 even owns a sand mine that supplies the raw material for glassmaking. The intense focus on the wine vertical is not accidental; G3 was started by the third generation of the Gallo winemaking family and includes the E&J Gallo Winery among its best clients.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free