It's the changing of the guard in Washington, DC, and I thought I'd dust off the slides from the webinar I did back in December 2008 to see what my prognostications were. Did I understand the times and what was about to unfold with the new administration? Sometimes I did, sometimes I didn't, and there were lots of things that played out in different ways but had the same result.

The reason I bring all this up is that on Wednesday, November 16, we have our monthly economic webinar. I'll be making my prognostications about the economy in light of the election and other matters. WhatTheyThink members, whether free, paid, or corporate, are invited to attend the 2:00pm Eastern time event. Just sign up at the registration page. If you can't attend at that time, please sign up anyway, and you will get a notification about the archived replay. For many of the webinars we have more post-event downloads than live attendees, as people listen at a time of convenience.

The December 2008 webinar was a time of great economic confusion. A recession had just been declared, which was interesting because they set the start date as eleven months prior, to December 2007. That was the longest delay in declaring a recession in history. The times were so confusing we had more than 1000 people sign up for that webinar – the most ever or since. Below are some of the forecasts I made at that event.

1) Stagflation: slow growth, high inflation

I thought for sure stagflation was on its way: slow growth, and high inflation, just like the late 1970s. What happened? We did get the slow growth. As for inflation, it didn't happen in the way I thought, it was different. Incomes went down and didn't really recover, only getting close recently. I've made this point a few times, and here's an example:

Case 1: Incomes flat, prices rise

PRICES move from 100 to 104

INCOMES flat and stay at 100

NET EFFECT prices up +4%

Case 2: Incomes fall, prices flat

PRICES flat and stay at 100

INCOMES fall from 100 to 96

NET EFFECT prices down -4%

In the second case, inflation is “tame” but because incomes fall, the net effect is that a person cannot afford goods they want because they are short on income. In case 1, the same occurs because income is flat but prices rose.

We ended up with the effects of stagflation, but we did not have stagflation in the way it's conceived. I guess I get a B on this one, accidentally stumbling on to some truth.

2) Stimulus package will be even more inflationary

The same example applies here. We got little inflation, but we got slow growth and the decline in incomes, and a lack of investment. The stimulus package did not work. The economy never got close to average post-WW2 GDP growth on a sustained basis.

Here's another inflation effect without the inflation measure. The Federal Reserve did its best to stimulate the economy with low interest rates. In the process, the incentive for saving and investment dried up. This especially hurt small savers and those with modest savings. If you had $100,000 in the bank you could almost count on $6000 annual interest, or $500 per month. That income fell precipitously. Even though transfer payments like Social Security are adjusted for inflation, other income is not. If you define inflation as a loss of purchasing power, this was the same effect.

I give myself a C on this one.

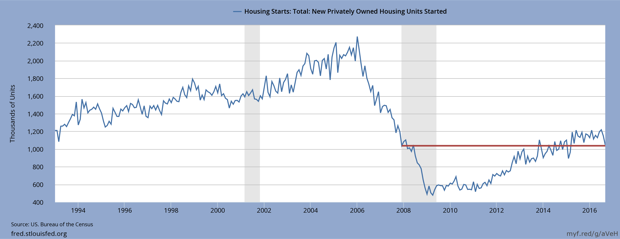

3) Housing markets seized; uncertainty and erratic approaches prolong the problems

Housing never recovered. It's still at levels lower than the Clinton administration. The red line is the level housing was at the beginning of the recession, and only in the last two years or so has broken above that line. I get a self-assigned A on this one.

4) Taxes will definitely rise, dampening investment; regulations increase costs, deter new market entrants

Taxes definitely rose, and that's not even including the classification of the ACA as a tax. Investment has been sluggish, the number of regulations increased throughout the period, continuing a trend from the Bush43 administration (see this report from the Competitive Enterprise Institute), and company formation struggled (see this article from the Washington Post). Another A on this one.

5) Productivity > real GDP, means unemployment will get worse

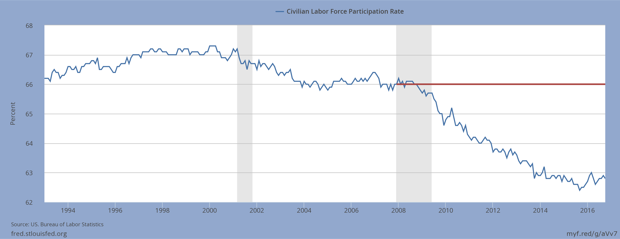

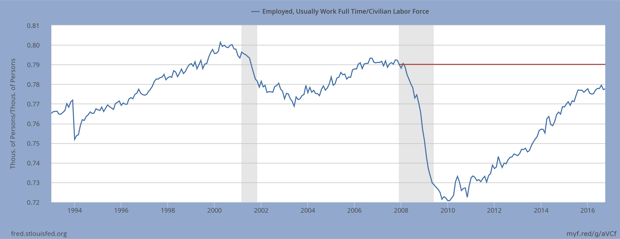

A good summary of this phenomenon is the labor participation rate, which has not recovered...

...and as the percentage of the labor force in full time jobs.

Another self-assigned A for this one. The unemployment rate never reflected the true nature of the employment picture, and unfortunately you had to always read past the headlines to understand how difficult the situation was.

6) Q4 2008 will be worst of the recessionary period

Another A on this one, as Q4-08 GDP was -8.2%. The bottom of the recession was near at hand, with Q1-09 at -5.4% and Q2-09 at -0.5%, with the recovery beginning in Q3-09 with +1.3% and Q4-09 at +3.9%.

I said it would be a “very slow rise” and would “take 2-3 years to play out.” It kept playing out very slowly and for a long time. This one gets a B+.

7) Real GDP for all of 2009 will be below 2%, Real GDP 2010 will show some signs of recovery, but below 3%

Real GDP for 2009 was negative, and 2010 was +2.5%. Another A.

8) Inflation will be tame for first half of 2009, 3% or less

It was just under 1%. Using December data for 2009 compared to 2008, inflation for the year was +2.7%. Another A.

9) Fed will have to raise rates in late 2009, but will be slow to do so

The slow part I got right, but the Fed never really raised rates though they pretend they want to. Give me an F. That's okay, they should probably get an F, too. I'm not an economist, so I have an excuse, but they are economists, we're told.

10) Unemployment will break 7.5% sometime in 2009, will stay there for a while

I never got the timing of the unemployment right. It took until March 2013 for the rate to fall back to 7.5% after peaking at 10% in October 2009. There were so many other factors affecting the unemployment rate, that I should get a D, but those circumstances should be considered for grading on a curve which can get me up to a “gentleman's C” as they used to call it.

And Other Things...

The Obama Administration was very successful in passing its legislation and defending it from erosion, unlike prior administrations. They believed that the changes they were implementing would cause some disruption and adjustment, but that those adjustments would be made and return to more typical levels in short time. They did not.

That December 2008 webinar also forecast that there would be an “activist Senate and House” and that “increased regulatory activity will be notable.” It was clear they would move with all due haste upon inauguration, and they did.

When mid-term elections changed the Congressional balance, the shift went to Executive Orders and rulings by various executive branch departments, such as EPA. It is interesting that historically Teddy Roosevelt issued more executive orders than President Obama. TR did not have as large a government, as the New Deal expansion of government was still years and years away, so rulings from regulators did not really exist in his time.

I did say that the “Obama administration will claim it was not expecting things to be this bad” especially after they realized that the stimulus did not work. The stimulus bill was passed in February 2009, and the recovery began that July. But it was a very weak recovery. They did, often, that the economy was worse than they were told, but that is the observation of many economists in explaining similar situations.

During the recovery, forecasting the economy seemed to always be off-target among the professional forecasters since the end of the recession. So the only answer they seemed to give was that they missed forecast because there were problems that must have been really worse than thought, and that would be followed by suggestions of more deficit spending or more Fed stimulus. Most all economists are trained in the same methods and beliefs today (no matter if they are Keynesians or monetarists), so they tend to see problems the same way and propose the similar solutions.

Perhaps they should expand their reading choices.

A marvelous book about a period like this is Larry Kudlow's (best known for his work at CNBC) and Brian Dimitrovic's look at JFK's economic proposals. JFK proposed a radical change of thinking, got broad support from unions and the civil rights movement in his quest to recover from the 1950s recessions and a slow start to his time in office. If you're a politics junkie, you'll get a kick out of reading about Beltway names you haven't heard in years or decades. Books about JFK are usually about the glamor of Camelot or the personal misbehavior, or the tragic assassination. It was nice to read a book that came from a much different topical perspective. It's a good read and not technical, and explains a lot about today's economy in the process.

I always recommend Gene Callahan's Economics for Real People and Dr. Thomas Sowell's Basic Economics, now in its fifth edition. If you're reading an economics book for the first time, start with Dr. Sowell's first. JFK's speech to the New York Economic Club is also 30 minutes well-spent.

And if you're interested in the Great Depression, the first one, which ended quickly, until the really big one came along, there's James Grant's much applauded The Forgotten Depression with the subtitle 1921: The Depression that Cured Itself. Historians, politics followers, and economists, will find the work of great interest.

Discussion

By Dave Compton on Nov 24, 2016

I don't think the continued impact of globalization and technology have been recognized. Also, the housing price peak would have been the big bubble bursting inflated assets, in this case, well, they started as houses but by the end, nobody knew what they were doing.

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free