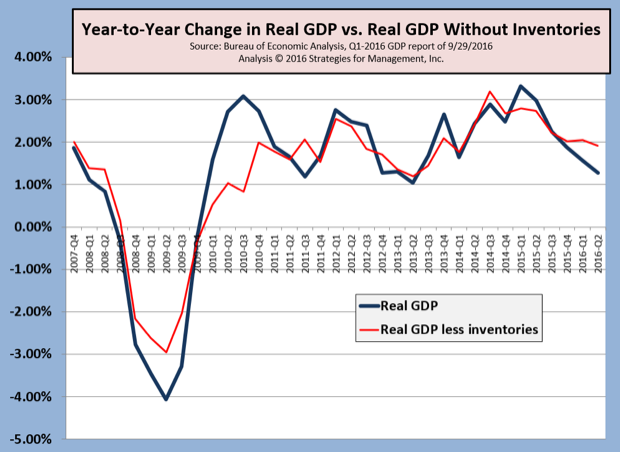

Real GDP for the second quarter got its final revision, and was raised from +1.1% to +1.4%. Regular readers know that we prefer to look at real GDP on a year-to-year basis, excluding inventories, to give a better long-term view of the economy. The second quarter had an inventory correction, which seemed overdue.

The economy remains in the +2% range, with little reason to believe it will get higher on a long-term basis, and some concerns that recession possibilities are now higher.

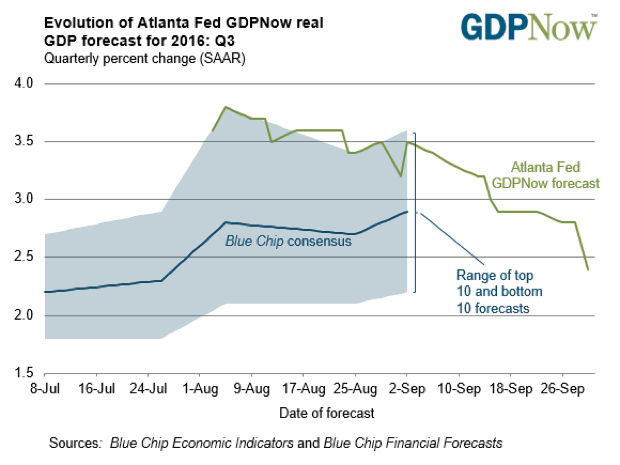

For the third quarter that just ended, we will not have official data until the end of October. The latest GDP prognostication can be found at the Atlanta Federal Reserve GDPNow page. But their estimate of Q3 had been declining with every major data release, as seen in the chart. It became +2.4% by its final report on September 30. That would put the average growth for 2016 in the +1.5% range.

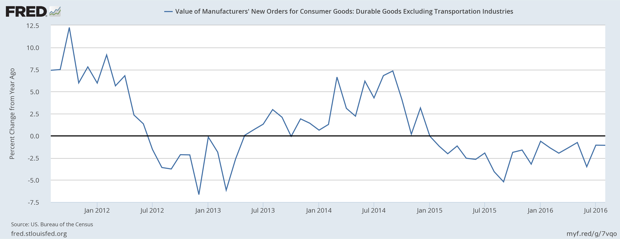

One of the bigger concerns is signs that are coming from the industrial sectors. An example of that is the orders of durable goods excluding the volatile sector of transportation equipment. The year-to-year comparisons have been negative for 20 months, typically a sign of recession. That's nearly two years, of course, in case you were wondering.

Discussion

By Wayne Lynn on Oct 04, 2016

Joe,

What would GDP look like if you took the impact of government spending out of the calculation?

Wayne

By Wayne Lynn on Oct 04, 2016

Hi Joe,

I wasn't as clear as I should have been. How big is the percentage that government spending now comprises of total GDP? Is it a drag on GDP performance?

Wayne

Discussion

Join the discussion Sign In or Become a Member, doing so is simple and free