The continuing story of this economic recovery is how many of the high-level data in the headlines is not what it really seems to be when you look at the underlying data. The explanation of the difference is too complex for the evening news, and even on the cable business channels the focus is on stock market indexes.

We have shown that many of the important data series have not confirmed the growth described by GDP. One is the revenues of the S&P500 stocks is still below its high. Median household income is about -7% lower than it was prior to the recession. The employment data has not confirmed a recovery.

First the good news, which is on a year-to-year basis. Since the unemployment report of February 2014...

- the unemployment rate has fallen to 5.5%, a full percentage point

- the employment-population ratio has improved from 58.8% to 59.3%

- employment has increased by +3 million

- full time workers have increased by +3 million, meaning that the period where part time work was a significant portion of the employment increase has passed

- the labor force has increased by +1.3 million, when employment is greater than the change in the labor force, that makes the unemployment rate decrease

- the labor participation rate appears to have bottomed, and is unlikely to worsen, and is likely to improve slowly from here

Now, the other issue since February 2014...

- 1.5 million workers have left the labor force, and it is now up to 92.9 million; this decreases the unemployment rate

- adding these workers back for the last year increases the unemployment rate to 5.7%; the number of workers "no longer in labor force" is +13.8 million higher than it was at the start of the recession, an continues to rise

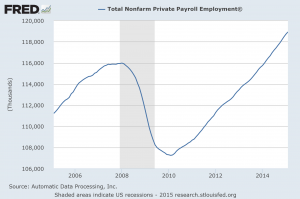

Though the chart looks very good (and it is very good that the direction is up, for sure), the recent payroll report of 118.9 million workers is actually 3.6 million workers short of where a population-adjusted figure from the start of the recession should be. There is a bias in general business reporting, and in government agencies, that payroll employment is better than self-employment. The household survey includes self-employment. People with two payroll jobs are counted twice in the payroll survey. Workers are counted just once in the household survey.

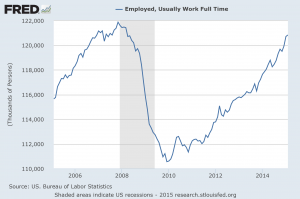

This chart, based on the household survey, shows the number of full time workers (click to enlarge):

Though the chart looks very good (and it is very good that the direction is up, for sure), the recent payroll report of 118.9 million workers is actually 3.6 million workers short of where a population-adjusted figure from the start of the recession should be. There is a bias in general business reporting, and in government agencies, that payroll employment is better than self-employment. The household survey includes self-employment. People with two payroll jobs are counted twice in the payroll survey. Workers are counted just once in the household survey.

This chart, based on the household survey, shows the number of full time workers (click to enlarge):

The number of full time workers is still -1.1 million less than it was at the start of the recession. Adjusted for population, it is -8.1 million short.

Last month's payroll report added +295,000 jobs. The household survey was just +96,000. This implies that a portion of self employed and freelance workers were shifted over to payroll jobs.

For the month, an additional 354,000 left the workforce. Had they stayed in the workforce, the unemployment rate would have been 5.8%, not 5.5%

The recession started more than seven years ago, and the employment markets have not returned to higher broad measures of that time. How will we know if things are improving at a better rate? The unemployment rate would actually rise. Most recoveries begin with about six months of worsening unemployment rates because workers flood the market faster than the market can absorb them, and then the unemployment rate drops sharply, confirming the recovery. This recovery, however, continues to be marked by improving unemployment rates with steady exits from the labor force. Is there a turnaround coming? Lately, many of the measures of the health of small business have been improving. The NFIB Small Business Optimism Index broke out above its sideways trend a few months ago. Even our own industry had a strong finish to 2014 compared to 2013. There is good reason to assume that the economy's growth will stay positive but below +2.5% in a long-term trend, but it seems that businesses have held off hiring as long as they could, and are now starting to slowly hire. The trickle will be bigger, but the floodgates will not burst open. # # #