In the long run, the net inventories figure should be zero, with slow buildups as the economy grows, and slow depletions when the economy declines. As the economy has been growing, average inventories seem to settle between $50 and $60 billion, but has been in the high $80s recently. Excess inventories will need to be worked down, and this may depress real GDP in coming quarters to a small degree.

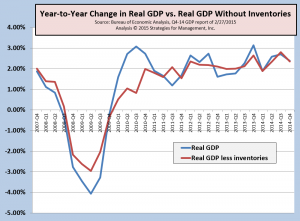

As hard data continue to replace estimates, the final report of Q4 GDP is likely to be revised slightly lower. These quarter-to-quarter changes are rarely important, which is why we still prefer the year-to-year comparisons in the chart below. The economy remains about 1 percentage below the post-WW2 average. Since Q1-13, real GDP has averaged +2.7%, so it is possible that some would consider the economy to be slowing slightly in comparison to the 2.37% in the most recent year-to-year comparison.

# # #

In the long run, the net inventories figure should be zero, with slow buildups as the economy grows, and slow depletions when the economy declines. As the economy has been growing, average inventories seem to settle between $50 and $60 billion, but has been in the high $80s recently. Excess inventories will need to be worked down, and this may depress real GDP in coming quarters to a small degree.

As hard data continue to replace estimates, the final report of Q4 GDP is likely to be revised slightly lower. These quarter-to-quarter changes are rarely important, which is why we still prefer the year-to-year comparisons in the chart below. The economy remains about 1 percentage below the post-WW2 average. Since Q1-13, real GDP has averaged +2.7%, so it is possible that some would consider the economy to be slowing slightly in comparison to the 2.37% in the most recent year-to-year comparison.

# # #

Commentary & Analysis

Recovery Indicators NASDAQ Up Strongly, Others Pull Back Slightly; Q4-2014 Real GDP Reduced to +2.2%

The NASDAQ had a very strong month,

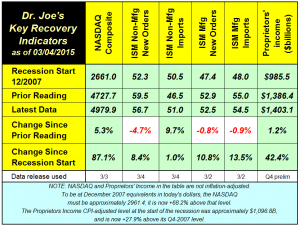

The NASDAQ had a very strong month, increasing more than 250 points, and breaking through the 5000 level for a brief time. There's no Internet bubble this time, and companies are generally in very good financial condition for the most part, with real sales and real profits; there may be exuberance this time, but not of the irrational kind. (click chart to enlarge)

The ISM Manufacturing indexes retreated slightly but are still in positive territory showing slow positive growth for manufacturing and non-manufacturing industries is the likely course. Though three of the four ISM indexes we use were negative, they are not at worrisome levels. Proprietors' income, a measure of small business activity, was revised slightly, from 1402.9 to $1,401.1 (+$200 imillion). Geopolitical risks are still elevated and and geo-economic currency issues are still playing out. These factors need to be monitored, but most rewarding business moves occur when others are distracted or worried rather than making adjustments and decisively moving toward long term strategic targets.

* * *

Q4-2014 GDP was revised down to +2.2%. Last month we commented that there was a surge in inventories that sent GDP up to +2.6%; the inventory figure was rolled back to a level consistent with prior quarters along with other revisions. Because inventories have been volatile, we have been providing real GDP data without that component to show the underlying growth rate of GDP. For 2014. the growth rate was +2.37% with inventories and +2.34% without. (click chart to enlarge)

The ISM Manufacturing indexes retreated slightly but are still in positive territory showing slow positive growth for manufacturing and non-manufacturing industries is the likely course. Though three of the four ISM indexes we use were negative, they are not at worrisome levels. Proprietors' income, a measure of small business activity, was revised slightly, from 1402.9 to $1,401.1 (+$200 imillion). Geopolitical risks are still elevated and and geo-economic currency issues are still playing out. These factors need to be monitored, but most rewarding business moves occur when others are distracted or worried rather than making adjustments and decisively moving toward long term strategic targets.

* * *

Q4-2014 GDP was revised down to +2.2%. Last month we commented that there was a surge in inventories that sent GDP up to +2.6%; the inventory figure was rolled back to a level consistent with prior quarters along with other revisions. Because inventories have been volatile, we have been providing real GDP data without that component to show the underlying growth rate of GDP. For 2014. the growth rate was +2.37% with inventories and +2.34% without. (click chart to enlarge)

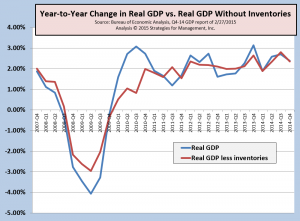

In the long run, the net inventories figure should be zero, with slow buildups as the economy grows, and slow depletions when the economy declines. As the economy has been growing, average inventories seem to settle between $50 and $60 billion, but has been in the high $80s recently. Excess inventories will need to be worked down, and this may depress real GDP in coming quarters to a small degree.

As hard data continue to replace estimates, the final report of Q4 GDP is likely to be revised slightly lower. These quarter-to-quarter changes are rarely important, which is why we still prefer the year-to-year comparisons in the chart below. The economy remains about 1 percentage below the post-WW2 average. Since Q1-13, real GDP has averaged +2.7%, so it is possible that some would consider the economy to be slowing slightly in comparison to the 2.37% in the most recent year-to-year comparison.

# # #

In the long run, the net inventories figure should be zero, with slow buildups as the economy grows, and slow depletions when the economy declines. As the economy has been growing, average inventories seem to settle between $50 and $60 billion, but has been in the high $80s recently. Excess inventories will need to be worked down, and this may depress real GDP in coming quarters to a small degree.

As hard data continue to replace estimates, the final report of Q4 GDP is likely to be revised slightly lower. These quarter-to-quarter changes are rarely important, which is why we still prefer the year-to-year comparisons in the chart below. The economy remains about 1 percentage below the post-WW2 average. Since Q1-13, real GDP has averaged +2.7%, so it is possible that some would consider the economy to be slowing slightly in comparison to the 2.37% in the most recent year-to-year comparison.

# # #

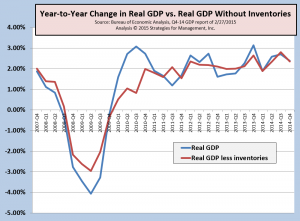

In the long run, the net inventories figure should be zero, with slow buildups as the economy grows, and slow depletions when the economy declines. As the economy has been growing, average inventories seem to settle between $50 and $60 billion, but has been in the high $80s recently. Excess inventories will need to be worked down, and this may depress real GDP in coming quarters to a small degree.

As hard data continue to replace estimates, the final report of Q4 GDP is likely to be revised slightly lower. These quarter-to-quarter changes are rarely important, which is why we still prefer the year-to-year comparisons in the chart below. The economy remains about 1 percentage below the post-WW2 average. Since Q1-13, real GDP has averaged +2.7%, so it is possible that some would consider the economy to be slowing slightly in comparison to the 2.37% in the most recent year-to-year comparison.

# # #

In the long run, the net inventories figure should be zero, with slow buildups as the economy grows, and slow depletions when the economy declines. As the economy has been growing, average inventories seem to settle between $50 and $60 billion, but has been in the high $80s recently. Excess inventories will need to be worked down, and this may depress real GDP in coming quarters to a small degree.

As hard data continue to replace estimates, the final report of Q4 GDP is likely to be revised slightly lower. These quarter-to-quarter changes are rarely important, which is why we still prefer the year-to-year comparisons in the chart below. The economy remains about 1 percentage below the post-WW2 average. Since Q1-13, real GDP has averaged +2.7%, so it is possible that some would consider the economy to be slowing slightly in comparison to the 2.37% in the most recent year-to-year comparison.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.