We have been concerned for more than a year about the distortions that changes in inventories have had on headline GDP reports. Inventories have been building the last few quarters, and this was the biggest inventory buildup since Q3-2010.

Leaving inventories out of the data, underlying GDP was +1.9% compared to the third quarter of 2014.

The year-to-year change is still sitting in the range of +2.5%, almost a full percentage point below the post-WW2 average.

The world's economic condition has been deteriorating in Europe and Asia, with the International Monetary Fund decreasing their non-US forecasts in recent reports. It will be interesting to see if they revise US downward after this report. Remember, however, there are two more revisions to this report on their way in 30 and 60 days. Recent reports of GDP components imply that it will stay at this reported level or be revised slightly downward.

There has been much speculation that the Fed will raise interest rates as the economy has been stronger in their minds, and even in their recent economic report. World economic conditions may not give them the comfort to do so. With inflation reports being very low, they might not need to do anything. Real interest rates have been negative for some time, so with inflation getting near zero, as it is measured, they may believe that will be a stealth interest rate rise. Compared to other markets, long US Treasury bonds are significantly higher. Fed attempts to raise rates might be fruitless in that environment.

My concern is that the inventory levels were probably built on optimistic forecasts of economic strength. That means there is the possibility of a mild correction in Q1, similar to what happened last year. We won't know until April, at earliest.

Until then, stay ahead of your customers and prospects. That's more important to your business than figuring out the pronouncements of economics statisticians.

# # #

We have been concerned for more than a year about the distortions that changes in inventories have had on headline GDP reports. Inventories have been building the last few quarters, and this was the biggest inventory buildup since Q3-2010.

Leaving inventories out of the data, underlying GDP was +1.9% compared to the third quarter of 2014.

The year-to-year change is still sitting in the range of +2.5%, almost a full percentage point below the post-WW2 average.

The world's economic condition has been deteriorating in Europe and Asia, with the International Monetary Fund decreasing their non-US forecasts in recent reports. It will be interesting to see if they revise US downward after this report. Remember, however, there are two more revisions to this report on their way in 30 and 60 days. Recent reports of GDP components imply that it will stay at this reported level or be revised slightly downward.

There has been much speculation that the Fed will raise interest rates as the economy has been stronger in their minds, and even in their recent economic report. World economic conditions may not give them the comfort to do so. With inflation reports being very low, they might not need to do anything. Real interest rates have been negative for some time, so with inflation getting near zero, as it is measured, they may believe that will be a stealth interest rate rise. Compared to other markets, long US Treasury bonds are significantly higher. Fed attempts to raise rates might be fruitless in that environment.

My concern is that the inventory levels were probably built on optimistic forecasts of economic strength. That means there is the possibility of a mild correction in Q1, similar to what happened last year. We won't know until April, at earliest.

Until then, stay ahead of your customers and prospects. That's more important to your business than figuring out the pronouncements of economics statisticians.

# # #

Commentary & Analysis

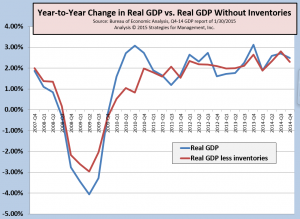

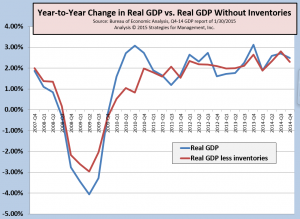

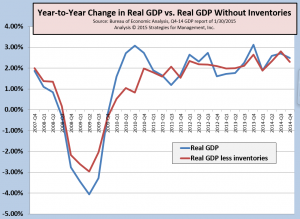

Q4-2014 GDP +2.6%, Weaker than Expectations, Yet Weaker in the Details

GDP was up again,

GDP was up again, and but fell into the longer term range of year-to-year changes as highlighted in our chart (click to enlarge). The third quarter's 5% level could not be sustained.

We have been concerned for more than a year about the distortions that changes in inventories have had on headline GDP reports. Inventories have been building the last few quarters, and this was the biggest inventory buildup since Q3-2010.

Leaving inventories out of the data, underlying GDP was +1.9% compared to the third quarter of 2014.

The year-to-year change is still sitting in the range of +2.5%, almost a full percentage point below the post-WW2 average.

The world's economic condition has been deteriorating in Europe and Asia, with the International Monetary Fund decreasing their non-US forecasts in recent reports. It will be interesting to see if they revise US downward after this report. Remember, however, there are two more revisions to this report on their way in 30 and 60 days. Recent reports of GDP components imply that it will stay at this reported level or be revised slightly downward.

There has been much speculation that the Fed will raise interest rates as the economy has been stronger in their minds, and even in their recent economic report. World economic conditions may not give them the comfort to do so. With inflation reports being very low, they might not need to do anything. Real interest rates have been negative for some time, so with inflation getting near zero, as it is measured, they may believe that will be a stealth interest rate rise. Compared to other markets, long US Treasury bonds are significantly higher. Fed attempts to raise rates might be fruitless in that environment.

My concern is that the inventory levels were probably built on optimistic forecasts of economic strength. That means there is the possibility of a mild correction in Q1, similar to what happened last year. We won't know until April, at earliest.

Until then, stay ahead of your customers and prospects. That's more important to your business than figuring out the pronouncements of economics statisticians.

# # #

We have been concerned for more than a year about the distortions that changes in inventories have had on headline GDP reports. Inventories have been building the last few quarters, and this was the biggest inventory buildup since Q3-2010.

Leaving inventories out of the data, underlying GDP was +1.9% compared to the third quarter of 2014.

The year-to-year change is still sitting in the range of +2.5%, almost a full percentage point below the post-WW2 average.

The world's economic condition has been deteriorating in Europe and Asia, with the International Monetary Fund decreasing their non-US forecasts in recent reports. It will be interesting to see if they revise US downward after this report. Remember, however, there are two more revisions to this report on their way in 30 and 60 days. Recent reports of GDP components imply that it will stay at this reported level or be revised slightly downward.

There has been much speculation that the Fed will raise interest rates as the economy has been stronger in their minds, and even in their recent economic report. World economic conditions may not give them the comfort to do so. With inflation reports being very low, they might not need to do anything. Real interest rates have been negative for some time, so with inflation getting near zero, as it is measured, they may believe that will be a stealth interest rate rise. Compared to other markets, long US Treasury bonds are significantly higher. Fed attempts to raise rates might be fruitless in that environment.

My concern is that the inventory levels were probably built on optimistic forecasts of economic strength. That means there is the possibility of a mild correction in Q1, similar to what happened last year. We won't know until April, at earliest.

Until then, stay ahead of your customers and prospects. That's more important to your business than figuring out the pronouncements of economics statisticians.

# # #

We have been concerned for more than a year about the distortions that changes in inventories have had on headline GDP reports. Inventories have been building the last few quarters, and this was the biggest inventory buildup since Q3-2010.

Leaving inventories out of the data, underlying GDP was +1.9% compared to the third quarter of 2014.

The year-to-year change is still sitting in the range of +2.5%, almost a full percentage point below the post-WW2 average.

The world's economic condition has been deteriorating in Europe and Asia, with the International Monetary Fund decreasing their non-US forecasts in recent reports. It will be interesting to see if they revise US downward after this report. Remember, however, there are two more revisions to this report on their way in 30 and 60 days. Recent reports of GDP components imply that it will stay at this reported level or be revised slightly downward.

There has been much speculation that the Fed will raise interest rates as the economy has been stronger in their minds, and even in their recent economic report. World economic conditions may not give them the comfort to do so. With inflation reports being very low, they might not need to do anything. Real interest rates have been negative for some time, so with inflation getting near zero, as it is measured, they may believe that will be a stealth interest rate rise. Compared to other markets, long US Treasury bonds are significantly higher. Fed attempts to raise rates might be fruitless in that environment.

My concern is that the inventory levels were probably built on optimistic forecasts of economic strength. That means there is the possibility of a mild correction in Q1, similar to what happened last year. We won't know until April, at earliest.

Until then, stay ahead of your customers and prospects. That's more important to your business than figuring out the pronouncements of economics statisticians.

# # #

We have been concerned for more than a year about the distortions that changes in inventories have had on headline GDP reports. Inventories have been building the last few quarters, and this was the biggest inventory buildup since Q3-2010.

Leaving inventories out of the data, underlying GDP was +1.9% compared to the third quarter of 2014.

The year-to-year change is still sitting in the range of +2.5%, almost a full percentage point below the post-WW2 average.

The world's economic condition has been deteriorating in Europe and Asia, with the International Monetary Fund decreasing their non-US forecasts in recent reports. It will be interesting to see if they revise US downward after this report. Remember, however, there are two more revisions to this report on their way in 30 and 60 days. Recent reports of GDP components imply that it will stay at this reported level or be revised slightly downward.

There has been much speculation that the Fed will raise interest rates as the economy has been stronger in their minds, and even in their recent economic report. World economic conditions may not give them the comfort to do so. With inflation reports being very low, they might not need to do anything. Real interest rates have been negative for some time, so with inflation getting near zero, as it is measured, they may believe that will be a stealth interest rate rise. Compared to other markets, long US Treasury bonds are significantly higher. Fed attempts to raise rates might be fruitless in that environment.

My concern is that the inventory levels were probably built on optimistic forecasts of economic strength. That means there is the possibility of a mild correction in Q1, similar to what happened last year. We won't know until April, at earliest.

Until then, stay ahead of your customers and prospects. That's more important to your business than figuring out the pronouncements of economics statisticians.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.