Commentary & Analysis

Recovery Indicators Post Another Good Month

The recovery indicators had a generally good month,

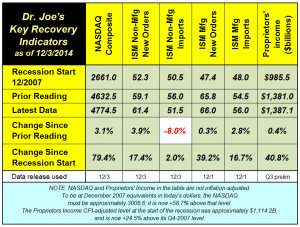

The recovery indicators had a generally good month, with increases in three of the ISM indicators and the NASDAQ. (click to enlarge)

Falling oil prices helped make the manufacturers bullish about their materials costs. The new orders readings are very strong.

This should probably be considered carefully as non-US economies are having problems. If there is a recession in these areas, the effect on the US might be minimal because of the oil price declines, but the optimism of new orders could result in overstaffing and high inventory levels that will need to be corrected.

Proprietors income for Q3 was reduced from 1388.2 to 1387.1. It's running at an annual rate <1%, which means it is not keeping up with inflation, and that it retreated by about 1% after adjusting for inflation. A small business contraction might be in the works; keep an eye on it.

The only item that decreased was non-manufacturing imports, but that is still at an index level that implies growth, just at a slower rate.

Generally, this is a good report.

# # #

Falling oil prices helped make the manufacturers bullish about their materials costs. The new orders readings are very strong.

This should probably be considered carefully as non-US economies are having problems. If there is a recession in these areas, the effect on the US might be minimal because of the oil price declines, but the optimism of new orders could result in overstaffing and high inventory levels that will need to be corrected.

Proprietors income for Q3 was reduced from 1388.2 to 1387.1. It's running at an annual rate <1%, which means it is not keeping up with inflation, and that it retreated by about 1% after adjusting for inflation. A small business contraction might be in the works; keep an eye on it.

The only item that decreased was non-manufacturing imports, but that is still at an index level that implies growth, just at a slower rate.

Generally, this is a good report.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.