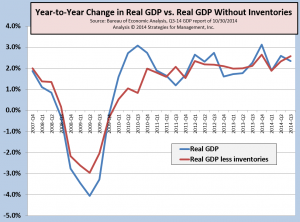

In the long run, changes in net inventories have zero effect, as businesses keep their inventories in line with changes in sales. Those adjustments take time, so there are quarter-to-quarter variations. GDP would have been higher had inventories been at the same level they were last quarter: they dropped by $22 billion. But Q3's inventory was more in line with recent averages, showing that businesses adjusted inventories in light of underlying conditions. There was a huge buildup of inventories at the end of 2013. That's not happening this year, as Q3-2014 net inventories were more than $30 billion less than 2013.

* * *

There was good news on the employment front in Friday's report. The unemployment rate fell to 5.8%, at that level for the wrong reasons with so many workers exiting the workforce in prior months. But last month the labor force actually increased by +416K, and employment was up +689K in the household survey (which includes self employment). The employment-population ratio is still at multidecade lows, but it improved, too. Perhaps the worst aspects of the labor market have finally found a bottom they can bounce on and begin to improve for real.

* * *

Those who regularly follow my writings and presentations know my concerns about stock buybacks and how they have been propping up stock prices out of proportion to actual economic growth. Bloomberg had an article last month about the topic, "S&P 500 Companies Spend 95% of Profits on Buybacks, Payouts." The biggest concern is that companies are diverting earnings to these activities and not productive capital investment. Buybacks are addictive, especially to executives whose bonuses are based on their company's stock price and earnings per share. Eventually you end up with a hollow business that is out of touch with the marketplace and an easy target for competitors.

# # #

In the long run, changes in net inventories have zero effect, as businesses keep their inventories in line with changes in sales. Those adjustments take time, so there are quarter-to-quarter variations. GDP would have been higher had inventories been at the same level they were last quarter: they dropped by $22 billion. But Q3's inventory was more in line with recent averages, showing that businesses adjusted inventories in light of underlying conditions. There was a huge buildup of inventories at the end of 2013. That's not happening this year, as Q3-2014 net inventories were more than $30 billion less than 2013.

* * *

There was good news on the employment front in Friday's report. The unemployment rate fell to 5.8%, at that level for the wrong reasons with so many workers exiting the workforce in prior months. But last month the labor force actually increased by +416K, and employment was up +689K in the household survey (which includes self employment). The employment-population ratio is still at multidecade lows, but it improved, too. Perhaps the worst aspects of the labor market have finally found a bottom they can bounce on and begin to improve for real.

* * *

Those who regularly follow my writings and presentations know my concerns about stock buybacks and how they have been propping up stock prices out of proportion to actual economic growth. Bloomberg had an article last month about the topic, "S&P 500 Companies Spend 95% of Profits on Buybacks, Payouts." The biggest concern is that companies are diverting earnings to these activities and not productive capital investment. Buybacks are addictive, especially to executives whose bonuses are based on their company's stock price and earnings per share. Eventually you end up with a hollow business that is out of touch with the marketplace and an easy target for competitors.

# # #

Commentary & Analysis

Upbeat Indicators and Employment Reports

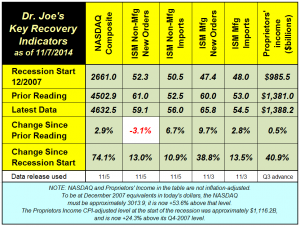

The recovery indicators improved since last month,

The recovery indicators improved since last month, with continued good performance in the ISM indicators. Even the indicator that was down, non-manufacturing new orders, is still at a level that indicates good growth. (click chart to enlarge)

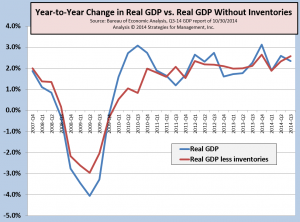

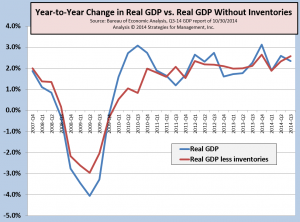

Last week, the first estimate of Q3 GDP was released, and it was +3.5%. It is likely that this will be revised down slightly as new data have been released that were only estimated in the GDP calculation, notably trade data. The revision will likely be down to +3.2%, which is still much better than earlier this year, and closer to the post-WW2 average. We prefer to look at the year-to-year comparison, which puts the underlying GDP growth at +2.3% with this latest reading. Inventories have distorted GDP data, and without them the latest Y/Y GDP is +2.6%. So let's say that underlying GDP remains in the +2.25-2.75% range, and will probably do so for some time. (click chart to enlarge)

Last week, the first estimate of Q3 GDP was released, and it was +3.5%. It is likely that this will be revised down slightly as new data have been released that were only estimated in the GDP calculation, notably trade data. The revision will likely be down to +3.2%, which is still much better than earlier this year, and closer to the post-WW2 average. We prefer to look at the year-to-year comparison, which puts the underlying GDP growth at +2.3% with this latest reading. Inventories have distorted GDP data, and without them the latest Y/Y GDP is +2.6%. So let's say that underlying GDP remains in the +2.25-2.75% range, and will probably do so for some time. (click chart to enlarge)

In the long run, changes in net inventories have zero effect, as businesses keep their inventories in line with changes in sales. Those adjustments take time, so there are quarter-to-quarter variations. GDP would have been higher had inventories been at the same level they were last quarter: they dropped by $22 billion. But Q3's inventory was more in line with recent averages, showing that businesses adjusted inventories in light of underlying conditions. There was a huge buildup of inventories at the end of 2013. That's not happening this year, as Q3-2014 net inventories were more than $30 billion less than 2013.

* * *

There was good news on the employment front in Friday's report. The unemployment rate fell to 5.8%, at that level for the wrong reasons with so many workers exiting the workforce in prior months. But last month the labor force actually increased by +416K, and employment was up +689K in the household survey (which includes self employment). The employment-population ratio is still at multidecade lows, but it improved, too. Perhaps the worst aspects of the labor market have finally found a bottom they can bounce on and begin to improve for real.

* * *

Those who regularly follow my writings and presentations know my concerns about stock buybacks and how they have been propping up stock prices out of proportion to actual economic growth. Bloomberg had an article last month about the topic, "S&P 500 Companies Spend 95% of Profits on Buybacks, Payouts." The biggest concern is that companies are diverting earnings to these activities and not productive capital investment. Buybacks are addictive, especially to executives whose bonuses are based on their company's stock price and earnings per share. Eventually you end up with a hollow business that is out of touch with the marketplace and an easy target for competitors.

# # #

In the long run, changes in net inventories have zero effect, as businesses keep their inventories in line with changes in sales. Those adjustments take time, so there are quarter-to-quarter variations. GDP would have been higher had inventories been at the same level they were last quarter: they dropped by $22 billion. But Q3's inventory was more in line with recent averages, showing that businesses adjusted inventories in light of underlying conditions. There was a huge buildup of inventories at the end of 2013. That's not happening this year, as Q3-2014 net inventories were more than $30 billion less than 2013.

* * *

There was good news on the employment front in Friday's report. The unemployment rate fell to 5.8%, at that level for the wrong reasons with so many workers exiting the workforce in prior months. But last month the labor force actually increased by +416K, and employment was up +689K in the household survey (which includes self employment). The employment-population ratio is still at multidecade lows, but it improved, too. Perhaps the worst aspects of the labor market have finally found a bottom they can bounce on and begin to improve for real.

* * *

Those who regularly follow my writings and presentations know my concerns about stock buybacks and how they have been propping up stock prices out of proportion to actual economic growth. Bloomberg had an article last month about the topic, "S&P 500 Companies Spend 95% of Profits on Buybacks, Payouts." The biggest concern is that companies are diverting earnings to these activities and not productive capital investment. Buybacks are addictive, especially to executives whose bonuses are based on their company's stock price and earnings per share. Eventually you end up with a hollow business that is out of touch with the marketplace and an easy target for competitors.

# # #

In the long run, changes in net inventories have zero effect, as businesses keep their inventories in line with changes in sales. Those adjustments take time, so there are quarter-to-quarter variations. GDP would have been higher had inventories been at the same level they were last quarter: they dropped by $22 billion. But Q3's inventory was more in line with recent averages, showing that businesses adjusted inventories in light of underlying conditions. There was a huge buildup of inventories at the end of 2013. That's not happening this year, as Q3-2014 net inventories were more than $30 billion less than 2013.

* * *

There was good news on the employment front in Friday's report. The unemployment rate fell to 5.8%, at that level for the wrong reasons with so many workers exiting the workforce in prior months. But last month the labor force actually increased by +416K, and employment was up +689K in the household survey (which includes self employment). The employment-population ratio is still at multidecade lows, but it improved, too. Perhaps the worst aspects of the labor market have finally found a bottom they can bounce on and begin to improve for real.

* * *

Those who regularly follow my writings and presentations know my concerns about stock buybacks and how they have been propping up stock prices out of proportion to actual economic growth. Bloomberg had an article last month about the topic, "S&P 500 Companies Spend 95% of Profits on Buybacks, Payouts." The biggest concern is that companies are diverting earnings to these activities and not productive capital investment. Buybacks are addictive, especially to executives whose bonuses are based on their company's stock price and earnings per share. Eventually you end up with a hollow business that is out of touch with the marketplace and an easy target for competitors.

# # #

In the long run, changes in net inventories have zero effect, as businesses keep their inventories in line with changes in sales. Those adjustments take time, so there are quarter-to-quarter variations. GDP would have been higher had inventories been at the same level they were last quarter: they dropped by $22 billion. But Q3's inventory was more in line with recent averages, showing that businesses adjusted inventories in light of underlying conditions. There was a huge buildup of inventories at the end of 2013. That's not happening this year, as Q3-2014 net inventories were more than $30 billion less than 2013.

* * *

There was good news on the employment front in Friday's report. The unemployment rate fell to 5.8%, at that level for the wrong reasons with so many workers exiting the workforce in prior months. But last month the labor force actually increased by +416K, and employment was up +689K in the household survey (which includes self employment). The employment-population ratio is still at multidecade lows, but it improved, too. Perhaps the worst aspects of the labor market have finally found a bottom they can bounce on and begin to improve for real.

* * *

Those who regularly follow my writings and presentations know my concerns about stock buybacks and how they have been propping up stock prices out of proportion to actual economic growth. Bloomberg had an article last month about the topic, "S&P 500 Companies Spend 95% of Profits on Buybacks, Payouts." The biggest concern is that companies are diverting earnings to these activities and not productive capital investment. Buybacks are addictive, especially to executives whose bonuses are based on their company's stock price and earnings per share. Eventually you end up with a hollow business that is out of touch with the marketplace and an easy target for competitors.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

- Komori unveils B2 UV Inkjet

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.