Commentary & Analysis

Recovery Indicators Have a Good Month

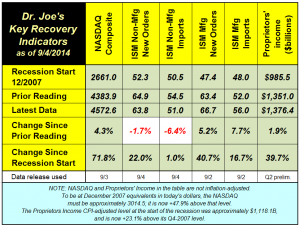

The recovery indicators have strengthened again with the NASDAQ having a good month,

The recovery indicators have strengthened again with the NASDAQ having a good month, and the ISM manufacturing indicators had an exceptional month, with a big increase in new orders.

The ISM non-manufacturing new orders declined slightly, but that index is at a very high and bullish level. The import index declined nearly to the level it was when the recession started, indicating slow growth.

Overall, five of the six indicators are in very good shape. In the recent upward GDP revision, proprietors income, an indicator about the health of small business, was revised up from from its initial reading of $1,364.1 billion to $1,376.4 billion.

There are many mixed signals in the economic data which imply that there is no great economic surge forward likely, but these recent top-line data imply improvements in the baseline level of economic activity, moving from the +2.25% range of GDP year-to-year growth to a +2.75%-+3.0% range. Those mixed signals remain sluggish incomes and spending for consumers, concerns about levels of business investment, and the slow rate of improvement in employment.

Recent events in world geopolitics may be a "wall of worry" that the US economy cautiously climbs.

Below is the chart of the recovery indicators (click chart to enlarge).

# # #

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.