As for the other indicators, the NASDAQ bounced around a bit but still came out 3% ahead of where it was last month, and the ISM manufacturing and non-manufacturing new orders grew. Imports for both categories were flat or declined, but their levels are still above 50, which means that they are still in growth territory.

There was a lot of joy on Wall Street as the S&P 500 made a new all-time high... well, not really. The Dow's been at inflation-adjusted highs over since it broke the16,000 mark. The Russell 2000 has been at real highs since it broke the 900 level, a while ago. It's in the 1130 range. But the two other indexes are not there yet. The NASDAQ still needs to break into Internet bubble 6500 territory (it's not close) and the S&P needs to be around 2150 (175 points away).

As the late CNBC anchor Mark Haines used to say, "all eyes are on Friday's employment report," which we anxiously await. Economists are bullish about a big 2Q GDP as "catch-up" from Q1, so they'll be looking for signs that's in progress.

There's enough conflicting economic data recently that the case for more muted and muddled growth, something we've been quite used to, is still the best bet. Watch for popular forecasts to be reeled in, yet again.

As for the other indicators, the NASDAQ bounced around a bit but still came out 3% ahead of where it was last month, and the ISM manufacturing and non-manufacturing new orders grew. Imports for both categories were flat or declined, but their levels are still above 50, which means that they are still in growth territory.

There was a lot of joy on Wall Street as the S&P 500 made a new all-time high... well, not really. The Dow's been at inflation-adjusted highs over since it broke the16,000 mark. The Russell 2000 has been at real highs since it broke the 900 level, a while ago. It's in the 1130 range. But the two other indexes are not there yet. The NASDAQ still needs to break into Internet bubble 6500 territory (it's not close) and the S&P needs to be around 2150 (175 points away).

As the late CNBC anchor Mark Haines used to say, "all eyes are on Friday's employment report," which we anxiously await. Economists are bullish about a big 2Q GDP as "catch-up" from Q1, so they'll be looking for signs that's in progress.

There's enough conflicting economic data recently that the case for more muted and muddled growth, something we've been quite used to, is still the best bet. Watch for popular forecasts to be reeled in, yet again.

Commentary & Analysis

Recovery Indicators Better in a Mixed Kind of Way

The recovery indicators were more encouraging this month,

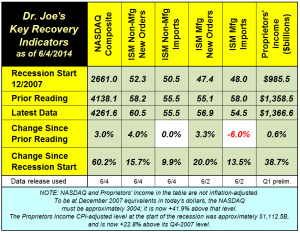

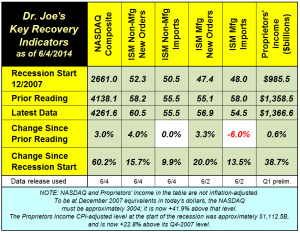

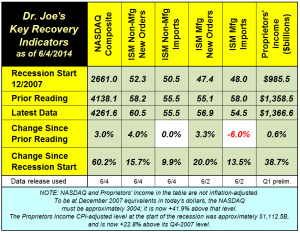

The recovery indicators were more encouraging this month, despite the revision to Q1 GDP to -1%. In that report, the original estimate of proprietors' income was reduced to $1,366 billion from its original $1371. (click chart to enlarge)

As for the other indicators, the NASDAQ bounced around a bit but still came out 3% ahead of where it was last month, and the ISM manufacturing and non-manufacturing new orders grew. Imports for both categories were flat or declined, but their levels are still above 50, which means that they are still in growth territory.

There was a lot of joy on Wall Street as the S&P 500 made a new all-time high... well, not really. The Dow's been at inflation-adjusted highs over since it broke the16,000 mark. The Russell 2000 has been at real highs since it broke the 900 level, a while ago. It's in the 1130 range. But the two other indexes are not there yet. The NASDAQ still needs to break into Internet bubble 6500 territory (it's not close) and the S&P needs to be around 2150 (175 points away).

As the late CNBC anchor Mark Haines used to say, "all eyes are on Friday's employment report," which we anxiously await. Economists are bullish about a big 2Q GDP as "catch-up" from Q1, so they'll be looking for signs that's in progress.

There's enough conflicting economic data recently that the case for more muted and muddled growth, something we've been quite used to, is still the best bet. Watch for popular forecasts to be reeled in, yet again.

As for the other indicators, the NASDAQ bounced around a bit but still came out 3% ahead of where it was last month, and the ISM manufacturing and non-manufacturing new orders grew. Imports for both categories were flat or declined, but their levels are still above 50, which means that they are still in growth territory.

There was a lot of joy on Wall Street as the S&P 500 made a new all-time high... well, not really. The Dow's been at inflation-adjusted highs over since it broke the16,000 mark. The Russell 2000 has been at real highs since it broke the 900 level, a while ago. It's in the 1130 range. But the two other indexes are not there yet. The NASDAQ still needs to break into Internet bubble 6500 territory (it's not close) and the S&P needs to be around 2150 (175 points away).

As the late CNBC anchor Mark Haines used to say, "all eyes are on Friday's employment report," which we anxiously await. Economists are bullish about a big 2Q GDP as "catch-up" from Q1, so they'll be looking for signs that's in progress.

There's enough conflicting economic data recently that the case for more muted and muddled growth, something we've been quite used to, is still the best bet. Watch for popular forecasts to be reeled in, yet again.

As for the other indicators, the NASDAQ bounced around a bit but still came out 3% ahead of where it was last month, and the ISM manufacturing and non-manufacturing new orders grew. Imports for both categories were flat or declined, but their levels are still above 50, which means that they are still in growth territory.

There was a lot of joy on Wall Street as the S&P 500 made a new all-time high... well, not really. The Dow's been at inflation-adjusted highs over since it broke the16,000 mark. The Russell 2000 has been at real highs since it broke the 900 level, a while ago. It's in the 1130 range. But the two other indexes are not there yet. The NASDAQ still needs to break into Internet bubble 6500 territory (it's not close) and the S&P needs to be around 2150 (175 points away).

As the late CNBC anchor Mark Haines used to say, "all eyes are on Friday's employment report," which we anxiously await. Economists are bullish about a big 2Q GDP as "catch-up" from Q1, so they'll be looking for signs that's in progress.

There's enough conflicting economic data recently that the case for more muted and muddled growth, something we've been quite used to, is still the best bet. Watch for popular forecasts to be reeled in, yet again.

As for the other indicators, the NASDAQ bounced around a bit but still came out 3% ahead of where it was last month, and the ISM manufacturing and non-manufacturing new orders grew. Imports for both categories were flat or declined, but their levels are still above 50, which means that they are still in growth territory.

There was a lot of joy on Wall Street as the S&P 500 made a new all-time high... well, not really. The Dow's been at inflation-adjusted highs over since it broke the16,000 mark. The Russell 2000 has been at real highs since it broke the 900 level, a while ago. It's in the 1130 range. But the two other indexes are not there yet. The NASDAQ still needs to break into Internet bubble 6500 territory (it's not close) and the S&P needs to be around 2150 (175 points away).

As the late CNBC anchor Mark Haines used to say, "all eyes are on Friday's employment report," which we anxiously await. Economists are bullish about a big 2Q GDP as "catch-up" from Q1, so they'll be looking for signs that's in progress.

There's enough conflicting economic data recently that the case for more muted and muddled growth, something we've been quite used to, is still the best bet. Watch for popular forecasts to be reeled in, yet again.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.