Commentary & Analysis

Organic Growth is Essential for Healthy Printing Businesses

A few weeks ago I wrote an article about the difficulty of putting industry data in perspective when there are trends that affect basic data measures.

A few weeks ago I wrote an article about the difficulty of putting industry data in perspective when there are trends that affect basic data measures. The article was about how surveys of business revenues are affected by consolidation, making it difficult to determine organic growth rates.

Organic growth rates are important in judging performance. If you hear news reports of the financial performance of retailers, for example, the phrase “same store sales” or “stores open more than one year” will be used. This means that they are attempting to convey the underlying growth rate of their business levels.

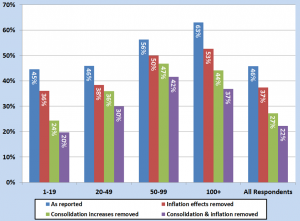

The survey conducted at the end of 2013 captured results for businesses that reported an increase in revenues of 1% or more were adjusted for consolidation effects. The chart below shows how results are adjusted for consolidation, inflation, and both. Note how much each adjustment reduces the percentage of respondents. (click to enlarge)

The blue bars are the original survey reports. The red bar is after adjusting for inflation. The green bar is the adjustment for consolidation. The rightmost blue bar is after adjusting for both.

Like the PIA Financial Ratios use the top 25% of respondents as “profit leaders,” these data show that 22% of the all respondents category survived the adjustments and had net growth of their core business. That's probably no accident, since we know that only the profit leaders have profits. For years, the other 75% have had no or low single-digit profits. In some recent years, they have had losses.

A good, healthy, core business is essential for printing businesses. Financial institutions have always displayed reluctance to loan to printer, as they have other industries dominated by small and mid-size family-owned businesses. Therefore, self-financing is critical for most printers. In recent years, and definitely in the years ahead, financial strength will prove to be a significant competitive weapon. Work to exceed typical financial ratios. Meeting typical industry averages will not be enough in the years ahead.

* * *

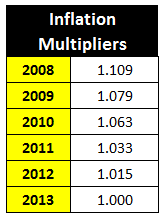

Inflation multipliers as of the end of 2013 are below. In late April we will publish the weights of the first quarter.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.