Commentary & Analysis

Q4-2013 GDP Revised Down from +3.2% to +2.4%, Consistent with Last Month's Analysis

Quarterly GDP data are released three times,

Quarterly GDP data are released three times, and are referred to as "advance," "preliminary," and "final." Advance reports are based on some real data plus a very large portion of estimated data. As time passes, those estimates are replaced by reports of actual data. There are estimates in the final report, but they represent a much smaller portion than in the earlier two reports. There is usually nothing final about statistics, of course. Every Spring, GDP history is revised going back multiple years.

Last month's GDP report was overstated, and was generally understood as such. One of the peculiar aspects of it was a repeat of Q3's increase in inventories. Q4's inventory buildup was reduced to about the same level as Q3. In last month's analysis, we stated that the buildup may have been business executives acting on two certainties, as they saw it, that interest rates would be rising sharply in 2014 as the Fed unwound its QE3 efforts, and per unit labor costs would be rising sharply because of ACA implementation. They seemed like good bets at the time, but they're not turning out that way. The Fed will be moving more cautiously than generally believed in those quarters, and ACA implementation has been delayed for many businesses. This means the disparity in labor costs between Q4-2013 and Q1-2014 will be much less than originally thought.

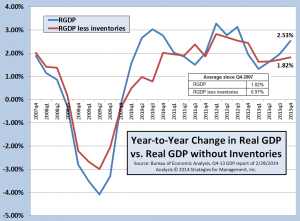

Unsold inventories look like they are a becoming problem in Q1-2014. Much of the latest data for retail sales, durable goods, and other indicators appear to be weakening. We will have more details and commentary next week when we publish the next set of recovery indicators. Below is an updated chart of real GDP with and without inventories since the beginning of the recession. (click to enlarge)

Inside GDP, there was a decline in the growth of Personal Consumption Expenditures. It was originally estimated as growing +3.3% compared to Q3, but it was revised to +2.5%. The increase in equipment sales was raised higher, to 10% compared to Q3. Are the investments being made to reduce the need for future workers? We won't know for a long time.

Be wary of reports about data being affected by weather-related items. This is always the worst Winter since the last time there was a Winter, and businesses are always improving their abilities to work despite weather conditions. One of my favorite stories this year was about Waffle House in Atlanta, and how they decided they would do whatever it took to stay open during the storms and their aftermath. It can be done. We used to do it back when I had to walk to school in the snow, every day, and uphill both ways. :)

We have more communications infrastructure than ever that allow work to be done no matter where employees are. The movement of goods is better and better managed than ever. While there are always disruptions in bad weather, they do not affect the entire country. E-commerce shopping and retailing is not shut down by weather. Consumers can get product information no matter what the weather by going online. Delivery of the mail does not affect billing and payments the way it used to because of electronic payments systems. No one has to go to the bank in the era when you can take a picture of a check with a smartphone and have it deposited into your account instantly. Some of the weaker economic data have been weak in areas unaffected by bad weather. It's all worth keeping an eye on.

* * *

There's been a lot of excitement on Wall Street and among the business cable channels talking heads about the S&P 500 being at a record level. It still has to reach 2122 to be an inflation-adjusted high, about 14% from current levels. The NASDAQ has bounced back in the last month, but is still not near its inflation-adjusted high of about 6500. The Dow and Russell 2000 have been in true record territory for a while. Stock buybacks remain very aggressive, increasing the risk of using stock indexes as proxies for general economic health. If companies had reason to invest in expanding their businesses, they would not be using buybacks at this pace.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.