Commentary & Analysis

Five of Six Recovery Indicators Retreat; Two Fall Below December 2007 Recession Levels

There has been a major change in the recovery indicators.

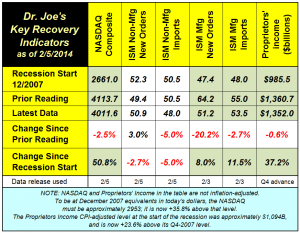

There has been a major change in the recovery indicators. Two of the six indicators are below levels at the start of the recession in December 2007, and five of the six retreated from the last report. (click to enlarge)

The NASDAQ had a rough month along with the rest of the stock market. Concerns about emerging markets and their monetary situations sent stocks lower. Many exchange-traded companies reported higher earnings but indicated stagnant sales levels; some proffered weak future sales or earnings guidance, giving another reason for the plunge. Of course, there's always Apple, an important part of the NASDAQ, which was punished because they only sold 33,000 more iPhones per day than last quarter. Some people are just not satisfied, it seems. It could be that stocks are just "tired" for now; they had a good run last year.

The big concern is that the ISM manufacturing new orders index got slammed, down more than 20% and imports down almost 3%. Both are still over 50 (51.2 and 53.5, respectively) indicating slow growth. The magnitude of the decline is the shocker, and is something we hinted at as possible in our ("laughable and embarrassing") blogpost last week. There we said it was the increase in inventories that made real GDP seem good when it was not. Economic and regulatory conditions provided a foundation for a combination of management actions in Q3 & Q4-2013. These took advantage of the period before the weekly hours of work restrictions of the ACA. This meant that Q3 and Q4 were the last months of wide flexibility in labor scheduling. Implementation of the ACA also meant that benefits costs of those workers would be significantly higher starting in 2014. The final factor was the belief that interest rates would rise in 2014 as the Fed started to taper its quantitative easing efforts. The savings in total labor costs, and the lower holding costs of extra inventory created by that labor would be low in Q3 and Q4 compared to 2014, hence the incentive to build inventories of goods because of their expected lower per unit costs. The costs of that inventory were lower than the costs of future units of production. Going into 2014 with higher inventory levels would create a buffer for cutbacks in hours and headcounts in 2014.

The ISM manufacturing new orders index might be an affirmation of that line of thinking. Its -20% decline was the steepest since October 2008, just before the announcement that we had been in recession for 11 months. Unlike that October 2008 report, which dropped the index down to 33, the current new orders index remains slightly above 50, indicating slow positive growth.

On the non-manufacturing side, the new orders index increased from the last report, but is still below the level of December 2007. The imports index also decreased below the levels of the recession's start.

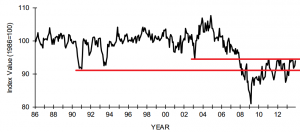

Proprietors income, mentioned in last week's post, contracted by -0.6%. This was the first decrease in this data series in four years, in Q1-2010. This is the only measure in the GDP and personal income reports that provides some insight into the state of small business. I've often mentioned the National Federation of Independent Business (NFIB) Small Business Index. That data series remains mired between two recession bottoms: that of the early 1990s recession and that of the early 2000s. This is the latest chart; new data are released next week. (click chart to enlarge)

If this turns out to be the first indications of a new recession, the arbiter of such designations, the National Bureau of Economic Research (NBER) will have a tough time figuring that out. It is common to believe that a recession is two quarters of negative growth, but that is not the official definition. Technically, you don't need negative GDP to be in a recession, but you do need a range of economic measures to be in serious trouble. Negative GDP, however, is something easy to understand. Right now, negative GDP seems unlikely. The indicators may just be signaling a much slower growth rate, probably in the 1.0% to 1.5% range. As for a recession, low growth rates always mean that you are closer to the precipice than usual, and the likelihood of falling is always higher when you are close to the edge.

But would we detect a new recession in a timely way? The recession that started December 2007 was not declared until 11 months later. The other problem is that many data series have not reached the levels that they were at when the December 2007 recession began, meaning that they never really recovered. This might finally be the start of the "double dip" that was in almost every economic analysis of about three or four years ago. Whether or not a particular period is declared a recession is meaningless for those who run businesses. The NBER had trouble detecting the recovery. Their declaration that the recession ended in June 2009 was made fifteen months later in September 2010. If it turns out a new recession began, NBER's pronouncement will be late and very nuanced, and not useful for making business decisions. Yes, these economic times are that strange.

Businesses run in real time and make decisions based on the conditions they are experiencing. Recessions are always declared in hindsight, mainly by academic economists who do not have to deal in a direct with decisions about allocating time, capital, or workforces in the pursuit of customers. Academic economists can only make business conditions assessments based on published data, and the data they need are not in real time. They have to wait for data to be refined and for those data to show a pattern first.

Real-time decision makers can't wait, and need to take actions using experience and what they directly observe, which is not always quantitative. Keep your eyes open and be observant. Be curious and ask questions. Remember, any economic downturn will increase the intensity of the shift to digital media. That means hunkering down and waiting for difficulties to pass is not a choice. If your company has not accommodated current and future media shifts in some strategic manner, it might be getting too late to do so.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.