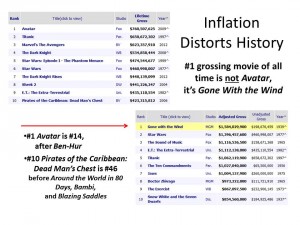

Many who have heard my discussions have found information about movie box office receipts as a good illustration. I recently updated the tables from BoxOfficeMojo.com, which adjusts movie receipts by historical average ticket prices. (Click chart to enlarge).

Avatar is the highest grossing film of all time, yet after inflation adjustment, it's in fourteenth place. The top three films of all time are Gone With the Wind, Star Wars, and The Sound of Music (which I have a preference for Mad Magazine's parody, "The Sound of Money" with the idea that "The hills are alive with the sound of money" which is very fitting this week with the economics meetings in Davos, Switzerland, and its final song, "Climb Every Mountain," which had lyrics starting with "Play just one theater, in every town, only sell reserved seats, turn most people down").

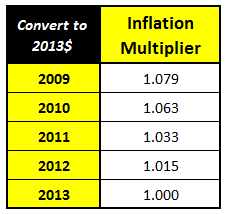

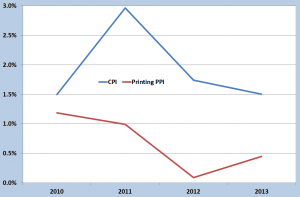

The chart below will never win any Oscars, but it has a simple plot that can be followed along by anyone who can use Microsoft Excel. Multiply your financial data for each of the years by the multiplier, and you've made a step to looking at your business in terms of the purchasing power of that period. (Click on the chart to enlarge.) This chart is based on the Consumer Price Index. There is always concern that the data should be based on the Producer Price Index for printing, and the aforementioned slide presentation reviews that. The main reason for the use of the CPI is that owners and workers don't get paid in printing dollars, they get paid in consumer dollars. The purpose of a business is to generate incomes for its owners and employees that can be used in the general marketplace. The chart below shows the shortfall between the Printing PPI and the CPI. That shortfall means two things. First, printing prices lag general inflation, which means in comparative terms, print is getting cheaper and cheaper. Second, it means that to keep incomes for owners and employees up with general inflation, printers need to find ways to make up for the shortfall with greater sales or lower costs or both. Printing prices are being dragged down by the costs and benefits of other media and the devices used to access them, as well as the price increases of the USPS. I was going through some of my writings of a few years ago, and as of eight years ago, the statistical relationships between postal prices and print volume changes were not strong. Those analyses were focused, however, on the immediate pre-increase and post-increase effects on volume for adjoining calendar quarters, and not on the long term secular volume trends related to USPS prices. At that time, standard mail was growing, fueled by the aggressive activities of banks in the mortgage and home equity markets. First class mail was in multi-year decline, as was periodical mail and the volume of catalogs. The media and communications markets now are different than those of 2006, and secular downward trends are still in place and intensified. It was in 2007 that social media came to broad public awareness, and a couple of years after that, smartphones and tablet computing. Those changes in media habits, supplemented by declining costs and increasing speeds and coverage of broadband have altered the competitive environment completely. Print may be getting cheaper every day, but the costs of alternatives are getting even cheaper faster. This means that the print business has to focus on aspects of printed goods that supplement other media, create gateways to those media, and do what those other media cannot do. This is one of the reasons why digital printing in all its formats (basic and wide and even 3D, though that's not really printing in our industry's context) are critical to the profitable expansion of print and related services. They remove print from being considered on its generic basis as output to part of a cohesive strategic and tactical whole, where the economic value is derived from that media relationship and not the precision application of colored liquids onto substrates. The opposite direction of price trends for digital media (broadband) and hard copy distribution (USPS) are signals to print businesses to focus their product offerings in different ways. This makes it essential to focus on the communications objectives of clients and the total costs of the actions needed to meet those objectives. Unless you understand your clients, you can't understand how to work in their best interests. The pressures on printing companies to find a profitable position in these developing communications marketplaces are enormous. There are encouraging results from the business conditions survey we recently completed. Finally, after many years, there is a notable positive difference in the revenue performance of marketing service providers and those printers that have not followed that path. The difference is not stark; there are still many ways to be profitable and healthy in our industry and the MSP initiative is one of them. But it is one way that finally seems to show some measurable upside. # # #