Commentary & Analysis

Recovery Indicators Okay, Revised Q3 GDP Not as Strong as It Looks

The recovery indicators took minor steps back,

The recovery indicators took minor steps back, but the NASDAQ had another good month and the new orders for manufacturing were very strong. Even though the non-manufacturing new orders and the manufacturing imports declined since last month, they are indicating continued growth. (When an ISM index is above 50 it indicates growth, when it is below, it indicates contraction.) There was a minor downward revision in proprietor's income, one of our best indicators of small business activity. (click to enlarge chart)

The second release of GDP for Q3-2013 indicated a strong economy, but the underlying data showed it wasn't what it really seemed. The Q3 GDP increase was revised up to +3.6%, which is good, the first time it's been above the post-WW2 average for a while. The problem is that inventory buildup in the data represents about half of the increase. This means that businesses are producing more goods than they are likely to sell in the short term. This trend may be continuing, as the Institute for Supply Management reports are showing increases in new orders in 4Q.

The concern is that the inventories will need to be worked off, so some future quarter's economic activity rate will be significantly lower.

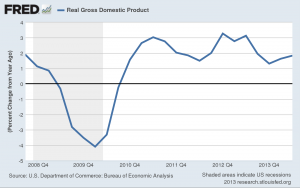

This is why it is usually better to look at GDP reports on a year-to-year basis rather than a quarter-to-quarter basis. This smooths the data and reduces these kinds of fluctuations. (click to enlarge chart)

The effects of inventory buildups and drawdowns, and other unusual shifts, are smoothed out by the year-to-year analysis. The chart shows that GDP is running at about a 2% rate.

Why are businesses stockpiling? The reasons for the buildup are not clear, but a plausible scenario that and working with is that labor costs today are much lower than labor costs in 2014. There will be increases in benefits costs for workers, mainly from the ACA. This means that the labor component of the total product cost at this moment is a better value than it will be weeks from now.

Also, there is concern that future financing costs will rise when the Federal Reserve attempts to unwind from its various monetary manipulations. Cheaper labor, cheaper finance, both for the short term.

Then there's another factor: many companies will manage their future labor cost by having fewer workers. There is a chance that many of the workers involved in the stockpiled inventories may not have jobs early next year because of their higher costs. This looks like an opportunistic shift of production from one year into another to handle future sales.

This kind of thing happens all the time, when taxpayers change behavior by shifting income or expenses because of an upcoming change in tax law, or sales managers shift orders from one year into another to reach a bonus or defer bookings after they've met targets. These are rational actions, but they distort the natural flow of activity. This time, it seems to be happening with inventories.

It's a GDP report that looks good on the outside, but not on the inside. After making an adjustment for inventories, you get a GDP for Q3 somewhere between +1.8% to +2.2%. Is the scenario described above what's happening? We won't know if this is the case until data become available and we watch what happens to inventories in Q1 and Q2 of 2014. The discussion won't be resolved until the Summer.

The recent backtracking on the ACA implementation did not happen until this quarter. In Q3, the assumption was that there would be full implementation in 2014, and that likely played a significant role in the planning of businesses for their labor needs. The “rescheduling” of the ACA does not mean that the increases in benefits costs will not occur, but the rises will be notable, but definitely muted compared to what might have occurred if no retreat from the deadlines was made. Most businesses realize it's just a reprieve and not a permanent change, and are likely to consider their restructurings plans, and will only deviate for brief opportunistic circumstances. This means that they will continue to focus on short-term productivity and efficiencies, and not on robust expansions. There will always be exceptions to generalizations, especially this one. But the general tone of business, especially small and mid-size business is filled with concerns and not enthusiasm.

I was having a conversation a few weeks ago with a financial planning acquaintance. If you were born in 1980, your work career has never been part a business boom. You were probably still in school for the second term of the Clinton presidency, and you were in grammar school during the second Reagan term, both of which are good proxies for the timelines of economic growth periods. This means that you have never experienced a sustained period of growth above post-WW2 average levels.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

- Komori unveils B2 UV Inkjet

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.