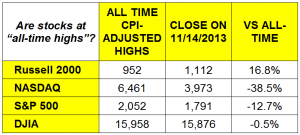

The NASDAQ still has quite a ways to go to get back to its "Internet bubble" level, and won't get there for quite some time. The S&P 500's high level was set when bank stocks were flying very high. The Russell 2000, which is an index of smaller companies, broke through its old high a while ago.

There has been some concern that the S&P's rise has been mainly propelled by stock buybacks, to the tune of 60% of its increase, according to a study by J.P. Morgan. Organic growth would be best, of course. But many public companies have been taking advantage of low interest rates to pay off or refinance debt (a good thing) or to buy stock back. This is generally cowardly, except when needed for employee purchase plans and similar purposes. The company's admitting that it has no idea where to put the extra money, and won't raise dividends or pay a special dividend. What's worse, some executive bonuses are tied in part to increases in earnings per share, so by decreasing the number of shares, they can earn a bonus, even though the company might be performing exactly the same as it was the year before. A rising stock price may have nothing to do with an expanding and better-run company. So the rise in the index turns out to be something we shouldn't get all that excited about.

Should we watch a stock index at all? Sure, they can be very helpful in determining the direction of financial events, but they're not always indicative of true investment results. One important factor is to consider is that no index takes into account dividend payments or the compounding effect of reinvested dividends over many years. That means that buybacks boost the index but a disciplined history of regular and growing dividends does not!

Since the bottom of the recession, any investor who regularly invested in stocks has done handsomely. Investors who began to invest at the tops of these markets and engaged in steady dollar-cost-averaging (a regular investment every month, or quarter [or week!] has probably done very well, especially if they reinvested dividends.

So what good is a stock index in determining anything? If they are distorted by inflation and buybacks can they be any help at all? It all depends on context. Never take the numbers at face value, no matter how giddy (or solemn) the talking heads get on cable. But yes, look at the numbers, but don't make them your solitary guideline.

# # #