Commentary & Analysis

Dr. Joe Recalculates the Unemployment Rate: It Improves to 7.1%, but Problems Remain; Printing Employment Holds Its Own, Unless You're a Supervisor

Today'

Today's release of the unemployment rate was the clash of two survey methodologies: the household survey and the payroll survey. Federal workers, idled by the shutdown were considere unemployed in the household survey but employed in the payroll survey because of the assurance that the workers would be paid for their idle time during the shutdown. The household survey is what the unemployment rate is based on. The Bureau of Labor Statistics issued special documentation with the data release, and I have re-calculated the unemployment rate considering the 307,000 Federal workers as employed. Despite adding back those workers, the household survey had a decline of -428,000 workers, but so many workers left the workforce that the unemployment rate "improved" to 7.1%. Last month, 932,000 workers permanently exited the workforce (counted in the reports as "not in labor force"), and the labor participation rate declined to 62.8%. Remember, you are counted in the labor force even if you are unemployed, as long as you are looking for a job. This sluggish general pattern of the labor market, and one of the primary reasons why the economy can't grow at historical rates. Fewer people working means that the output of goods and services must rely almost solely on productivity increases for growth, and those have never been enough to support robust expansionary economic growth.

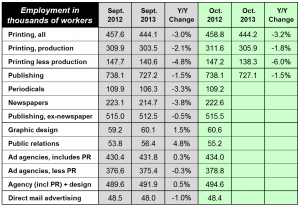

Printing employment held steady from September to October, increasing slightly on the production side, and decreasing on the non-production side. This is likely the continuing effects of consolidation in the industry, as production employment is down -1.8% since last year, but non-production employment is down 6%. There were many revisions last month throughout the printing and content creation markets, as the BLS appeared to underreport September employment to a small degree, now corrected. The surge in public relations employees appears to be slowing and gradually coming in line with employment levels at the end of 2012. This week's disappointing printing shipments report showing steep declines in August and September shipments cause great concern about October's shipment levels. These employment data for October showed a 1,400 increase in production employment, which implies that October shipments, normally higher than September's, would be at least flat or slightly better than the prior month.

Below is the summary chart; click to enlarge.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.