Commentary & Analysis

August and September Commercial Printing Shipments Take a Tumble

Maybe the government should have stayed in shutdown.

Maybe the government should have stayed in shutdown. The Commerce Department released the August and September printing shipments data on Monday. August's data were not released on schedule because of the shutdown, and delayed until the normal September release this week. Perhaps they should have kept the data to themselves.

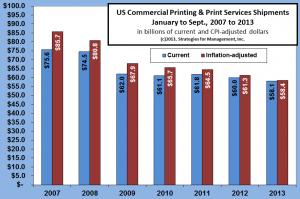

August shipments were $6.532 billion, and September's were $6.527 billion in current dollars, down -6.6% and -5.5%, respectively. After adjusting for inflation using the Consumer Price Index, they were down -8.0% and -6.6%, respectively. This creates great concern about October's shipments levels. We'll get a peek at those in Friday's employment report. If printing employment dipped in October, one of the industry's strongest months, that could be an ominous sign about how the year will finish, and underscore a relentless digital media shift for retailers, especially.

It is likely that October 2012 was the last month where shipments more than $7 billion in current dollars. Our models are forecasting just under $6.8 billion, but they might be as low as $6.6 billion if they follow recent patterns. (click chart to enlarge)

Remember, these are aggregate industry data. There are companies that are defying these trends every day by changing their offerings, getting involved in strategic communications deployment, and other supportive aspects of meeting client overall communications objectives. The recent RRD/CGX merger is very much about the decline of big-volume, high profile print (catalogs, magazines, books, inserts) that drive a large portion of these data. Those were categories in which RRD dominated for decades. RRD/CGX is also about finding new ways to serve large corporate infrastructures. But much of print is about other markets and other applications. Creative and entrepreneurial approaches to small and mid-size business communications are greatly needed. Don't ignore the aggregate data, but they should be used to emphasize the importance of urgency to act on new and better strategies.

There will be a complete wrap-up of economic data, the latest recovery indicators, and other comments on Friday, after the employment data are released.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.