Although the Fed does not value its portfolio on a mark-to-market basis, the spike in interest rates over the second quarter has already reduced the market value of the Fed’s portfolio by about $192 billion, wiping out the entirety of the past year’s unrealized portfolio gains. Higher rates would continue to reduce the value of liquid assets available for sale, thus eroding the Fed’s capital cushion. Given that the Fed’s capital currently sits at only $55 billion, a continued increase in interest rates could potentially erase the Fed’s capital base. This could impair the Fed's ability to sell assets and protect the purchasing power of the dollar, which in turn could reduce the value of Treasuries and push interest rates even higher.Note the first line: "...the Fed does not value its portfolio on a mark-to-market basis." One of the reasons for the financial collapse of 2008 was the shift to mark-to-market accounting by financial institutions. Is this another case where a (quasi)government entity is exempt from the regulations that are imposed on others? A similar issue occurs with items such as the Federal debt. It is currently between $16 and $17 trillion, about the size of annual GDP. Using GAAP accounting standards, like most large companies are required to, the figure is actually about $80 trillion, taking into account future obligations such as pensions. The Fed is likely to allow the bulk of its portfolio of bonds and obligations it owns to mature and not reinvest in additional securities so as not to create sudden jolts in the market and to make it seem like their losses are smaller. The value of their portfolio will be just as subject to inflation loss as everyone else's as short term interest rates remain below inflation levels. # # #

Commentary & Analysis

Recovery Indicators Have a Good Month; Are Stocks at All-Time Highs? (Revisited)

The recovery indicators bounced back from their unimpressive levels of last month.

The recovery indicators bounced back from their unimpressive levels of last month. Only one of the indicators dropped. The NASDAQ had a good month, up 7.2%. It is now almost 25% above its level at the start of the recession and is still moving higher despite Apple's sluggish stock performance. ISM Manufacturing and Non-manufacturing new orders had a strong rise. (click chart to enlarge)

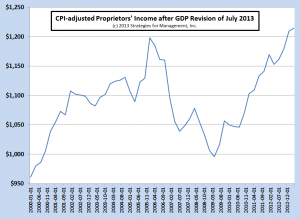

Last week, the Bureau of Economic Analysis made significant revisions to the calculation of Gross Domestic Product, going all the way back to 1929. This new method is claimed to better recognize the value of intellectual property and R&D spending. Since proprietors' income, a measure of the trends in small business, is part of that calculation, revisions were seen there as well. The BEA revised proprietors' income down by $100 billion at the start of the recession in Q4-2007. This made the rebound of proprietors' income since the start of the recession all the stronger. This is curious, because no other economic data, such as employment as measured in the household survey of the Bureau of Labor Statistics, and surveys by independent organizations such as the National Federation of Independent Business (NFIB), indicate such a significant rise. That aside, the new data indicate that proprietors' income has risen more than 35% since the start of the recession, and is nearly up more than 22% on an inflation-adjusted basis. The chart below shows this data series adjusted using the Consumer Price Index. (click chart to enlarge)

* * *

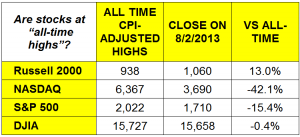

The stock markets are doing well lately, and it's a good time to see if the various stock indexes are at real all-time highs after adjusting for inflation. The only one that is legitimately so is the Russell 2000, which is mainly smaller stocks (small stocks and small business are not synonymous; to see the requirements to be listed on NASDAQ, visit Investopedia). The NASDAQ is still far from its Internet bubble high. The index bottomed in the Spring of 2009 and is now up more than 2.5x from that time. The S&P 500, which has many financial stocks, is still about -15% below an all-time high. The Dow is likely to break 15,700 soon. Steady investors who dollar-cost averaged (a consistent amount invested every month or quarter) and reinvested their dividends through the declines and the rebounds did well whether the indexes are at new highs or not. (click chart to enlarge)

* * *

The Federal Reserve's purchases of Treasury instruments has now turned to break-even, and is likely headed to a loss. Guggenheim Partners’ Global Chief Investment Officer Scott Minerd writes:

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.