Commentary & Analysis

GDP Still Short of Normal Recovery; Revisions Make Recession "Less Bad"

The Bureau of Economic Analysis made changes to the calculation of GDP,

The Bureau of Economic Analysis made changes to the calculation of GDP, revising data back to the Great Depression. These revisions were basically related to the measurement of the value of intellectual property, R&D, and products such as entertainment such as motion pictures. If you use the (incorrect) rule of thumb that two consecutive quarters of negative GDP as the definition of a recession, the one we had in the early 2000s has now disappeared, with the lowest reading of GDP at that time now reported on a Y/Y basis as +0.18%. As far as the most recent recession was concerned, it was still deep, but less so. A Wall Street Journal article describes the revision and a BEA document explains it in greater detail. Revisions to one of the data series we follow as an indicator of small business activity, proprietors income, will be discussed in my article next week with the release of the latest recovery indicators.

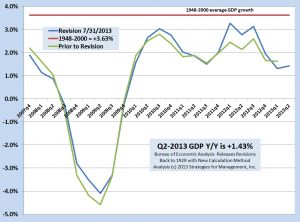

As far as this latest report, it is still much below the post-WW2 average up to 2000 of +3.63 annual real growth (to 2013 the average is +3.28%); click chart to enlarge.

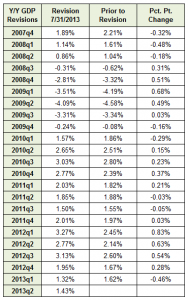

Among the latest revisions, on a year-to-year basis, Q1-2013 was revised down from +1.62% to +1.32%, but Q4-2012 was revised to +1.95% from +1.67%. The deepest quarter of the recession, Q2-2009, was revised from -4.58% to -4.09%.

The table below summarizes the changes since the recession (click to enlarge):

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.