Commentary & Analysis

GDP Report Shows Struggling Economy; Should You Use GDP as a Benchmark?

Last Friday'

Last Friday's GDP report for Q1-2013 came in lower than expectations at +2.5%. That is an annual growth rate compared to Q4-2012. That looked like a pickup in activity compared to Q4-2012 which was +0.4%. Because of the changes in tax rates, there were distortions in the Q4 data as companies reduced spending, slowing real GDP growth, and shifting the expenses to Q1. This affected recent reports of incomes as well, so it is probably better to average the two quarters, which would be about +1.45%. Even better is to look at GDP on a year-to-year basis, since businesses make long term decisions and have trouble discerning what short-term fluctuations mean, suspicious that they are just statistical estimation errors. (click chart to enlarge)

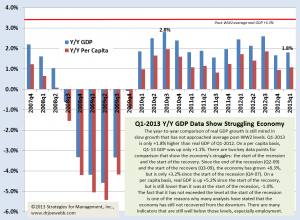

Comparing on a year-to-year basis also minimizes the effects of revisions. that fine-tune the data. On that basis, the year-to-year comparison of real GDP growth is still mired in slow growth that has not approached average post-WW2 levels. Q1-2013 is only +1.8% higher than real GDP of Q1-2012. On a per capita (per person) basis, Q1-13 GDP was up only +1.1%.

There are two key data points that can give a better sense of how the economy is doing. That is to compare the data to where it was at the start of the recession and then at the start of the recovery. Since the end of the recession (Q2-09) and the start of the recovery (Q3-09), the economy has grown +8.3%, but is only +3.2% since the start of the recession (Q4-07). On a per capita basis, real GDP is up +5.2% since the start of the recovery, but is still lower than it was at the start of the recession, -1.0%.

The fact that it has not exceeded the level at the start of the recession is one of the reasons why many analysts have stated that the economy has still not recovered from the downturn. There are many indicators that are still well below those levels, especially employment, as noted in an earlier post. Since the start of the recession, the economy has averaged +0.7% annualized growth, and -0.1% annualized decline in per capita GDP. Since the start of the recovery, the averages are +1.6% and +0.8%, respectively.

So how does a business owner or executive compare their company performance to the economy? GDP is a summary of business activities, profitable and unprofitable, expansionary and contracting, so it is a net number that actually says little. While the evaluation of business activities compared to an objective figure like GDP has great appeal, it is misleading to use it as such, especially in planning.

Hold your business separate; judge its performance compared to personal goals as well as market-based goals. GDP is for the entire country, but most businesses are local or regional, or targeted to particular market segments or niches, or even to a small handful of customers. Those aspects of one's business should determine the kinds of benchmarks that are used to assess their performance and plan for their future.

Does last Friday's GDP report mean anything? Of course it does: we all like to know how the economy is doing because we each have a stake in its health and growth as consumers, savers and investors, and businesspeople. But it should not be the dominant metric for judging a business entity.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.