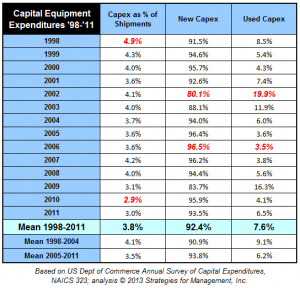

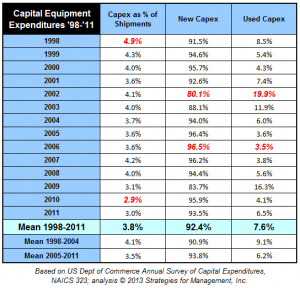

As industry shipments have declined, the rate of capital equipment investment has declined faster. In 1999, a relatively strong year for commercial print in that decade, 4.9% of shipments was spent on capital investments, or approximately $7 billion in today's dollars. By 2011, the percentage had gradually fallen to 3%, or under $3 billion. The data reflect the disappearance of prepress equipment into software, workflow, and communications technologies, and the decline of big ticket purchases such as heatset web offset, gravure, and other long run length production equipment. Mergers and acquisitions disrupt traditional capital purchase patterns by shifting resources from production infrastructure to the purchase of companies. (click chart to enlarge)

Capex can be a confusing area to track statistically, so a few comments about the data can be helpful.

- The data show occasional bursts of used equipment purchases. Most all searches for new equipment in a printing plant begin with a search for used equipment, first. It's not so much that the equipment is used, it's that it's displaced. The used equipment market grows because of availability. When there is an increase in the number of print business closures, that equipment comes to market. When leases go bad and the equipment is repossessed, that equipment ends up in the used equipment market. Economic distress makes used equipment sales rise, but the inclination of all printers is to look for used equipment first. There are times when used equipment is relatively young, in which case it is a good deal, or the printer is seeking a model similar to what they already own to minimize downtime for training and to ensure smooth operations.

- Used equipment is cheaper, abandoned equipment is cheaper yet. The rash of “tuck-ins,” where companies access to customer bases are acquired rather than buying a company, often leads to abandoned equipment, or equipment tied up in bankruptcy. This further reduces the price, which means that you can't use the data in the chart to say in 2011 that “only 6.5% of capital equipment expenditures were for used equipment, so it's a tiny market.” Many used equipment sales prevent a new equipment sale, so it should be of great interest. This is why there is often great interest in getting traded-in equipment out of the marketplace. Years ago, trade-ins in the US would head to Asia, Africa, Central or South America. Now these regions are buying new equipment, or leaping to other technologies, such as skipping offset and going straight to digital. This further depresses used equipment prices, and the equipment is more likely to stay in the same market in which it was sold.

- That said, there are times when used equipment is a means of saving funds for mainstream operations and preserving funds for new equipment purchases. This is extremely important when there is a technology change, and used equipment becomes a means of transition from the old to the new.

- Mergers & acquisitions tend to depress new purchases of equipment. First, they divert resources to the purchase of the business and its financing. Second, merged companies “cherry pick” equipment involved in the merger, keeping the best and discarding the unneeded, thus reducing the dollars available for the latest equipment.

- One of the reasons for M&A may be the avoidance of new capital expenditures. That is, companies may have considered purchasing the same new equipment, but once merged, only one purchase is needed.

- As M&A activity increased when print demand declined, the capital investment ratio has declined. In the 1990s, it often appeared that as print demand was rising, the flow of M&A money from bankers looking for growing markets, stimulated capital purchases. At that time, print businesses were on the positive periphery of the Internet financial bubble. When that bubble burst, and M&A activity shifted from riding a rising tide to finding bargains among the rubble, the rate of capital investment contracted.

In the long term, used equipment is a means of the industry preserving its capital and dispersing scarce resources efficiently. Changes in patterns of capital investments is a reflection of industry conditions, economic factors, and adaptation to changes in demand, especially new communications competitors.

# # #

Capex can be a confusing area to track statistically, so a few comments about the data can be helpful.

Capex can be a confusing area to track statistically, so a few comments about the data can be helpful.