Commentary & Analysis

It's Claimed Stocks are Making All-time Highs... Not Really...

The business press has been writing that stock indices are at new all-

The business press has been writing that stock indices are at new all-time or at highs since the recession. That is, unless you adjust for inflation.

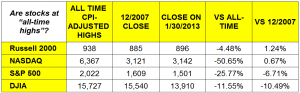

Using end-of-month historical closes, the Russell 2000 is -4.48% off its all time high, and just +1.24% since the start of the recession in December 2007. The S&P 500 is off -25.77% off its all-time high, and is still -6.71% since December 2007. The DJIA is -11.55% and -10.49% respectively. As for the NASDAQ, it's almost -51% off its all time high, and is only +0.67% above its December 2007 close. If it wasn't for Apple, it would probably be down -10% to -15%.

If someone dollar-cost-averaged (same dollar amount invested every month) through the recession and the sluggish and slight recovery, they probably did very well and got inflation-beating returns. The key to that is staying disciplined, especially through 2008 where the best bargains occurred and many investors panicked. I worked this out one day when it was claimed that the Wilshire 5000 had hit an all-time high. When I adjusted it for inflation, it clearly did not. All investors should be well aware that there are two significant eroders of savings: taxes and inflation. This is one reason why products like IRAs and 401k's are so important for long term savings. They deal with the tax issue or postpone it to a later time, but they don't manage with the inflation issue and the loss of purchasing power. Beating inflation is critical to investing.

Starting with the value of that index at December 2007, it had about a 20% return for that period with the same amount invested every month, even though it had a slight loss comparing the value of the index at those two end-points. One only earned back their money and more when they invested in a disciplined way with a small amount every month.

Bonds were the better investment thanks to "Helicopter Ben" during that period. A benefit of bond funds is that their monthly reinvestment of interest enhances any dollar-cost-averaging strategy. Very few stock funds pay monthly dividends. Most pay them quarterly, some pay them annually.

Here's the chart showing the highs and the performance since, showing that most of the major measures of stock market performance are not at highs at all once inflation is taken into account. The all-time and December 2007 closes are adjusted using the CPI (click to enlarge):

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.