GDP for the fourth quarter of 2012 was reported by the Bureau of Economic Analysis as contracting since the third quarter at the annualized rate of -

GDP for the fourth quarter of 2012 was reported by the

Bureau of Economic Analysis as contracting since the third quarter at the annualized rate of -0.1%. Remember, GDP is a bookkeeping exercise that considers a dollar spent on a candy bar as the same as a dollar spent on a college education. A decline in government spending on defense was one of the most significant contributors to the decline. Consumer and business activities were positive, though not near historic levels:

Real personal consumption expenditures increased 2.2 percent

in the fourth quarter, compared with an increase of 1.6 percent in the third.

Durable goods increased 13.9 percent, compared with an

increase of 8.9 percent. Nondurable goods increased 0.4 percent,

compared with an increase of 1.2 percent. Services increased 0.9 percent,

compared with an increase of 0.6 percent.

Business investment in equipment and software was up +12.4%.

Exports and imports both contracted. Remember, despite the common assumption that imports are "bad," there are resources and raw materials that must be imported because they are located in other geographies. My usual example is how Starbucks imports coffee and its value-added from operations is significantly greater than its materials costs. North Dakota grown coffee just isn't that good :)

Proprietors' income grew at a current dollar annual rate of about 7.3% (roughly 5% after inflation). Disposable personal income on a per capita basis was up +8.1%, and +6.8% after adjusting for inflation at an annual rate compared to Q3. Real disposable income on a per capita basis was the highest since Q2-2008, when there was no recognition that the economy was in a recession at that time (remember, the recession was declared in November 2008 and its start was pegged at that time as December 2007).

How are all of these contradictions possible? Many small businesses, which are often flexible in their ability as to the calendar time they realize income on a short term basis, shifted income to Q4 to lighten their likely tax burden. Corporations, large and small, declared special dividends or shifted dividend payments to 2012 to avoid higher tax rates in 2013.

As far as the investment in equipment and software, that is a continuing pattern of emphasis on internal efficiency rather than economic expansion and risk-taking. When ability to forecast future demand is impaired, higher tax rates become part of investment return calculations, and the possibility of higher inflation's effects on the value of those returns are included in net present value calculations, the economic desire to invest in risks of new ventures declines. Therefore, investments that improve internal efficiency gain management's preference because they are measurable and have quicker and more reliable payback periods.

The negative GDP report may have gotten some news attention, but the positive parts of the report underscore the problems of the economy and its lack of vitality. Whether or not a new "double dip" recession will be declared is of little consequence. Keep navigating accordingly, and remember that changing costs is far more important than cutting costs.

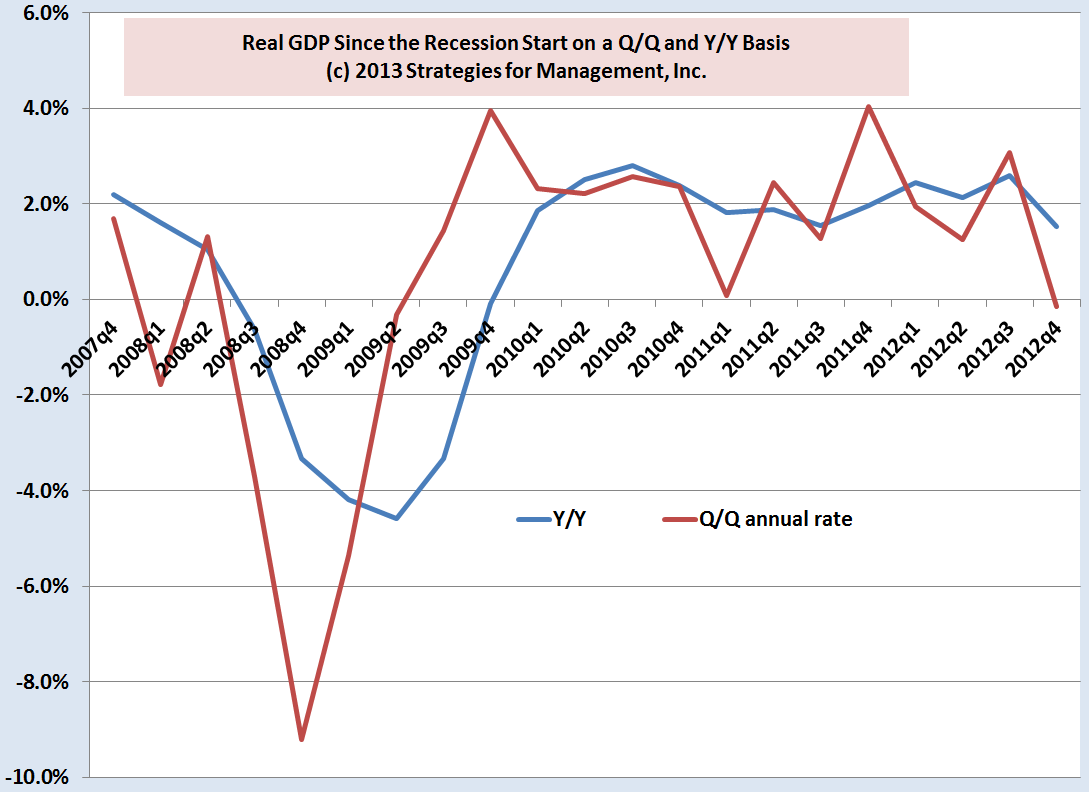

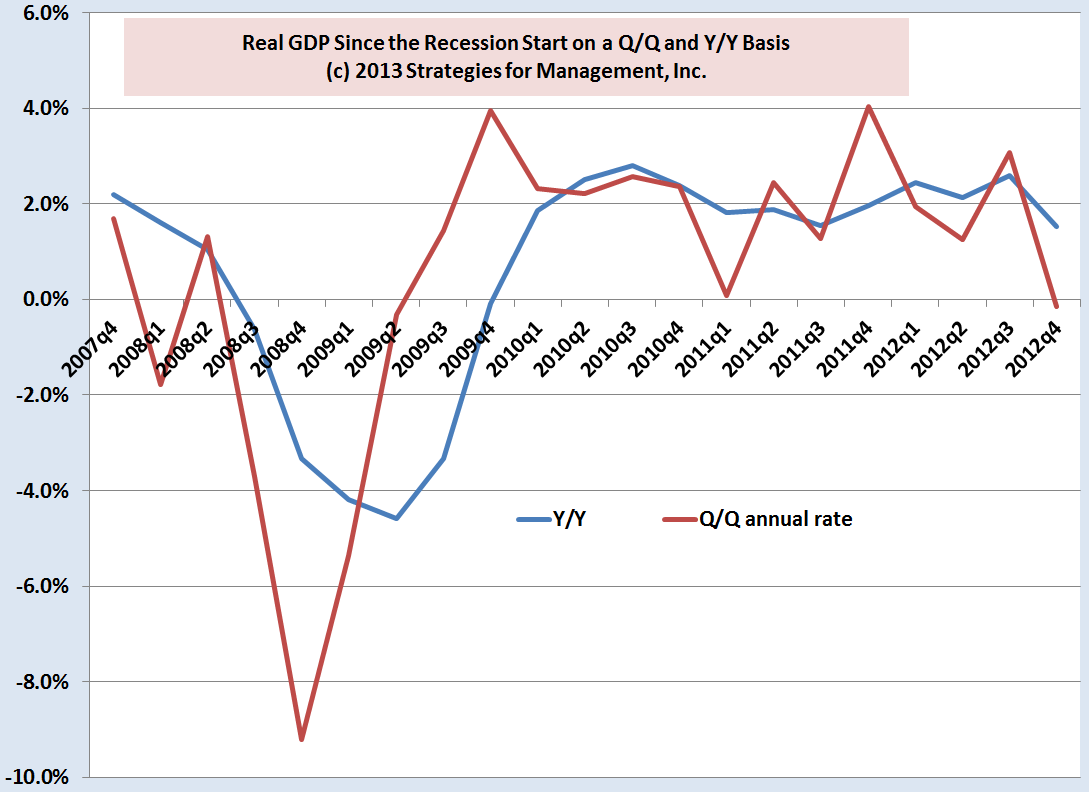

The chart below shows real GDP on a quarter-to-quarter basis (as is done in news reports) and my preferred year-to-year basis. GDP for Q4 will be revised two more times in the next two months.

# # #