Commentary & Analysis

Recovery Indicators Still Show Flat Economy; Printing Shipments Have a Positive October

How many months have we claimed that the economy is still in sideways mode?

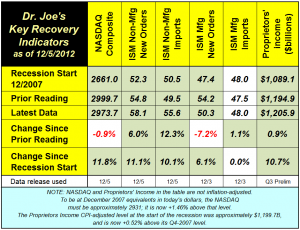

How many months have we claimed that the economy is still in sideways mode? It seems like years. The NASDAQ is down -0.9% compared to November's figure, despite some serious gyrations during the month, including a closing low of 2836 in the middle of the month, and what some analysts are calling a bear market signal for Apple stock. That's now in the range of $550 from $700 just a few months ago. Other tech companies, like Intel, have suffered value setbacks, all despite another gadget-heavy holiday shopping season. It sure burned a lot of energy (and tested investor patience) to get back to almost the same place where it started a month before. (Click to enlarge table).

Another important indicator, ISM manufacturing report's new orders index fell by -7.2%. The manufacturing sector has been declining, and other aspects of the ISM report showed that employment would be contracting. Their non-manufacturing report had more positive news, with a +6% increase in new orders and a 12.3% increase in imports.

Proprietors' income, a measure of small business activity, was revised down for the third quarter. Using the new figure, it was up +0.9% compared to the second quarter. After adjusting for inflation, proprietors' income is up only +0.52% since the start of the recession in December 2007, or about +0.1% per year. The NASDAQ is up only +1.46% on that basis, or less than +0.3% per year.

Last week, the estimate of GDP for the third quarter was revised up to +2.7% from +2.0%, still well below the post-WW2 average of +3.4%. There are many forecasts for the fourth quarter that are being revised down as fears of recession persist. It may be the case, however, that GDP and personal income data for Q4 may surprise to the upside because of tax moves of small businesses and investors, such as the issuance of special dividends or accelerated dividends in response to the likely increase in capital gains and dividend taxes. Some of the churn of the stock markets is attributed to portfolio shifts to take capital gains in 2012 rather than in 2013. The aggregate effect of these moves may make Q4 GDP seem stronger than its true underlying economic fundamentals, and Q1-2013 may display weaker conditions than its actual trend. The economy seems to be just above recession levels, anyway, and there is a good chance it may fall into one, with Q4-2011 as its official start once all of the data revisions are made. But is it a recession if what we're seeing is really a lack of robust recovery from the economy's lows of 2009? Does it really matter if the recovery never really got far off the ground? The employment data of Friday December 7 may shed some new light on these economic conditions.

October printing shipments were up +$251 million (+3.6%) compared to October 2011. On an inflation-adjusted basis, shipments were up $100 million (+1.4%). For January through October, shipments were down -1.6% compared to 2011, and down -3.7% on an inflation-adjusted basis. September shipments were revised down by -$49 million, and were down -3.9% on a current dollar basis and -5.8% on an inflation-adjusted basis compared to 2011.

* * *

On a personal note, the loss of Mark Bonacorso was indeed a shock to all. Mark was a great professional and a delight in personal conversation. His stories about working with some high-priced prima donna chefs were just priceless. I regret not having the opportunity of working with him more than the handful of times our paths happened to cross. I envy those who had the chance. Heartfelt prayers go to his family and all those who had the benefit of his friendship.

Another important indicator, ISM manufacturing report's new orders index fell by -7.2%. The manufacturing sector has been declining, and other aspects of the ISM report showed that employment would be contracting. Their non-manufacturing report had more positive news, with a +6% increase in new orders and a 12.3% increase in imports.

Proprietors' income, a measure of small business activity, was revised down for the third quarter. Using the new figure, it was up +0.9% compared to the second quarter. After adjusting for inflation, proprietors' income is up only +0.52% since the start of the recession in December 2007, or about +0.1% per year. The NASDAQ is up only +1.46% on that basis, or less than +0.3% per year.

Last week, the estimate of GDP for the third quarter was revised up to +2.7% from +2.0%, still well below the post-WW2 average of +3.4%. There are many forecasts for the fourth quarter that are being revised down as fears of recession persist. It may be the case, however, that GDP and personal income data for Q4 may surprise to the upside because of tax moves of small businesses and investors, such as the issuance of special dividends or accelerated dividends in response to the likely increase in capital gains and dividend taxes. Some of the churn of the stock markets is attributed to portfolio shifts to take capital gains in 2012 rather than in 2013. The aggregate effect of these moves may make Q4 GDP seem stronger than its true underlying economic fundamentals, and Q1-2013 may display weaker conditions than its actual trend. The economy seems to be just above recession levels, anyway, and there is a good chance it may fall into one, with Q4-2011 as its official start once all of the data revisions are made. But is it a recession if what we're seeing is really a lack of robust recovery from the economy's lows of 2009? Does it really matter if the recovery never really got far off the ground? The employment data of Friday December 7 may shed some new light on these economic conditions.

October printing shipments were up +$251 million (+3.6%) compared to October 2011. On an inflation-adjusted basis, shipments were up $100 million (+1.4%). For January through October, shipments were down -1.6% compared to 2011, and down -3.7% on an inflation-adjusted basis. September shipments were revised down by -$49 million, and were down -3.9% on a current dollar basis and -5.8% on an inflation-adjusted basis compared to 2011.

* * *

On a personal note, the loss of Mark Bonacorso was indeed a shock to all. Mark was a great professional and a delight in personal conversation. His stories about working with some high-priced prima donna chefs were just priceless. I regret not having the opportunity of working with him more than the handful of times our paths happened to cross. I envy those who had the chance. Heartfelt prayers go to his family and all those who had the benefit of his friendship.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.