The NASDAQ pulled back -4.3%. While it is +12.7% higher than it was when the recession started, it's only +2.3% after adjusting for inflation from the level it was almost five years ago. Proprietors' income, a measure of small business activity, is up +1.5% compared to the second quarter, and +11.4% since the start of the recession. After adjustment for inflation, it is +1.06% higher than it was in Q4-2007.

Activity in the manufacturing sector picked up as noted by the ISM new orders index, but imports of materials were down. Many imported raw materials are necessary for manufacturing because various materials and minerals are not found in the US. Imports of non-manufacturing industries were also down. New orders for non-manufacturing slowed down. Because the ISM index is 54.8, that still indicates positive growth in that sector. When an ISM index is above 50, it means that the index is growing. Higher numbers indicate faster growth.

Last week's first GDP estimate for Q3-2012 still showed a sideways moving economy. Friday's report of the unemployment rate showed a worsening job market in the headline number, but as usual, reading past the headline showed something else, such as a slight improvement in the labor particpation rate. The household survey showed an increase in employment by 410,000 workers as 578,000 workers joined the workforce. U-6, the unemployment statistic that includes discouraged or underused workers, is now 14.6%. While that is still high, it was 15.0% in July, and was 16% at this time last year.

# # #

The NASDAQ pulled back -4.3%. While it is +12.7% higher than it was when the recession started, it's only +2.3% after adjusting for inflation from the level it was almost five years ago. Proprietors' income, a measure of small business activity, is up +1.5% compared to the second quarter, and +11.4% since the start of the recession. After adjustment for inflation, it is +1.06% higher than it was in Q4-2007.

Activity in the manufacturing sector picked up as noted by the ISM new orders index, but imports of materials were down. Many imported raw materials are necessary for manufacturing because various materials and minerals are not found in the US. Imports of non-manufacturing industries were also down. New orders for non-manufacturing slowed down. Because the ISM index is 54.8, that still indicates positive growth in that sector. When an ISM index is above 50, it means that the index is growing. Higher numbers indicate faster growth.

Last week's first GDP estimate for Q3-2012 still showed a sideways moving economy. Friday's report of the unemployment rate showed a worsening job market in the headline number, but as usual, reading past the headline showed something else, such as a slight improvement in the labor particpation rate. The household survey showed an increase in employment by 410,000 workers as 578,000 workers joined the workforce. U-6, the unemployment statistic that includes discouraged or underused workers, is now 14.6%. While that is still high, it was 15.0% in July, and was 16% at this time last year.

# # #

Commentary & Analysis

Recovery Indicators Retreat; Economic Indicators Still Moving Sideways

Since the beginning of October,

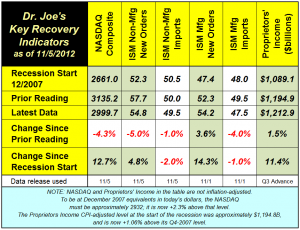

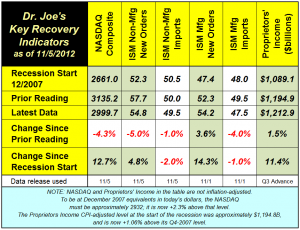

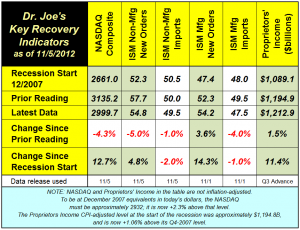

Since the beginning of October, four of the six recovery indicators retreated, and two of them are below the levels at the start of the recession back in December 2007. (Click image to enlarge)

The NASDAQ pulled back -4.3%. While it is +12.7% higher than it was when the recession started, it's only +2.3% after adjusting for inflation from the level it was almost five years ago. Proprietors' income, a measure of small business activity, is up +1.5% compared to the second quarter, and +11.4% since the start of the recession. After adjustment for inflation, it is +1.06% higher than it was in Q4-2007.

Activity in the manufacturing sector picked up as noted by the ISM new orders index, but imports of materials were down. Many imported raw materials are necessary for manufacturing because various materials and minerals are not found in the US. Imports of non-manufacturing industries were also down. New orders for non-manufacturing slowed down. Because the ISM index is 54.8, that still indicates positive growth in that sector. When an ISM index is above 50, it means that the index is growing. Higher numbers indicate faster growth.

Last week's first GDP estimate for Q3-2012 still showed a sideways moving economy. Friday's report of the unemployment rate showed a worsening job market in the headline number, but as usual, reading past the headline showed something else, such as a slight improvement in the labor particpation rate. The household survey showed an increase in employment by 410,000 workers as 578,000 workers joined the workforce. U-6, the unemployment statistic that includes discouraged or underused workers, is now 14.6%. While that is still high, it was 15.0% in July, and was 16% at this time last year.

# # #

The NASDAQ pulled back -4.3%. While it is +12.7% higher than it was when the recession started, it's only +2.3% after adjusting for inflation from the level it was almost five years ago. Proprietors' income, a measure of small business activity, is up +1.5% compared to the second quarter, and +11.4% since the start of the recession. After adjustment for inflation, it is +1.06% higher than it was in Q4-2007.

Activity in the manufacturing sector picked up as noted by the ISM new orders index, but imports of materials were down. Many imported raw materials are necessary for manufacturing because various materials and minerals are not found in the US. Imports of non-manufacturing industries were also down. New orders for non-manufacturing slowed down. Because the ISM index is 54.8, that still indicates positive growth in that sector. When an ISM index is above 50, it means that the index is growing. Higher numbers indicate faster growth.

Last week's first GDP estimate for Q3-2012 still showed a sideways moving economy. Friday's report of the unemployment rate showed a worsening job market in the headline number, but as usual, reading past the headline showed something else, such as a slight improvement in the labor particpation rate. The household survey showed an increase in employment by 410,000 workers as 578,000 workers joined the workforce. U-6, the unemployment statistic that includes discouraged or underused workers, is now 14.6%. While that is still high, it was 15.0% in July, and was 16% at this time last year.

# # #

The NASDAQ pulled back -4.3%. While it is +12.7% higher than it was when the recession started, it's only +2.3% after adjusting for inflation from the level it was almost five years ago. Proprietors' income, a measure of small business activity, is up +1.5% compared to the second quarter, and +11.4% since the start of the recession. After adjustment for inflation, it is +1.06% higher than it was in Q4-2007.

Activity in the manufacturing sector picked up as noted by the ISM new orders index, but imports of materials were down. Many imported raw materials are necessary for manufacturing because various materials and minerals are not found in the US. Imports of non-manufacturing industries were also down. New orders for non-manufacturing slowed down. Because the ISM index is 54.8, that still indicates positive growth in that sector. When an ISM index is above 50, it means that the index is growing. Higher numbers indicate faster growth.

Last week's first GDP estimate for Q3-2012 still showed a sideways moving economy. Friday's report of the unemployment rate showed a worsening job market in the headline number, but as usual, reading past the headline showed something else, such as a slight improvement in the labor particpation rate. The household survey showed an increase in employment by 410,000 workers as 578,000 workers joined the workforce. U-6, the unemployment statistic that includes discouraged or underused workers, is now 14.6%. While that is still high, it was 15.0% in July, and was 16% at this time last year.

# # #

The NASDAQ pulled back -4.3%. While it is +12.7% higher than it was when the recession started, it's only +2.3% after adjusting for inflation from the level it was almost five years ago. Proprietors' income, a measure of small business activity, is up +1.5% compared to the second quarter, and +11.4% since the start of the recession. After adjustment for inflation, it is +1.06% higher than it was in Q4-2007.

Activity in the manufacturing sector picked up as noted by the ISM new orders index, but imports of materials were down. Many imported raw materials are necessary for manufacturing because various materials and minerals are not found in the US. Imports of non-manufacturing industries were also down. New orders for non-manufacturing slowed down. Because the ISM index is 54.8, that still indicates positive growth in that sector. When an ISM index is above 50, it means that the index is growing. Higher numbers indicate faster growth.

Last week's first GDP estimate for Q3-2012 still showed a sideways moving economy. Friday's report of the unemployment rate showed a worsening job market in the headline number, but as usual, reading past the headline showed something else, such as a slight improvement in the labor particpation rate. The household survey showed an increase in employment by 410,000 workers as 578,000 workers joined the workforce. U-6, the unemployment statistic that includes discouraged or underused workers, is now 14.6%. While that is still high, it was 15.0% in July, and was 16% at this time last year.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.