Commentary & Analysis

Recovery Indicators Retreat; Economy's Sidestep Continues

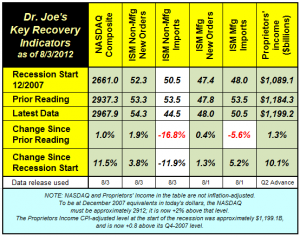

The recovery indicators continue their sideways move with a mixed performance.

The recovery indicators continue their sideways move with a mixed performance. The NASDAQ increase slightly, and is back ahead of its position at the start of the recession by 2%. Considering it's taken four and a half years, a fiscal stimulus, two quantitative easings punctuated by “Operation Twist,” it's quite a disappointment. When we were assembling the recovery indicators, we chose the NASDAQ because it was not as heavily influenced by bank stocks as the S&P 500 is. Since December 31, 2007, Apple's stock has gone from about $181 and closed recently at $620, a 343% rise. The stock is now about 12% of the NASDAQ index. So the 2% inflation-adjusted rise in the index is probably significantly negative without that company's legendary performance.

For the first time in quite a while, two of the indicators fell since the prior month, both of them imports. Much manufacturing and also many service industries, rely on the importation of raw materials not available in the US, hence the (contrarian) inclusion in the index. Revisions to GDP data made in late July included revisions to proprietors' income, a measure of small business activity. This has been depressed by the decline in construction compared to levels in the housing bubble. All economies have sectors that ebb and flow, but construction has been in a funk since its crash. The news accounts of housing construction growth are basically trumpeting a market that is bouncing along a bottom: sometimes it's good, sometimes it's bad. But it always seems to be moving sideways and not getting worse.

And then the ultimate sideways movement was last week's unemployment report. The report was spun in so many ways, with a rise in the unemployment rate to 8.3%. The Bureau of Labor Statistics clearly stated that unemployment was essentially unchanged, as the rise was just a small difference in rounding. Those who took great comfort in the increase in payroll jobs of 160,000 were trumpeting a headline. Deeper in the report was a decrease in household employment, which includes the self-employed, partnerships, and other workers, of -195,000. The measure of unemployment that includes discouraged workers (U-6) is now 15%, and has been rising since March when it was 14.5%.

There are still two themes playing out in the economy. The first is that the Fed is still attempting to prop up the prices of goods produced a while ago (housing and its associated loans), which undermines the rewards of savings and investment (most conservative investments, like CD's and Treasurys are paying below inflation rates). The second is that expectations of higher future costs (inflation, tax rates, regulatory compliance) encourages businesses to seek efficiency rather than expansion. Efficiency has immediate and predictable returns. Expansion has risks including negative cash flows during start-up and the risk that business assumptions underlying the expansion decisions may turn out to be flawed or untrue. While efficiency can increase profitability with lower risk, it does not increase long-run profits in changing markets. Efficiency investments tend to be historically focused and justified, while expansion investments are future-focused, and therefore riskier. Until the psychology and also the financial justifications for taking on risk change, expect the sidestep to continue.

For the first time in quite a while, two of the indicators fell since the prior month, both of them imports. Much manufacturing and also many service industries, rely on the importation of raw materials not available in the US, hence the (contrarian) inclusion in the index. Revisions to GDP data made in late July included revisions to proprietors' income, a measure of small business activity. This has been depressed by the decline in construction compared to levels in the housing bubble. All economies have sectors that ebb and flow, but construction has been in a funk since its crash. The news accounts of housing construction growth are basically trumpeting a market that is bouncing along a bottom: sometimes it's good, sometimes it's bad. But it always seems to be moving sideways and not getting worse.

And then the ultimate sideways movement was last week's unemployment report. The report was spun in so many ways, with a rise in the unemployment rate to 8.3%. The Bureau of Labor Statistics clearly stated that unemployment was essentially unchanged, as the rise was just a small difference in rounding. Those who took great comfort in the increase in payroll jobs of 160,000 were trumpeting a headline. Deeper in the report was a decrease in household employment, which includes the self-employed, partnerships, and other workers, of -195,000. The measure of unemployment that includes discouraged workers (U-6) is now 15%, and has been rising since March when it was 14.5%.

There are still two themes playing out in the economy. The first is that the Fed is still attempting to prop up the prices of goods produced a while ago (housing and its associated loans), which undermines the rewards of savings and investment (most conservative investments, like CD's and Treasurys are paying below inflation rates). The second is that expectations of higher future costs (inflation, tax rates, regulatory compliance) encourages businesses to seek efficiency rather than expansion. Efficiency has immediate and predictable returns. Expansion has risks including negative cash flows during start-up and the risk that business assumptions underlying the expansion decisions may turn out to be flawed or untrue. While efficiency can increase profitability with lower risk, it does not increase long-run profits in changing markets. Efficiency investments tend to be historically focused and justified, while expansion investments are future-focused, and therefore riskier. Until the psychology and also the financial justifications for taking on risk change, expect the sidestep to continue.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.