The changes in 2009 mean that the trough of the recession (Q2-2009) was less deep, and the recovery was less strong. The major revisions were in 2010. Should businesspeople really care? In a practical sense, no. But these revised data are used in forecasting models by private and institutional economists, so they may change the direction of the forecasts you read about or otherwise use in your business.

A recession starts at the last time the economy was at its highest point, and ends when it is at its lowest since that time. A recovery begins at the lowest point and ends when GDP (and other factors) surpass the level where the recession started. Originally, data indicated that the economy reached that point in Q1-2011; these and prior revisions have moved it six months later, to Q3-2011. (For more information about how the dates of business cycles are determined, go to the National Bureau of Economic Research site. It's not “two consecutive negative quarters of GDP” as popularly believed.)

Remember, GDP calculation is just bookkeeping. It's not even accounting; no cause and effect relationship is implied in the figures. Accounting is an analysis of the relationships of those figures, such as how certain costs affect other costs or output for decision-making. GDP is all about the arithmetic of adding up the value of goods and services and not much else. Our “favorite” aspect of GDP bookkeeping is that imports are subtracted from GDP and exports are added. In one sense, that's proper, because imported items were not produced domestically. Therefore, the bookkeeping implies that imports are “bad” and should be avoided and exports are “good” and should be encouraged. If those imports are raw materials, however, the value added created domestically is usually far greater. An easy example is Starbucks, which uses imported coffee because none can be grown in the US, but creates all of its margin through marketing and distribution domestically. Without the imported coffee, there is no Starbucks.

There will be increased attention to economic reports in coming weeks as the presidential election season gets to be in full swing. Keep an eye on the data and read past the headlines. The key report will always be the unemployment report. The next one is Friday, August 3.

The changes in 2009 mean that the trough of the recession (Q2-2009) was less deep, and the recovery was less strong. The major revisions were in 2010. Should businesspeople really care? In a practical sense, no. But these revised data are used in forecasting models by private and institutional economists, so they may change the direction of the forecasts you read about or otherwise use in your business.

A recession starts at the last time the economy was at its highest point, and ends when it is at its lowest since that time. A recovery begins at the lowest point and ends when GDP (and other factors) surpass the level where the recession started. Originally, data indicated that the economy reached that point in Q1-2011; these and prior revisions have moved it six months later, to Q3-2011. (For more information about how the dates of business cycles are determined, go to the National Bureau of Economic Research site. It's not “two consecutive negative quarters of GDP” as popularly believed.)

Remember, GDP calculation is just bookkeeping. It's not even accounting; no cause and effect relationship is implied in the figures. Accounting is an analysis of the relationships of those figures, such as how certain costs affect other costs or output for decision-making. GDP is all about the arithmetic of adding up the value of goods and services and not much else. Our “favorite” aspect of GDP bookkeeping is that imports are subtracted from GDP and exports are added. In one sense, that's proper, because imported items were not produced domestically. Therefore, the bookkeeping implies that imports are “bad” and should be avoided and exports are “good” and should be encouraged. If those imports are raw materials, however, the value added created domestically is usually far greater. An easy example is Starbucks, which uses imported coffee because none can be grown in the US, but creates all of its margin through marketing and distribution domestically. Without the imported coffee, there is no Starbucks.

There will be increased attention to economic reports in coming weeks as the presidential election season gets to be in full swing. Keep an eye on the data and read past the headlines. The key report will always be the unemployment report. The next one is Friday, August 3.

Commentary & Analysis

Q2 GDP Disappoints at +1.5%; GDP Revisions Make Recession Less Bad and Recovery Less Good

The advance GDP for the second quarter of 2012 was +

The advance GDP for the second quarter of 2012 was +1.5%. This was a slowdown from the first quarter, which was 1.9%.

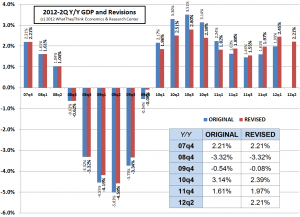

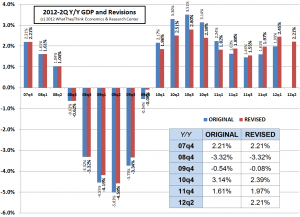

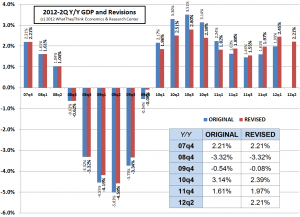

Revisions were made to GDP data starting with 2009. The Bureau of Economic Analysis stated the annual GDP data revisions as follows: “The percent change from the preceding year in real GDP was revised up from a decrease of 3.5% to a decrease of 3.1% for 2009, was revised down from an increase of 3.0% to an increase of 2.4% for 2010, and was revised up from an increase of 1.7% to an increase of 1.8% for 2011.”

The real GDP data are adjusted for inflation. The rate used by the Bureau of Economics was very small, 0.7%, so a small change in the inflation calculation in upcoming revisions can potentially change Q2-2012 GDP by a significant amount. Few people really believe the 0.7% inflation rate, so keep an eye on this in next month's revision.

Because the GDP data are under regular revision, especially advance reports released just 30 days after the end of the quarter, it's best to review GDP data on a year-to-year basis rather than quarter-to-quarter. Comparing the second quarter 2012 data to the second quarter of 2011, GDP grew by +2.21%.

The chart shows the revisions. The chart begins with the recession start of Q4-2007. Original data are in blue, and the revised data are in red. (click chart to enlarge)

The changes in 2009 mean that the trough of the recession (Q2-2009) was less deep, and the recovery was less strong. The major revisions were in 2010. Should businesspeople really care? In a practical sense, no. But these revised data are used in forecasting models by private and institutional economists, so they may change the direction of the forecasts you read about or otherwise use in your business.

A recession starts at the last time the economy was at its highest point, and ends when it is at its lowest since that time. A recovery begins at the lowest point and ends when GDP (and other factors) surpass the level where the recession started. Originally, data indicated that the economy reached that point in Q1-2011; these and prior revisions have moved it six months later, to Q3-2011. (For more information about how the dates of business cycles are determined, go to the National Bureau of Economic Research site. It's not “two consecutive negative quarters of GDP” as popularly believed.)

Remember, GDP calculation is just bookkeeping. It's not even accounting; no cause and effect relationship is implied in the figures. Accounting is an analysis of the relationships of those figures, such as how certain costs affect other costs or output for decision-making. GDP is all about the arithmetic of adding up the value of goods and services and not much else. Our “favorite” aspect of GDP bookkeeping is that imports are subtracted from GDP and exports are added. In one sense, that's proper, because imported items were not produced domestically. Therefore, the bookkeeping implies that imports are “bad” and should be avoided and exports are “good” and should be encouraged. If those imports are raw materials, however, the value added created domestically is usually far greater. An easy example is Starbucks, which uses imported coffee because none can be grown in the US, but creates all of its margin through marketing and distribution domestically. Without the imported coffee, there is no Starbucks.

There will be increased attention to economic reports in coming weeks as the presidential election season gets to be in full swing. Keep an eye on the data and read past the headlines. The key report will always be the unemployment report. The next one is Friday, August 3.

The changes in 2009 mean that the trough of the recession (Q2-2009) was less deep, and the recovery was less strong. The major revisions were in 2010. Should businesspeople really care? In a practical sense, no. But these revised data are used in forecasting models by private and institutional economists, so they may change the direction of the forecasts you read about or otherwise use in your business.

A recession starts at the last time the economy was at its highest point, and ends when it is at its lowest since that time. A recovery begins at the lowest point and ends when GDP (and other factors) surpass the level where the recession started. Originally, data indicated that the economy reached that point in Q1-2011; these and prior revisions have moved it six months later, to Q3-2011. (For more information about how the dates of business cycles are determined, go to the National Bureau of Economic Research site. It's not “two consecutive negative quarters of GDP” as popularly believed.)

Remember, GDP calculation is just bookkeeping. It's not even accounting; no cause and effect relationship is implied in the figures. Accounting is an analysis of the relationships of those figures, such as how certain costs affect other costs or output for decision-making. GDP is all about the arithmetic of adding up the value of goods and services and not much else. Our “favorite” aspect of GDP bookkeeping is that imports are subtracted from GDP and exports are added. In one sense, that's proper, because imported items were not produced domestically. Therefore, the bookkeeping implies that imports are “bad” and should be avoided and exports are “good” and should be encouraged. If those imports are raw materials, however, the value added created domestically is usually far greater. An easy example is Starbucks, which uses imported coffee because none can be grown in the US, but creates all of its margin through marketing and distribution domestically. Without the imported coffee, there is no Starbucks.

There will be increased attention to economic reports in coming weeks as the presidential election season gets to be in full swing. Keep an eye on the data and read past the headlines. The key report will always be the unemployment report. The next one is Friday, August 3.

The changes in 2009 mean that the trough of the recession (Q2-2009) was less deep, and the recovery was less strong. The major revisions were in 2010. Should businesspeople really care? In a practical sense, no. But these revised data are used in forecasting models by private and institutional economists, so they may change the direction of the forecasts you read about or otherwise use in your business.

A recession starts at the last time the economy was at its highest point, and ends when it is at its lowest since that time. A recovery begins at the lowest point and ends when GDP (and other factors) surpass the level where the recession started. Originally, data indicated that the economy reached that point in Q1-2011; these and prior revisions have moved it six months later, to Q3-2011. (For more information about how the dates of business cycles are determined, go to the National Bureau of Economic Research site. It's not “two consecutive negative quarters of GDP” as popularly believed.)

Remember, GDP calculation is just bookkeeping. It's not even accounting; no cause and effect relationship is implied in the figures. Accounting is an analysis of the relationships of those figures, such as how certain costs affect other costs or output for decision-making. GDP is all about the arithmetic of adding up the value of goods and services and not much else. Our “favorite” aspect of GDP bookkeeping is that imports are subtracted from GDP and exports are added. In one sense, that's proper, because imported items were not produced domestically. Therefore, the bookkeeping implies that imports are “bad” and should be avoided and exports are “good” and should be encouraged. If those imports are raw materials, however, the value added created domestically is usually far greater. An easy example is Starbucks, which uses imported coffee because none can be grown in the US, but creates all of its margin through marketing and distribution domestically. Without the imported coffee, there is no Starbucks.

There will be increased attention to economic reports in coming weeks as the presidential election season gets to be in full swing. Keep an eye on the data and read past the headlines. The key report will always be the unemployment report. The next one is Friday, August 3.

The changes in 2009 mean that the trough of the recession (Q2-2009) was less deep, and the recovery was less strong. The major revisions were in 2010. Should businesspeople really care? In a practical sense, no. But these revised data are used in forecasting models by private and institutional economists, so they may change the direction of the forecasts you read about or otherwise use in your business.

A recession starts at the last time the economy was at its highest point, and ends when it is at its lowest since that time. A recovery begins at the lowest point and ends when GDP (and other factors) surpass the level where the recession started. Originally, data indicated that the economy reached that point in Q1-2011; these and prior revisions have moved it six months later, to Q3-2011. (For more information about how the dates of business cycles are determined, go to the National Bureau of Economic Research site. It's not “two consecutive negative quarters of GDP” as popularly believed.)

Remember, GDP calculation is just bookkeeping. It's not even accounting; no cause and effect relationship is implied in the figures. Accounting is an analysis of the relationships of those figures, such as how certain costs affect other costs or output for decision-making. GDP is all about the arithmetic of adding up the value of goods and services and not much else. Our “favorite” aspect of GDP bookkeeping is that imports are subtracted from GDP and exports are added. In one sense, that's proper, because imported items were not produced domestically. Therefore, the bookkeeping implies that imports are “bad” and should be avoided and exports are “good” and should be encouraged. If those imports are raw materials, however, the value added created domestically is usually far greater. An easy example is Starbucks, which uses imported coffee because none can be grown in the US, but creates all of its margin through marketing and distribution domestically. Without the imported coffee, there is no Starbucks.

There will be increased attention to economic reports in coming weeks as the presidential election season gets to be in full swing. Keep an eye on the data and read past the headlines. The key report will always be the unemployment report. The next one is Friday, August 3.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

- Komori unveils B2 UV Inkjet

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.