The latest Quarterly Services Survey of the Department of Commerce show that ad agency revenues continue their slow rise despite corporate cutbacks and a sluggish economy.

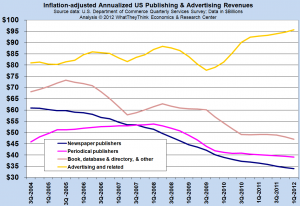

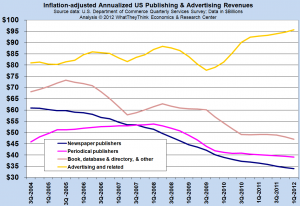

The latest Quarterly Services Survey of the Department of Commerce show that ad agency revenues continue their slow rise despite corporate cutbacks and a sluggish economy. The chart below shows the data as annualized four-quarter moving totals, adjusted for inflation (click to enlarge).

The key date to look at is the third quarter of 2009, which was the first full quarter of the GDP recovery. Ad agency revenues rebounded while the publishing sectors kept declining. The book decline was steeper than the others, likely the effect of tablets and other technologies that reduce per-unit revenues. Magazines declined, and revenue levels have flattened. The erosion of newspaper revenues continues at an unfortunately steady pace. These trends were also

explored a few months ago in this blog.

One of the reasons for the rise in agency revenues is that they have changed their product mix to include other media. For printers, the shift to marketing services is often viewed as a panacea to the sales and financial ills of individual print businesses, of which I have always been skeptical. One of the reasons agencies can make the change more easily is that they are not weighed down by the anchor (for many printers) of investment in manufacturing equipment that is no longer relevant to the marketplace. For agencies, the shift is easier with changes of personnel or the experimental learning of new tools. That does not mean that it's easy, just easier. An essential revenue source for agencies has been the buying and placement in media for the advertising that they developed. They would be paid based on the cost of space ads in magazines and newspapers, and as a percentage of the costs of radio or television time.

Social media has changed the nature of the business, since it does not require a space purchase. It does, however, require that content be created and deployed, and that the interactions with the marketplace be constantly managed and engaged. Yes, ad agencies are marketing services providers, which is why so many of them view the shift that many print businesses attempt as a threat to their business and as undercutting their client relationships.

A

recent article in e-Marketer shows how the offerings of agencies have changed. The “marketers” column shows the percentage of marketers participating in the survey that use those particular media, and the “ad agencies” column show the percentage of ad agencies that offer those media services to their clients.

First, it's interesting to note that not all agencies offer these services. Most all agencies would offer print, such as development of product brochures or basic space ads. Not all agencies, however, would offer creation of broadcast advertising, so it's not a surprise that there are differences. The real surprise is that there is a tendency to create a category called “digital media,” but the array of such media almost precludes offering all of them.

Note how in 2009, 70% of agencies offered web development, and now 83% do. Even the number of marketers involved with web development has risen. Instead of replacing the Internet, mobile media have created new and specialized needs for it. Blogs and podcasting have decreased. Social media planning and buying wasn't included in the 2009 survey, and already 60% of agencies offer it. And, as discussed in

Disrupting the Future, strategic counsel has become more important as the number of media choices has made media budget allocation more challenging and media selection more confusing.

The key date to look at is the third quarter of 2009, which was the first full quarter of the GDP recovery. Ad agency revenues rebounded while the publishing sectors kept declining. The book decline was steeper than the others, likely the effect of tablets and other technologies that reduce per-unit revenues. Magazines declined, and revenue levels have flattened. The erosion of newspaper revenues continues at an unfortunately steady pace. These trends were also explored a few months ago in this blog.

One of the reasons for the rise in agency revenues is that they have changed their product mix to include other media. For printers, the shift to marketing services is often viewed as a panacea to the sales and financial ills of individual print businesses, of which I have always been skeptical. One of the reasons agencies can make the change more easily is that they are not weighed down by the anchor (for many printers) of investment in manufacturing equipment that is no longer relevant to the marketplace. For agencies, the shift is easier with changes of personnel or the experimental learning of new tools. That does not mean that it's easy, just easier. An essential revenue source for agencies has been the buying and placement in media for the advertising that they developed. They would be paid based on the cost of space ads in magazines and newspapers, and as a percentage of the costs of radio or television time.

Social media has changed the nature of the business, since it does not require a space purchase. It does, however, require that content be created and deployed, and that the interactions with the marketplace be constantly managed and engaged. Yes, ad agencies are marketing services providers, which is why so many of them view the shift that many print businesses attempt as a threat to their business and as undercutting their client relationships.

A recent article in e-Marketer shows how the offerings of agencies have changed. The “marketers” column shows the percentage of marketers participating in the survey that use those particular media, and the “ad agencies” column show the percentage of ad agencies that offer those media services to their clients.

The key date to look at is the third quarter of 2009, which was the first full quarter of the GDP recovery. Ad agency revenues rebounded while the publishing sectors kept declining. The book decline was steeper than the others, likely the effect of tablets and other technologies that reduce per-unit revenues. Magazines declined, and revenue levels have flattened. The erosion of newspaper revenues continues at an unfortunately steady pace. These trends were also explored a few months ago in this blog.

One of the reasons for the rise in agency revenues is that they have changed their product mix to include other media. For printers, the shift to marketing services is often viewed as a panacea to the sales and financial ills of individual print businesses, of which I have always been skeptical. One of the reasons agencies can make the change more easily is that they are not weighed down by the anchor (for many printers) of investment in manufacturing equipment that is no longer relevant to the marketplace. For agencies, the shift is easier with changes of personnel or the experimental learning of new tools. That does not mean that it's easy, just easier. An essential revenue source for agencies has been the buying and placement in media for the advertising that they developed. They would be paid based on the cost of space ads in magazines and newspapers, and as a percentage of the costs of radio or television time.

Social media has changed the nature of the business, since it does not require a space purchase. It does, however, require that content be created and deployed, and that the interactions with the marketplace be constantly managed and engaged. Yes, ad agencies are marketing services providers, which is why so many of them view the shift that many print businesses attempt as a threat to their business and as undercutting their client relationships.

A recent article in e-Marketer shows how the offerings of agencies have changed. The “marketers” column shows the percentage of marketers participating in the survey that use those particular media, and the “ad agencies” column show the percentage of ad agencies that offer those media services to their clients.

First, it's interesting to note that not all agencies offer these services. Most all agencies would offer print, such as development of product brochures or basic space ads. Not all agencies, however, would offer creation of broadcast advertising, so it's not a surprise that there are differences. The real surprise is that there is a tendency to create a category called “digital media,” but the array of such media almost precludes offering all of them.

Note how in 2009, 70% of agencies offered web development, and now 83% do. Even the number of marketers involved with web development has risen. Instead of replacing the Internet, mobile media have created new and specialized needs for it. Blogs and podcasting have decreased. Social media planning and buying wasn't included in the 2009 survey, and already 60% of agencies offer it. And, as discussed in Disrupting the Future, strategic counsel has become more important as the number of media choices has made media budget allocation more challenging and media selection more confusing.

First, it's interesting to note that not all agencies offer these services. Most all agencies would offer print, such as development of product brochures or basic space ads. Not all agencies, however, would offer creation of broadcast advertising, so it's not a surprise that there are differences. The real surprise is that there is a tendency to create a category called “digital media,” but the array of such media almost precludes offering all of them.

Note how in 2009, 70% of agencies offered web development, and now 83% do. Even the number of marketers involved with web development has risen. Instead of replacing the Internet, mobile media have created new and specialized needs for it. Blogs and podcasting have decreased. Social media planning and buying wasn't included in the 2009 survey, and already 60% of agencies offer it. And, as discussed in Disrupting the Future, strategic counsel has become more important as the number of media choices has made media budget allocation more challenging and media selection more confusing.