The new orders portion of the ISM non-manufacturing index rose from 53.5 to 55.5. The imports index for non-manufacturing fell by -6.2%, and indicates slower growth. The overall ISM manufacturing index retreated slightly since last month, but the manufacturing new orders index was strong, up +3.3% compared to last month, and imports was flat.

Proprietors income rose in Q1-2012, but the Bureau of Economic Statistics revised its initial figure down from $1132.6 billion to $1130.8 billion. It remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy.

The economy continues to move sideways in a very substandard recovery. Remember, the recession was officially over in June 2009, and growth has been very weak for the last year and a half. GDP growth for the first quarter was revised down from +2.2% to +1.9%. There are signs that the economy is slowing again. Last week's negative unemployment report was blown out of proportion by the media; it was not a disaster except from an election perspective. There were many positive elements in the report, such as an increase in the labor force and a +442,000 increase in employment as shown in the household survey which includes freelancers and self-employed workers; this will be covered in next week's column.

Though another recession is unlikely, slow growth rates always indicate higher recessionary risk.

The new orders portion of the ISM non-manufacturing index rose from 53.5 to 55.5. The imports index for non-manufacturing fell by -6.2%, and indicates slower growth. The overall ISM manufacturing index retreated slightly since last month, but the manufacturing new orders index was strong, up +3.3% compared to last month, and imports was flat.

Proprietors income rose in Q1-2012, but the Bureau of Economic Statistics revised its initial figure down from $1132.6 billion to $1130.8 billion. It remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy.

The economy continues to move sideways in a very substandard recovery. Remember, the recession was officially over in June 2009, and growth has been very weak for the last year and a half. GDP growth for the first quarter was revised down from +2.2% to +1.9%. There are signs that the economy is slowing again. Last week's negative unemployment report was blown out of proportion by the media; it was not a disaster except from an election perspective. There were many positive elements in the report, such as an increase in the labor force and a +442,000 increase in employment as shown in the household survey which includes freelancers and self-employed workers; this will be covered in next week's column.

Though another recession is unlikely, slow growth rates always indicate higher recessionary risk.

Commentary & Analysis

Latest Recovery Indicators Take a Step Back as Economy Continues Lackluster Growth

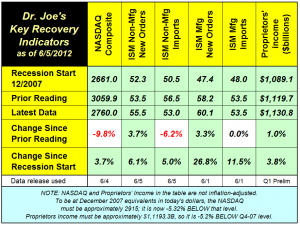

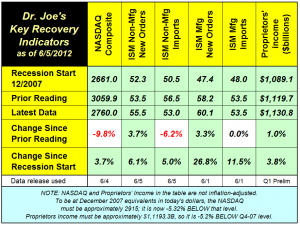

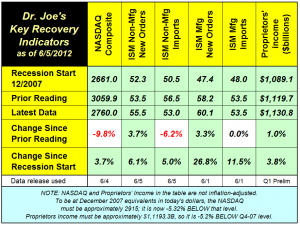

The NASDAQ Composite index was down significantly since last month as stocks tumbled with fears of a European recession and debt crisis and an economic slowdown in China.

The NASDAQ Composite index was down significantly since last month as stocks tumbled with fears of a European recession and debt crisis and an economic slowdown in China. The NASDAQ is above its value at the beginning of the recession by +3.7%, but below it by -5.32% once adjusted for inflation. (click on table to enlarge)

The new orders portion of the ISM non-manufacturing index rose from 53.5 to 55.5. The imports index for non-manufacturing fell by -6.2%, and indicates slower growth. The overall ISM manufacturing index retreated slightly since last month, but the manufacturing new orders index was strong, up +3.3% compared to last month, and imports was flat.

Proprietors income rose in Q1-2012, but the Bureau of Economic Statistics revised its initial figure down from $1132.6 billion to $1130.8 billion. It remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy.

The economy continues to move sideways in a very substandard recovery. Remember, the recession was officially over in June 2009, and growth has been very weak for the last year and a half. GDP growth for the first quarter was revised down from +2.2% to +1.9%. There are signs that the economy is slowing again. Last week's negative unemployment report was blown out of proportion by the media; it was not a disaster except from an election perspective. There were many positive elements in the report, such as an increase in the labor force and a +442,000 increase in employment as shown in the household survey which includes freelancers and self-employed workers; this will be covered in next week's column.

Though another recession is unlikely, slow growth rates always indicate higher recessionary risk.

The new orders portion of the ISM non-manufacturing index rose from 53.5 to 55.5. The imports index for non-manufacturing fell by -6.2%, and indicates slower growth. The overall ISM manufacturing index retreated slightly since last month, but the manufacturing new orders index was strong, up +3.3% compared to last month, and imports was flat.

Proprietors income rose in Q1-2012, but the Bureau of Economic Statistics revised its initial figure down from $1132.6 billion to $1130.8 billion. It remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy.

The economy continues to move sideways in a very substandard recovery. Remember, the recession was officially over in June 2009, and growth has been very weak for the last year and a half. GDP growth for the first quarter was revised down from +2.2% to +1.9%. There are signs that the economy is slowing again. Last week's negative unemployment report was blown out of proportion by the media; it was not a disaster except from an election perspective. There were many positive elements in the report, such as an increase in the labor force and a +442,000 increase in employment as shown in the household survey which includes freelancers and self-employed workers; this will be covered in next week's column.

Though another recession is unlikely, slow growth rates always indicate higher recessionary risk.

The new orders portion of the ISM non-manufacturing index rose from 53.5 to 55.5. The imports index for non-manufacturing fell by -6.2%, and indicates slower growth. The overall ISM manufacturing index retreated slightly since last month, but the manufacturing new orders index was strong, up +3.3% compared to last month, and imports was flat.

Proprietors income rose in Q1-2012, but the Bureau of Economic Statistics revised its initial figure down from $1132.6 billion to $1130.8 billion. It remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy.

The economy continues to move sideways in a very substandard recovery. Remember, the recession was officially over in June 2009, and growth has been very weak for the last year and a half. GDP growth for the first quarter was revised down from +2.2% to +1.9%. There are signs that the economy is slowing again. Last week's negative unemployment report was blown out of proportion by the media; it was not a disaster except from an election perspective. There were many positive elements in the report, such as an increase in the labor force and a +442,000 increase in employment as shown in the household survey which includes freelancers and self-employed workers; this will be covered in next week's column.

Though another recession is unlikely, slow growth rates always indicate higher recessionary risk.

The new orders portion of the ISM non-manufacturing index rose from 53.5 to 55.5. The imports index for non-manufacturing fell by -6.2%, and indicates slower growth. The overall ISM manufacturing index retreated slightly since last month, but the manufacturing new orders index was strong, up +3.3% compared to last month, and imports was flat.

Proprietors income rose in Q1-2012, but the Bureau of Economic Statistics revised its initial figure down from $1132.6 billion to $1130.8 billion. It remains -5.2% below the inflation-adjusted level at the start of the recession. Small business continues to lag the overall economy.

The economy continues to move sideways in a very substandard recovery. Remember, the recession was officially over in June 2009, and growth has been very weak for the last year and a half. GDP growth for the first quarter was revised down from +2.2% to +1.9%. There are signs that the economy is slowing again. Last week's negative unemployment report was blown out of proportion by the media; it was not a disaster except from an election perspective. There were many positive elements in the report, such as an increase in the labor force and a +442,000 increase in employment as shown in the household survey which includes freelancers and self-employed workers; this will be covered in next week's column.

Though another recession is unlikely, slow growth rates always indicate higher recessionary risk.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- New RISO Printing Unit Offers Easy Integration for Package Printing

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.