Commentary & Analysis

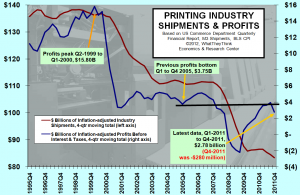

Profits Winning Streak Over: Industry Has -$276 Million Loss in 4Q-2011; Finishes 2011 with $2.78 Billion in Profits

For seven consecutive quarters,

For seven consecutive quarters, the US commercial printing industry produced nearly $6 billion in inflation-adjusted profits, and gave -$280 million of it back in the fourth quarter of 2011. It was the first loss since Q4-2009 (-$22 million), and the first one of some magnitude since Q1-2009 (-$470 million). The revised third quarter of 2011 had resulted in nearly $1.15 billion of profits.

For all of 2011, the estimated profit was $2.78 billion, -5.3% compared to 2010. On an annualized basis, the industry has had nine consecutive quarters of profits. These annualized profits are a four-quarter moving total of profits data, where the latest quarter's profits are added, and the oldest quarter's data are dropped, producing an annualized figure that is not distorted by calendar seasonal factors, making long-term trends easier to see. This four-quarter moving total appears to have peaked in Q3-2011 at $3.95 billion.

A spreadsheet of the data and charts is available for download. (Click image below to enlarge summary chart).

For years, the printing industry would have a strong finish to the calendar year, usually benefiting from the retail sales patterns of holiday and Christmas consumer purchases. The seasonal pattern has been significantly altered by digital media alternatives, as discussed in my first column of 2012.

A decline of profits in an individual quarter is a problem when it becomes part of a larger a pattern, of which this is not. This is only the fourth industry loss since our data series began in 1995, and very small in comparison to that of Q4-2008 when the loss was more than -$2.7 billion.

The concern should be that it is in the context of another changing sales pattern, which is the decline in January shipments of -2.4% versus 2011 (-4.5% on an inflation-adjusted basis), and that the fourth quarter of 2011 was down -2.2% versus 2010 (-5.2% on an inflation-adjusted basis). The fourth quarter decrease occurred at a time when real (inflation-adjusted) GDP has been reported in the +3% range. The gap between real GDP (+3%) and inflation-adjusted printing shipments (-5.2%) is 8 percentage points, which is an unusually wide, and disconcerting level. Our statistical work over the years has shown a negative correlation of GDP and print (GDP rises, print declines) that is often hard to reconcile with print's culture where a good economy always meant good business, which has not been the case for more than a decade and a half.

Can profits rise again? The winning streak in profits occurred despite declining revenues. When weak printing companies exit the market by consolidation or closure, they are no longer a drag on profits. When profitable companies change their costs and offerings to be more appropriate to the marketplaces they serve, they can remain profitable. It is likely that the industry will adjust, yet again, to these different shipment levels, and weak businesses will leave the market, leaving healthier ones behind. Those healthier business still have to adapt with media changes in a proactive manner.

February printing shipments data are released next week, as are printing employment data. General economic data continue to be mildly positive. The pressures for restructuring continue, and will greatly intensify in 2012. Act now.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.