The recovery indicators still show an economy having difficulties gaining forward momentum.

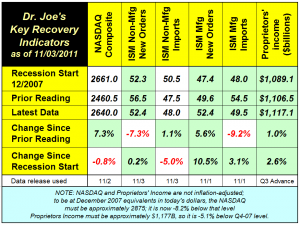

The recovery indicators still show an economy having difficulties gaining forward momentum. The NASDAQ had a strong move over the last month, but it is still below its level at the close of December 2007, pegged as the beginning of the recession. When adjusted for inflation, the NASDAQ is -8% below its value at that time. (Click table to enlarge).

The ISM non-manufacturing index new orders decreased from 56.5 to 52.4, but it is still above 50, which is considered neutral. In December 2007, it was 52.3, and the latest report for new orders is 52.4. Imports were 48, a sign of contraction.

The ISM's manufacturing index was a real bright spot, with the new orders index increasing by 5.6% since last month, though imports, needed for many raw materials, fell -9.2%. Still, the ISM manufacturing imports index is above the level of December 2007. The inflation portion of the ISM report, which is not included in our table, dropped significantly, from 56 to 41, which indicates that raw materials prices dropped during the period. Commodity prices worldwide have been falling as expectations for economic growth have been waning. The question is how far they will drop; most prices appear to have bottomed out.

Proprietors' income, a measure of the health of small business, was up by 1%, and is 2.6% higher than the start of the recession. Unfortunately, inflation has eroded those gains, and then some. Proprietors' income is below the December 2007 level on an inflation-adjusted basis by -5.1%.

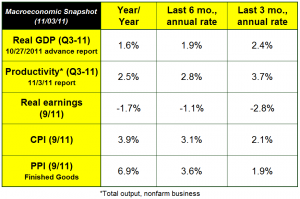

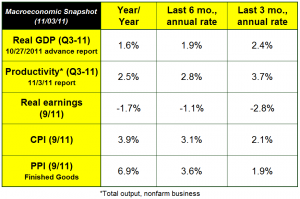

Today's productivity report indicated that job growth will continue to be tepid. As long as productivity is greater than GDP, the need to hire additional workers is lessened on an aggregate basis. Real earnings are still in decline, so workers are not seeing the benefits of the increased output. The increased productivity is being used to pay for increased operating costs, as seen in the Producer Price Index. Since the rise in the PPI rate appears to be slowing, it will be interesting to see if the pressures for productivity subside, and if earnings start to rise. We believe that PPI will start to rise again, so that premise may never be tested. The economy is still in efficiency mode with little to encourage expansion. Stay the course, navigate the challenges, and keep searching for new opportunities, even if they appear to be small. (Click on table to enlarge).

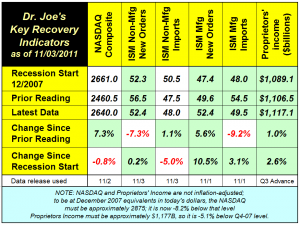

The ISM non-manufacturing index new orders decreased from 56.5 to 52.4, but it is still above 50, which is considered neutral. In December 2007, it was 52.3, and the latest report for new orders is 52.4. Imports were 48, a sign of contraction.

The ISM's manufacturing index was a real bright spot, with the new orders index increasing by 5.6% since last month, though imports, needed for many raw materials, fell -9.2%. Still, the ISM manufacturing imports index is above the level of December 2007. The inflation portion of the ISM report, which is not included in our table, dropped significantly, from 56 to 41, which indicates that raw materials prices dropped during the period. Commodity prices worldwide have been falling as expectations for economic growth have been waning. The question is how far they will drop; most prices appear to have bottomed out.

Proprietors' income, a measure of the health of small business, was up by 1%, and is 2.6% higher than the start of the recession. Unfortunately, inflation has eroded those gains, and then some. Proprietors' income is below the December 2007 level on an inflation-adjusted basis by -5.1%.

Today's productivity report indicated that job growth will continue to be tepid. As long as productivity is greater than GDP, the need to hire additional workers is lessened on an aggregate basis. Real earnings are still in decline, so workers are not seeing the benefits of the increased output. The increased productivity is being used to pay for increased operating costs, as seen in the Producer Price Index. Since the rise in the PPI rate appears to be slowing, it will be interesting to see if the pressures for productivity subside, and if earnings start to rise. We believe that PPI will start to rise again, so that premise may never be tested. The economy is still in efficiency mode with little to encourage expansion. Stay the course, navigate the challenges, and keep searching for new opportunities, even if they appear to be small. (Click on table to enlarge).

The ISM non-manufacturing index new orders decreased from 56.5 to 52.4, but it is still above 50, which is considered neutral. In December 2007, it was 52.3, and the latest report for new orders is 52.4. Imports were 48, a sign of contraction.

The ISM's manufacturing index was a real bright spot, with the new orders index increasing by 5.6% since last month, though imports, needed for many raw materials, fell -9.2%. Still, the ISM manufacturing imports index is above the level of December 2007. The inflation portion of the ISM report, which is not included in our table, dropped significantly, from 56 to 41, which indicates that raw materials prices dropped during the period. Commodity prices worldwide have been falling as expectations for economic growth have been waning. The question is how far they will drop; most prices appear to have bottomed out.

Proprietors' income, a measure of the health of small business, was up by 1%, and is 2.6% higher than the start of the recession. Unfortunately, inflation has eroded those gains, and then some. Proprietors' income is below the December 2007 level on an inflation-adjusted basis by -5.1%.

Today's productivity report indicated that job growth will continue to be tepid. As long as productivity is greater than GDP, the need to hire additional workers is lessened on an aggregate basis. Real earnings are still in decline, so workers are not seeing the benefits of the increased output. The increased productivity is being used to pay for increased operating costs, as seen in the Producer Price Index. Since the rise in the PPI rate appears to be slowing, it will be interesting to see if the pressures for productivity subside, and if earnings start to rise. We believe that PPI will start to rise again, so that premise may never be tested. The economy is still in efficiency mode with little to encourage expansion. Stay the course, navigate the challenges, and keep searching for new opportunities, even if they appear to be small. (Click on table to enlarge).