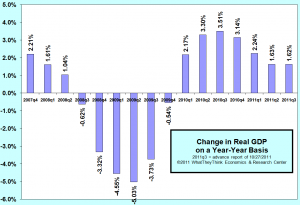

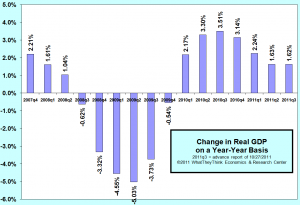

Today's GDP release was met with general optimism, but by peering under the hood the problems in the economy are still quite evident. While the annualized quarter-to-quarter change was +2.5%, which is good news, the comparison with the same quarter of a year ago was just +1.62%. Viewing GDP on a year-to-year basis minimizes the volatility of the data, and provides a better-rounded view of the economy. The chart below (click to enlarge) shows how the y-y growth rate is actually quite the same as last quarter.

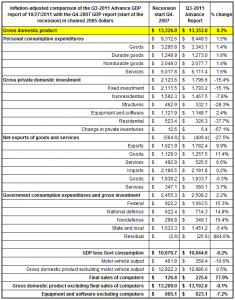

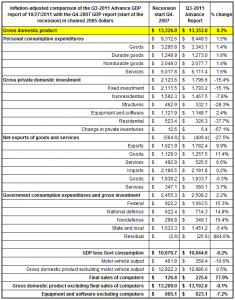

To take a further step back, the comparison with Q4 of 2007, which we use because the start of the recession has been dated as December 2007, shows that real GDP is up only +0.2% since that time. Housing and nonresidential construction is still mired in a depression, with the only bright spot of domestic investment being equipment and software, up +2.4% since Q4-07. Exports are up +9.9%, and imports are up +0.2%, mainly the result of the purposely weakened dollar. Government spending is up +15.3%, while state and local spending is down -5.4%. From some employment analysis we recently conducted, the bulk of the spending decline has been in cities, towns, and counties. (Click on the table below to enlarge).

Excluding government spending, GDP is down -0.2%. While the economy overall recovered from the downturn, the private economy is still climbing out of contraction. Computer sales are up +77.9% since Q4-07, but the rest of capital equipment is down -7.2%.

Overall, it is still a very uneven economy that will continue to take a while to be firmly grounded.

* * *

Next week will be one of the more eventful ones for those who follow economic data. Both Institute of Supply Management reports will be out, factory orders will be released by the Commerce Department, and several reports about employment will be offered, culminating in the unemployment report next Friday.

To take a further step back, the comparison with Q4 of 2007, which we use because the start of the recession has been dated as December 2007, shows that real GDP is up only +0.2% since that time. Housing and nonresidential construction is still mired in a depression, with the only bright spot of domestic investment being equipment and software, up +2.4% since Q4-07. Exports are up +9.9%, and imports are up +0.2%, mainly the result of the purposely weakened dollar. Government spending is up +15.3%, while state and local spending is down -5.4%. From some employment analysis we recently conducted, the bulk of the spending decline has been in cities, towns, and counties. (Click on the table below to enlarge).

To take a further step back, the comparison with Q4 of 2007, which we use because the start of the recession has been dated as December 2007, shows that real GDP is up only +0.2% since that time. Housing and nonresidential construction is still mired in a depression, with the only bright spot of domestic investment being equipment and software, up +2.4% since Q4-07. Exports are up +9.9%, and imports are up +0.2%, mainly the result of the purposely weakened dollar. Government spending is up +15.3%, while state and local spending is down -5.4%. From some employment analysis we recently conducted, the bulk of the spending decline has been in cities, towns, and counties. (Click on the table below to enlarge).

Excluding government spending, GDP is down -0.2%. While the economy overall recovered from the downturn, the private economy is still climbing out of contraction. Computer sales are up +77.9% since Q4-07, but the rest of capital equipment is down -7.2%.

Overall, it is still a very uneven economy that will continue to take a while to be firmly grounded.

* * *

Next week will be one of the more eventful ones for those who follow economic data. Both Institute of Supply Management reports will be out, factory orders will be released by the Commerce Department, and several reports about employment will be offered, culminating in the unemployment report next Friday.

Excluding government spending, GDP is down -0.2%. While the economy overall recovered from the downturn, the private economy is still climbing out of contraction. Computer sales are up +77.9% since Q4-07, but the rest of capital equipment is down -7.2%.

Overall, it is still a very uneven economy that will continue to take a while to be firmly grounded.

* * *

Next week will be one of the more eventful ones for those who follow economic data. Both Institute of Supply Management reports will be out, factory orders will be released by the Commerce Department, and several reports about employment will be offered, culminating in the unemployment report next Friday.