The Bureau of Economic Analysis released Gross Domestic Product (GDP) data for the second quarter, and it disappointed economists and analysts with its small +1.3% annual growth rate. The real surprises, however, were in the details of five years of revisions, especially that made of the first quarter of 2011. The new data for Q1-2011 was revised down, significantly, from the initial +1.9% to only +0.4%.

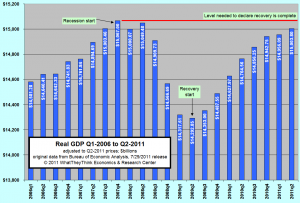

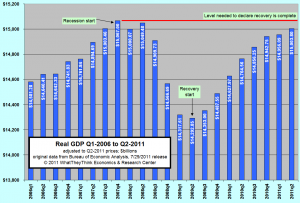

There revisions also showed that the recession was deeper than originally reported. The original data showed that the economy surpassed the level of Q4-2007, when the recession started, in Q4-2010. These new data showed that the economy had still not reached those levels.

GDP data are reported on a real basis, that is, adjusted for inflation, and also on a quarterly annualized basis. That means that the data compare what happens between quarters. So the Q2-2011 report showed economic growth of +1.3%. That means that if the economy were to grow for a whole year in the way it did from Q1 to Q2, it would be at an annual rate of +1.3%. So the report really means that growth from Q1 to Q2 was actually 1.3/4, or roughly +0.33%.

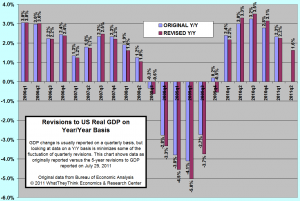

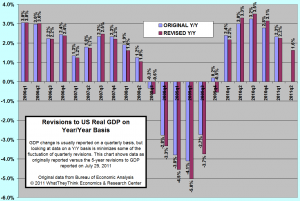

Quarterly data tend to jump around a bit, so we prefer looking at GDP on a year-to-year (Y/Y) basis. That is, we'd prefer to compare Q2-2011 against Q2-2010. The chart below shows the GDP comparison on this basis (click chart to enlarge):

The chart shows that the recession (Q7-2007 to Q2-2009) was deeper than originally reported.

On an inflation-adjusted dollar basis, the revisions also showed that the recovery was not completed in Q4-2010, but is still underway (click chart to enlarge):

The economy is still faltering. While there was great hope that successful completion of the debt ceiling negotiations would be met with economic enthusiasm, from what we know of the agreements as proposed is that, as usual, the debt ceiling is just raised, and there is a lot of kicking the can down the road, so each side can blame the other for lack or restraint or lack of cooperation, and spending can continue.

The

ISM report of Monday, August 1, showed a decline in manufacturing growth ahead, further underscoring the the debt limit debate actually has little to do with the underlying economic realities. On Wednesday, the ADP employment index, ISM non-manufacturing index, and factory orders will be reported, and then attention will shift to employment. Thursday's initial jobless claims will be eyed to see it stays below 400,000 as it was last week (last week's data may be revised to be above that), and then Friday's unemployment report will be viewed as exceptionally important. It is likely that the workforce will continue its contraction, and that the unemployment rate will stay about the same.

Any approved debt deal still has to be viewed in this grander context, so it's important not to get carried away with any budgetary enthusiasm:

1) The economy is slow and the risks of another recession are rising (it is more likely that the muddle will continue); there will be growing pressure for more stimulus in coming months.

2) The Fed is continuing QE2 by replacing whatever bonds mature and replacing them with new purchases; it is likely they will have a QE3 but will not call it that or call attention to it. The dollar will stay weak and is likely to become weaker

3) The barrage of regulations and taxes for 2013 and 2014 are still on track for implementation

4) The incentives against hiring in the tax law and upcoming regulations will ensure that businesses will continue to spend money on efficiency rather than expansion, which usually means more money for computing and communications, and anything else that streamlines operations and cuts costs at the same time.

None of this adds up to a robust economy. Work and invest accordingly to profitably navigate what's ahead.

The chart shows that the recession (Q7-2007 to Q2-2009) was deeper than originally reported.

On an inflation-adjusted dollar basis, the revisions also showed that the recovery was not completed in Q4-2010, but is still underway (click chart to enlarge):

The chart shows that the recession (Q7-2007 to Q2-2009) was deeper than originally reported.

On an inflation-adjusted dollar basis, the revisions also showed that the recovery was not completed in Q4-2010, but is still underway (click chart to enlarge):

The economy is still faltering. While there was great hope that successful completion of the debt ceiling negotiations would be met with economic enthusiasm, from what we know of the agreements as proposed is that, as usual, the debt ceiling is just raised, and there is a lot of kicking the can down the road, so each side can blame the other for lack or restraint or lack of cooperation, and spending can continue.

The ISM report of Monday, August 1, showed a decline in manufacturing growth ahead, further underscoring the the debt limit debate actually has little to do with the underlying economic realities. On Wednesday, the ADP employment index, ISM non-manufacturing index, and factory orders will be reported, and then attention will shift to employment. Thursday's initial jobless claims will be eyed to see it stays below 400,000 as it was last week (last week's data may be revised to be above that), and then Friday's unemployment report will be viewed as exceptionally important. It is likely that the workforce will continue its contraction, and that the unemployment rate will stay about the same.

Any approved debt deal still has to be viewed in this grander context, so it's important not to get carried away with any budgetary enthusiasm:

1) The economy is slow and the risks of another recession are rising (it is more likely that the muddle will continue); there will be growing pressure for more stimulus in coming months.

2) The Fed is continuing QE2 by replacing whatever bonds mature and replacing them with new purchases; it is likely they will have a QE3 but will not call it that or call attention to it. The dollar will stay weak and is likely to become weaker

3) The barrage of regulations and taxes for 2013 and 2014 are still on track for implementation

4) The incentives against hiring in the tax law and upcoming regulations will ensure that businesses will continue to spend money on efficiency rather than expansion, which usually means more money for computing and communications, and anything else that streamlines operations and cuts costs at the same time.

None of this adds up to a robust economy. Work and invest accordingly to profitably navigate what's ahead.

The economy is still faltering. While there was great hope that successful completion of the debt ceiling negotiations would be met with economic enthusiasm, from what we know of the agreements as proposed is that, as usual, the debt ceiling is just raised, and there is a lot of kicking the can down the road, so each side can blame the other for lack or restraint or lack of cooperation, and spending can continue.

The ISM report of Monday, August 1, showed a decline in manufacturing growth ahead, further underscoring the the debt limit debate actually has little to do with the underlying economic realities. On Wednesday, the ADP employment index, ISM non-manufacturing index, and factory orders will be reported, and then attention will shift to employment. Thursday's initial jobless claims will be eyed to see it stays below 400,000 as it was last week (last week's data may be revised to be above that), and then Friday's unemployment report will be viewed as exceptionally important. It is likely that the workforce will continue its contraction, and that the unemployment rate will stay about the same.

Any approved debt deal still has to be viewed in this grander context, so it's important not to get carried away with any budgetary enthusiasm:

1) The economy is slow and the risks of another recession are rising (it is more likely that the muddle will continue); there will be growing pressure for more stimulus in coming months.

2) The Fed is continuing QE2 by replacing whatever bonds mature and replacing them with new purchases; it is likely they will have a QE3 but will not call it that or call attention to it. The dollar will stay weak and is likely to become weaker

3) The barrage of regulations and taxes for 2013 and 2014 are still on track for implementation

4) The incentives against hiring in the tax law and upcoming regulations will ensure that businesses will continue to spend money on efficiency rather than expansion, which usually means more money for computing and communications, and anything else that streamlines operations and cuts costs at the same time.

None of this adds up to a robust economy. Work and invest accordingly to profitably navigate what's ahead.