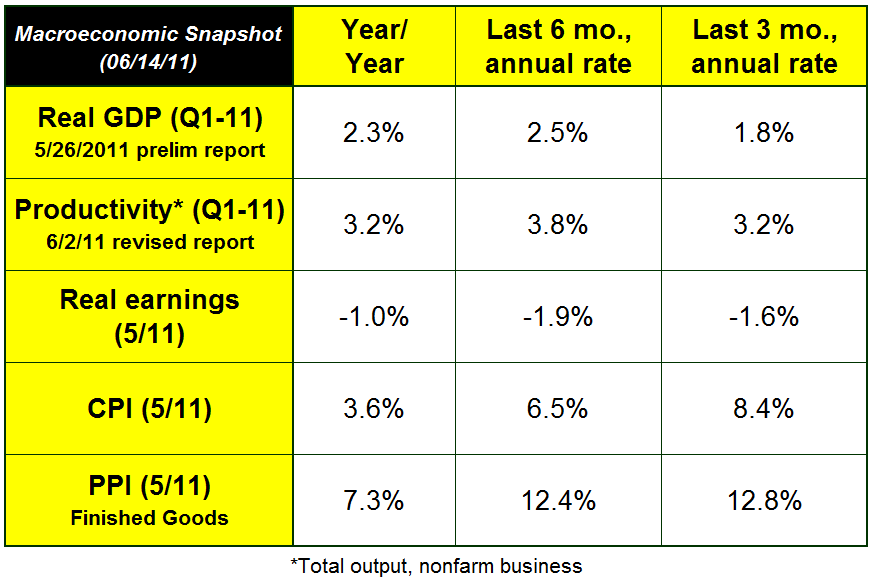

The economic narrative of the chart above is the same as we have had for a couple of years. Economic growth as measured by GDP is anemic, especially for a recovery. Productivity has been exceeding GDP, which means that at the highest economic level, there is little reason to hire additional employees. The economy is producing more with roughly the same number of employees.

The real (inflation-adjusted) earnings of workers is negative. That means that the additional productivity of workers, which should be showing up in their paychecks, is going elsewhere. Workers are paying higher prices in stores (noted by the Consumer Price Index) and their extra pay that they should be getting from their productivity is going elsewhere. That's being used to pay for the higher prices businesses are paying for raw materials as noted by the Producer Price Index.

This cycle is expected to continue for quite some time, as businesses prepare for further increased costs in the future.

Much has been made about the recent declines in gas prices because of declining oil prices. Oil prices are still high, but more of their decline is the result of the increasing value of the dollar compared to other currencies, especially the Euro. The dollar has been on a decade-long decline that is only being interrupted because Europe's currency situation is worse. This is primarily the problems of Greece being borne by Germany and France and other economies. The additional worries about Portugal, Ireland, Italy, and Spain also weigh on the competitive nature of currency valuations. It's not that the dollar is intrinsically better than the Euro, it's just that it's less bad.

The weak dollar was supposed to help the economy by promoting exports. In some sense it has, but it has caused inflation, which quickly erodes those benefits. What many seem to forget is that lower-priced US exports also creates high-priced imports. Much of those imports are raw materials used in manufacturing. It also creates something else: it makes ownership of US companies cheaper.

The recent pullbacks in the stock market are mainly the result of the small rise in the dollar. The NASDAQ is now lower than it was when the recession started in December 2007.

The cheaper dollar also means that money comes from overseas to buy US companies and investment. Recent data indicate that foreign direct investment increased by 49% in 2010 compared to 2009, and totaled more than $200 billion. This is always seen as a vote of confidence in the economy which receives this investment. Nowhere was it mentioned in any of the reports of these data that US assets look particularly cheap at this time.

This may be a case of being careful what you ask for. The more internationalized a business becomes, the more options they have to avoid governmental economic prescriptions, or at least minimize their effects. This is one reason why multinational companies are less affected by changes in exchange rates, because they usually have transactions on both sides of borders that can balance out exchange rate issues.

One of the major complaints of the past few years is how much money large multinational companies have just sitting in their accounts. Much of this money is offshore in subsidiaries that they own, and if repatriated would be subject to US corporation tax, which is higher than most other countries. The money stays offshore, and ends up invested there instead. Microsoft is a good example. Last year, Microsoft found it was worthwhile to borrow against its offshore holdings to pay dividends. It also used its offshore monies to buy foreign-based Internet phone company Skype.

The more companies, even small businesses, do business globally, and invest globally, the more options they have. When economies are weak, and regulatory environments become more intense, having a wider range of strategic alternatives is obviously a desirable position.

Overall, economic conditions still demand cautious action. Because of the weak growth economy with inflationary pressures assumed, the emphasis remains on efficiency rather than expansion. When businesses do not see significant revenue opportunities from growing markets, they focus on improving their operations where they can see more immediate and measurable impact. That value proposition is always attractive, but especially attractive in these times.

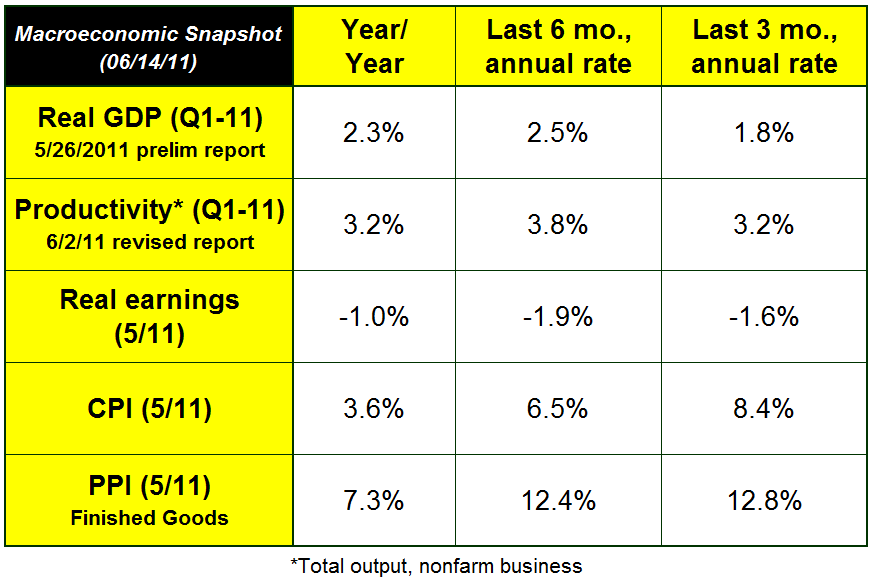

The economic narrative of the chart above is the same as we have had for a couple of years. Economic growth as measured by GDP is anemic, especially for a recovery. Productivity has been exceeding GDP, which means that at the highest economic level, there is little reason to hire additional employees. The economy is producing more with roughly the same number of employees.

The real (inflation-adjusted) earnings of workers is negative. That means that the additional productivity of workers, which should be showing up in their paychecks, is going elsewhere. Workers are paying higher prices in stores (noted by the Consumer Price Index) and their extra pay that they should be getting from their productivity is going elsewhere. That's being used to pay for the higher prices businesses are paying for raw materials as noted by the Producer Price Index.

This cycle is expected to continue for quite some time, as businesses prepare for further increased costs in the future.

Much has been made about the recent declines in gas prices because of declining oil prices. Oil prices are still high, but more of their decline is the result of the increasing value of the dollar compared to other currencies, especially the Euro. The dollar has been on a decade-long decline that is only being interrupted because Europe's currency situation is worse. This is primarily the problems of Greece being borne by Germany and France and other economies. The additional worries about Portugal, Ireland, Italy, and Spain also weigh on the competitive nature of currency valuations. It's not that the dollar is intrinsically better than the Euro, it's just that it's less bad.

The weak dollar was supposed to help the economy by promoting exports. In some sense it has, but it has caused inflation, which quickly erodes those benefits. What many seem to forget is that lower-priced US exports also creates high-priced imports. Much of those imports are raw materials used in manufacturing. It also creates something else: it makes ownership of US companies cheaper.

The recent pullbacks in the stock market are mainly the result of the small rise in the dollar. The NASDAQ is now lower than it was when the recession started in December 2007.

The cheaper dollar also means that money comes from overseas to buy US companies and investment. Recent data indicate that foreign direct investment increased by 49% in 2010 compared to 2009, and totaled more than $200 billion. This is always seen as a vote of confidence in the economy which receives this investment. Nowhere was it mentioned in any of the reports of these data that US assets look particularly cheap at this time.

This may be a case of being careful what you ask for. The more internationalized a business becomes, the more options they have to avoid governmental economic prescriptions, or at least minimize their effects. This is one reason why multinational companies are less affected by changes in exchange rates, because they usually have transactions on both sides of borders that can balance out exchange rate issues.

One of the major complaints of the past few years is how much money large multinational companies have just sitting in their accounts. Much of this money is offshore in subsidiaries that they own, and if repatriated would be subject to US corporation tax, which is higher than most other countries. The money stays offshore, and ends up invested there instead. Microsoft is a good example. Last year, Microsoft found it was worthwhile to borrow against its offshore holdings to pay dividends. It also used its offshore monies to buy foreign-based Internet phone company Skype.

The more companies, even small businesses, do business globally, and invest globally, the more options they have. When economies are weak, and regulatory environments become more intense, having a wider range of strategic alternatives is obviously a desirable position.

Overall, economic conditions still demand cautious action. Because of the weak growth economy with inflationary pressures assumed, the emphasis remains on efficiency rather than expansion. When businesses do not see significant revenue opportunities from growing markets, they focus on improving their operations where they can see more immediate and measurable impact. That value proposition is always attractive, but especially attractive in these times.

Commentary & Analysis

The Efficiency Economy

Last week'

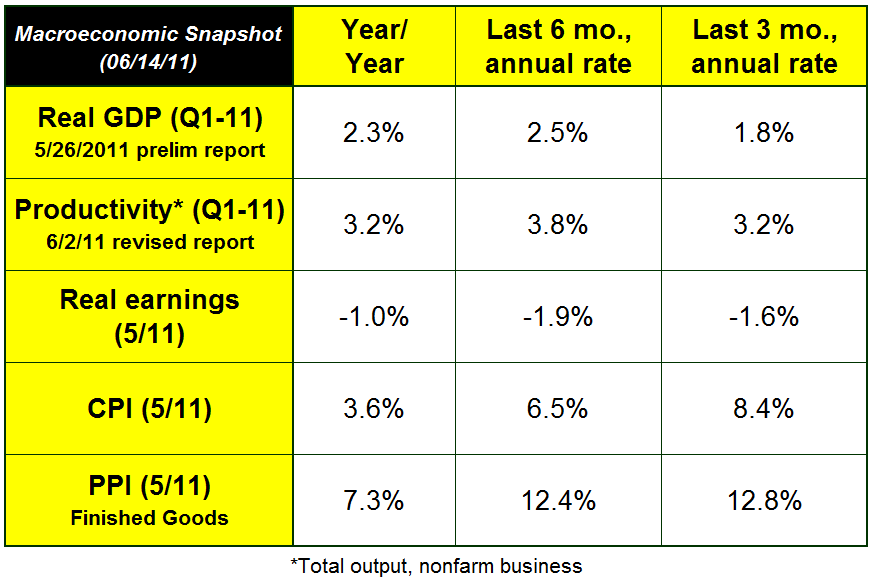

Last week's inflation data were released, and they weren't exactly pretty. For the last three months, the annualized Consumer Price Index is running at +8.4% and the Producer Price Index was at a whopping +12.8%. All of this is occurring while the Federal Reserve keeps claiming that inflation is tame.

The economic narrative of the chart above is the same as we have had for a couple of years. Economic growth as measured by GDP is anemic, especially for a recovery. Productivity has been exceeding GDP, which means that at the highest economic level, there is little reason to hire additional employees. The economy is producing more with roughly the same number of employees.

The real (inflation-adjusted) earnings of workers is negative. That means that the additional productivity of workers, which should be showing up in their paychecks, is going elsewhere. Workers are paying higher prices in stores (noted by the Consumer Price Index) and their extra pay that they should be getting from their productivity is going elsewhere. That's being used to pay for the higher prices businesses are paying for raw materials as noted by the Producer Price Index.

This cycle is expected to continue for quite some time, as businesses prepare for further increased costs in the future.

Much has been made about the recent declines in gas prices because of declining oil prices. Oil prices are still high, but more of their decline is the result of the increasing value of the dollar compared to other currencies, especially the Euro. The dollar has been on a decade-long decline that is only being interrupted because Europe's currency situation is worse. This is primarily the problems of Greece being borne by Germany and France and other economies. The additional worries about Portugal, Ireland, Italy, and Spain also weigh on the competitive nature of currency valuations. It's not that the dollar is intrinsically better than the Euro, it's just that it's less bad.

The weak dollar was supposed to help the economy by promoting exports. In some sense it has, but it has caused inflation, which quickly erodes those benefits. What many seem to forget is that lower-priced US exports also creates high-priced imports. Much of those imports are raw materials used in manufacturing. It also creates something else: it makes ownership of US companies cheaper.

The recent pullbacks in the stock market are mainly the result of the small rise in the dollar. The NASDAQ is now lower than it was when the recession started in December 2007.

The cheaper dollar also means that money comes from overseas to buy US companies and investment. Recent data indicate that foreign direct investment increased by 49% in 2010 compared to 2009, and totaled more than $200 billion. This is always seen as a vote of confidence in the economy which receives this investment. Nowhere was it mentioned in any of the reports of these data that US assets look particularly cheap at this time.

This may be a case of being careful what you ask for. The more internationalized a business becomes, the more options they have to avoid governmental economic prescriptions, or at least minimize their effects. This is one reason why multinational companies are less affected by changes in exchange rates, because they usually have transactions on both sides of borders that can balance out exchange rate issues.

One of the major complaints of the past few years is how much money large multinational companies have just sitting in their accounts. Much of this money is offshore in subsidiaries that they own, and if repatriated would be subject to US corporation tax, which is higher than most other countries. The money stays offshore, and ends up invested there instead. Microsoft is a good example. Last year, Microsoft found it was worthwhile to borrow against its offshore holdings to pay dividends. It also used its offshore monies to buy foreign-based Internet phone company Skype.

The more companies, even small businesses, do business globally, and invest globally, the more options they have. When economies are weak, and regulatory environments become more intense, having a wider range of strategic alternatives is obviously a desirable position.

Overall, economic conditions still demand cautious action. Because of the weak growth economy with inflationary pressures assumed, the emphasis remains on efficiency rather than expansion. When businesses do not see significant revenue opportunities from growing markets, they focus on improving their operations where they can see more immediate and measurable impact. That value proposition is always attractive, but especially attractive in these times.

The economic narrative of the chart above is the same as we have had for a couple of years. Economic growth as measured by GDP is anemic, especially for a recovery. Productivity has been exceeding GDP, which means that at the highest economic level, there is little reason to hire additional employees. The economy is producing more with roughly the same number of employees.

The real (inflation-adjusted) earnings of workers is negative. That means that the additional productivity of workers, which should be showing up in their paychecks, is going elsewhere. Workers are paying higher prices in stores (noted by the Consumer Price Index) and their extra pay that they should be getting from their productivity is going elsewhere. That's being used to pay for the higher prices businesses are paying for raw materials as noted by the Producer Price Index.

This cycle is expected to continue for quite some time, as businesses prepare for further increased costs in the future.

Much has been made about the recent declines in gas prices because of declining oil prices. Oil prices are still high, but more of their decline is the result of the increasing value of the dollar compared to other currencies, especially the Euro. The dollar has been on a decade-long decline that is only being interrupted because Europe's currency situation is worse. This is primarily the problems of Greece being borne by Germany and France and other economies. The additional worries about Portugal, Ireland, Italy, and Spain also weigh on the competitive nature of currency valuations. It's not that the dollar is intrinsically better than the Euro, it's just that it's less bad.

The weak dollar was supposed to help the economy by promoting exports. In some sense it has, but it has caused inflation, which quickly erodes those benefits. What many seem to forget is that lower-priced US exports also creates high-priced imports. Much of those imports are raw materials used in manufacturing. It also creates something else: it makes ownership of US companies cheaper.

The recent pullbacks in the stock market are mainly the result of the small rise in the dollar. The NASDAQ is now lower than it was when the recession started in December 2007.

The cheaper dollar also means that money comes from overseas to buy US companies and investment. Recent data indicate that foreign direct investment increased by 49% in 2010 compared to 2009, and totaled more than $200 billion. This is always seen as a vote of confidence in the economy which receives this investment. Nowhere was it mentioned in any of the reports of these data that US assets look particularly cheap at this time.

This may be a case of being careful what you ask for. The more internationalized a business becomes, the more options they have to avoid governmental economic prescriptions, or at least minimize their effects. This is one reason why multinational companies are less affected by changes in exchange rates, because they usually have transactions on both sides of borders that can balance out exchange rate issues.

One of the major complaints of the past few years is how much money large multinational companies have just sitting in their accounts. Much of this money is offshore in subsidiaries that they own, and if repatriated would be subject to US corporation tax, which is higher than most other countries. The money stays offshore, and ends up invested there instead. Microsoft is a good example. Last year, Microsoft found it was worthwhile to borrow against its offshore holdings to pay dividends. It also used its offshore monies to buy foreign-based Internet phone company Skype.

The more companies, even small businesses, do business globally, and invest globally, the more options they have. When economies are weak, and regulatory environments become more intense, having a wider range of strategic alternatives is obviously a desirable position.

Overall, economic conditions still demand cautious action. Because of the weak growth economy with inflationary pressures assumed, the emphasis remains on efficiency rather than expansion. When businesses do not see significant revenue opportunities from growing markets, they focus on improving their operations where they can see more immediate and measurable impact. That value proposition is always attractive, but especially attractive in these times.

The economic narrative of the chart above is the same as we have had for a couple of years. Economic growth as measured by GDP is anemic, especially for a recovery. Productivity has been exceeding GDP, which means that at the highest economic level, there is little reason to hire additional employees. The economy is producing more with roughly the same number of employees.

The real (inflation-adjusted) earnings of workers is negative. That means that the additional productivity of workers, which should be showing up in their paychecks, is going elsewhere. Workers are paying higher prices in stores (noted by the Consumer Price Index) and their extra pay that they should be getting from their productivity is going elsewhere. That's being used to pay for the higher prices businesses are paying for raw materials as noted by the Producer Price Index.

This cycle is expected to continue for quite some time, as businesses prepare for further increased costs in the future.

Much has been made about the recent declines in gas prices because of declining oil prices. Oil prices are still high, but more of their decline is the result of the increasing value of the dollar compared to other currencies, especially the Euro. The dollar has been on a decade-long decline that is only being interrupted because Europe's currency situation is worse. This is primarily the problems of Greece being borne by Germany and France and other economies. The additional worries about Portugal, Ireland, Italy, and Spain also weigh on the competitive nature of currency valuations. It's not that the dollar is intrinsically better than the Euro, it's just that it's less bad.

The weak dollar was supposed to help the economy by promoting exports. In some sense it has, but it has caused inflation, which quickly erodes those benefits. What many seem to forget is that lower-priced US exports also creates high-priced imports. Much of those imports are raw materials used in manufacturing. It also creates something else: it makes ownership of US companies cheaper.

The recent pullbacks in the stock market are mainly the result of the small rise in the dollar. The NASDAQ is now lower than it was when the recession started in December 2007.

The cheaper dollar also means that money comes from overseas to buy US companies and investment. Recent data indicate that foreign direct investment increased by 49% in 2010 compared to 2009, and totaled more than $200 billion. This is always seen as a vote of confidence in the economy which receives this investment. Nowhere was it mentioned in any of the reports of these data that US assets look particularly cheap at this time.

This may be a case of being careful what you ask for. The more internationalized a business becomes, the more options they have to avoid governmental economic prescriptions, or at least minimize their effects. This is one reason why multinational companies are less affected by changes in exchange rates, because they usually have transactions on both sides of borders that can balance out exchange rate issues.

One of the major complaints of the past few years is how much money large multinational companies have just sitting in their accounts. Much of this money is offshore in subsidiaries that they own, and if repatriated would be subject to US corporation tax, which is higher than most other countries. The money stays offshore, and ends up invested there instead. Microsoft is a good example. Last year, Microsoft found it was worthwhile to borrow against its offshore holdings to pay dividends. It also used its offshore monies to buy foreign-based Internet phone company Skype.

The more companies, even small businesses, do business globally, and invest globally, the more options they have. When economies are weak, and regulatory environments become more intense, having a wider range of strategic alternatives is obviously a desirable position.

Overall, economic conditions still demand cautious action. Because of the weak growth economy with inflationary pressures assumed, the emphasis remains on efficiency rather than expansion. When businesses do not see significant revenue opportunities from growing markets, they focus on improving their operations where they can see more immediate and measurable impact. That value proposition is always attractive, but especially attractive in these times.

The economic narrative of the chart above is the same as we have had for a couple of years. Economic growth as measured by GDP is anemic, especially for a recovery. Productivity has been exceeding GDP, which means that at the highest economic level, there is little reason to hire additional employees. The economy is producing more with roughly the same number of employees.

The real (inflation-adjusted) earnings of workers is negative. That means that the additional productivity of workers, which should be showing up in their paychecks, is going elsewhere. Workers are paying higher prices in stores (noted by the Consumer Price Index) and their extra pay that they should be getting from their productivity is going elsewhere. That's being used to pay for the higher prices businesses are paying for raw materials as noted by the Producer Price Index.

This cycle is expected to continue for quite some time, as businesses prepare for further increased costs in the future.

Much has been made about the recent declines in gas prices because of declining oil prices. Oil prices are still high, but more of their decline is the result of the increasing value of the dollar compared to other currencies, especially the Euro. The dollar has been on a decade-long decline that is only being interrupted because Europe's currency situation is worse. This is primarily the problems of Greece being borne by Germany and France and other economies. The additional worries about Portugal, Ireland, Italy, and Spain also weigh on the competitive nature of currency valuations. It's not that the dollar is intrinsically better than the Euro, it's just that it's less bad.

The weak dollar was supposed to help the economy by promoting exports. In some sense it has, but it has caused inflation, which quickly erodes those benefits. What many seem to forget is that lower-priced US exports also creates high-priced imports. Much of those imports are raw materials used in manufacturing. It also creates something else: it makes ownership of US companies cheaper.

The recent pullbacks in the stock market are mainly the result of the small rise in the dollar. The NASDAQ is now lower than it was when the recession started in December 2007.

The cheaper dollar also means that money comes from overseas to buy US companies and investment. Recent data indicate that foreign direct investment increased by 49% in 2010 compared to 2009, and totaled more than $200 billion. This is always seen as a vote of confidence in the economy which receives this investment. Nowhere was it mentioned in any of the reports of these data that US assets look particularly cheap at this time.

This may be a case of being careful what you ask for. The more internationalized a business becomes, the more options they have to avoid governmental economic prescriptions, or at least minimize their effects. This is one reason why multinational companies are less affected by changes in exchange rates, because they usually have transactions on both sides of borders that can balance out exchange rate issues.

One of the major complaints of the past few years is how much money large multinational companies have just sitting in their accounts. Much of this money is offshore in subsidiaries that they own, and if repatriated would be subject to US corporation tax, which is higher than most other countries. The money stays offshore, and ends up invested there instead. Microsoft is a good example. Last year, Microsoft found it was worthwhile to borrow against its offshore holdings to pay dividends. It also used its offshore monies to buy foreign-based Internet phone company Skype.

The more companies, even small businesses, do business globally, and invest globally, the more options they have. When economies are weak, and regulatory environments become more intense, having a wider range of strategic alternatives is obviously a desirable position.

Overall, economic conditions still demand cautious action. Because of the weak growth economy with inflationary pressures assumed, the emphasis remains on efficiency rather than expansion. When businesses do not see significant revenue opportunities from growing markets, they focus on improving their operations where they can see more immediate and measurable impact. That value proposition is always attractive, but especially attractive in these times.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.