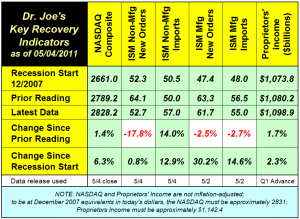

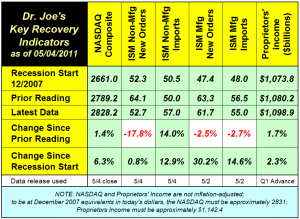

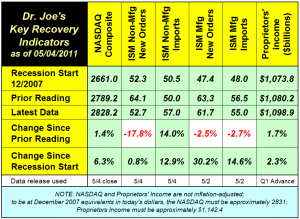

The clearest picture of the disappointing recovery is what has happened to proprietors' income, an indicator of the condition of small business. It may look higher than the recession levels as noted in our chart, but it's still behind once you adjust for inflation. Considering that the recession started just over three years ago, small business has grown less than one percent per year. If it kept up with inflation, it would be $1,142.4 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it's essentially just kept up with inflation, too. The recovery is accepted as beginning in June 2009 and was completed in terms of GDP by Q4-2010. This "post-recovery" economy seems to be slipping already, and the risks of a second recession are rising.

If it went into a new recession, it would not be a "double-dip" (there is no true economic term "double dip," and I much prefer the phrase to be used in conjunction with the dispensing of ice cream rather than economics). It would be a second recession, since the first recession was declared over in June 2009. We're not there yet; let's hope we find a different destination.

The clearest picture of the disappointing recovery is what has happened to proprietors' income, an indicator of the condition of small business. It may look higher than the recession levels as noted in our chart, but it's still behind once you adjust for inflation. Considering that the recession started just over three years ago, small business has grown less than one percent per year. If it kept up with inflation, it would be $1,142.4 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it's essentially just kept up with inflation, too. The recovery is accepted as beginning in June 2009 and was completed in terms of GDP by Q4-2010. This "post-recovery" economy seems to be slipping already, and the risks of a second recession are rising.

If it went into a new recession, it would not be a "double-dip" (there is no true economic term "double dip," and I much prefer the phrase to be used in conjunction with the dispensing of ice cream rather than economics). It would be a second recession, since the first recession was declared over in June 2009. We're not there yet; let's hope we find a different destination.

Commentary & Analysis

Recovery Indicators Better than the Recession Start, but are Now Stalling

The economy is slowing,

The economy is slowing, even though all of the recovery indicators are positive compared to the start of the recession in December 2007. It's the first time that's happened since we started tracking these data for this purpose. This week's Institute for Supply Management manufacturing and non-manufacturing new order indices took a tumble. The manufacturing imports indicator went down, but the non-manufacturing imports had a spike upward. Combine these new orders data with last week's disappointing Q1 GDP report (only +1.8%) and it's fairly clear that this has been no typical recovery. It has been sluggish, and it may be getting more so. Here's the chart (click to enlarge):

The clearest picture of the disappointing recovery is what has happened to proprietors' income, an indicator of the condition of small business. It may look higher than the recession levels as noted in our chart, but it's still behind once you adjust for inflation. Considering that the recession started just over three years ago, small business has grown less than one percent per year. If it kept up with inflation, it would be $1,142.4 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it's essentially just kept up with inflation, too. The recovery is accepted as beginning in June 2009 and was completed in terms of GDP by Q4-2010. This "post-recovery" economy seems to be slipping already, and the risks of a second recession are rising.

If it went into a new recession, it would not be a "double-dip" (there is no true economic term "double dip," and I much prefer the phrase to be used in conjunction with the dispensing of ice cream rather than economics). It would be a second recession, since the first recession was declared over in June 2009. We're not there yet; let's hope we find a different destination.

The clearest picture of the disappointing recovery is what has happened to proprietors' income, an indicator of the condition of small business. It may look higher than the recession levels as noted in our chart, but it's still behind once you adjust for inflation. Considering that the recession started just over three years ago, small business has grown less than one percent per year. If it kept up with inflation, it would be $1,142.4 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it's essentially just kept up with inflation, too. The recovery is accepted as beginning in June 2009 and was completed in terms of GDP by Q4-2010. This "post-recovery" economy seems to be slipping already, and the risks of a second recession are rising.

If it went into a new recession, it would not be a "double-dip" (there is no true economic term "double dip," and I much prefer the phrase to be used in conjunction with the dispensing of ice cream rather than economics). It would be a second recession, since the first recession was declared over in June 2009. We're not there yet; let's hope we find a different destination.

The clearest picture of the disappointing recovery is what has happened to proprietors' income, an indicator of the condition of small business. It may look higher than the recession levels as noted in our chart, but it's still behind once you adjust for inflation. Considering that the recession started just over three years ago, small business has grown less than one percent per year. If it kept up with inflation, it would be $1,142.4 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it's essentially just kept up with inflation, too. The recovery is accepted as beginning in June 2009 and was completed in terms of GDP by Q4-2010. This "post-recovery" economy seems to be slipping already, and the risks of a second recession are rising.

If it went into a new recession, it would not be a "double-dip" (there is no true economic term "double dip," and I much prefer the phrase to be used in conjunction with the dispensing of ice cream rather than economics). It would be a second recession, since the first recession was declared over in June 2009. We're not there yet; let's hope we find a different destination.

The clearest picture of the disappointing recovery is what has happened to proprietors' income, an indicator of the condition of small business. It may look higher than the recession levels as noted in our chart, but it's still behind once you adjust for inflation. Considering that the recession started just over three years ago, small business has grown less than one percent per year. If it kept up with inflation, it would be $1,142.4 billion in today's dollars. As for the NASDAQ, it's almost 6% higher than December 2007, but it's essentially just kept up with inflation, too. The recovery is accepted as beginning in June 2009 and was completed in terms of GDP by Q4-2010. This "post-recovery" economy seems to be slipping already, and the risks of a second recession are rising.

If it went into a new recession, it would not be a "double-dip" (there is no true economic term "double dip," and I much prefer the phrase to be used in conjunction with the dispensing of ice cream rather than economics). It would be a second recession, since the first recession was declared over in June 2009. We're not there yet; let's hope we find a different destination.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- March 2024 Inkjet Installation Roundup

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.