The 2009 Annual Survey of Capital Expenditures was recently released by the Commerce Department.

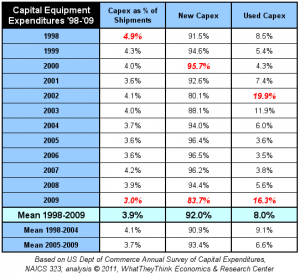

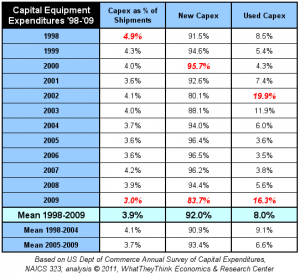

The 2009 Annual Survey of Capital Expenditures was recently released by the Commerce Department. Among fascinating contents is the breakdown of capital equipment expenditures between new and used. In recent years, the percentage of dollars spent on used equipment increased. The chart below (click to enlarge) shows how capital expenditures as a percentage of sales have decreased. Years ago, 5% of sales was a good rule of thumb; now 4% is the number. Used equipment purchases increase as a share of total expenditures in weak economic times. In 2002 and 2003, there were many displaced presses, and they had to find homes. In 2002, used equipment was almost 20% of the dollars spent on capex. In 2009, the printing industry was very weak, and used equipment purchases as a percentage of capex was double the 12-year average.

The common wisdom has seemed to be that printers are, to keep it nice, "frugal" with their dollars. That same wisdom also believes that used equipment sales it hurt industry suppliers, and ultimately hurts the entire industry's need for competitive productivity. After studying these trends for many years, I have come to a different set of ideas.

- Printers are always looking for used equipment. Capital is scarce in the industry, and equipment that matches their operations, and is proven to operate well, is usually the first type of equipment sought.

- The fact that used equipment is sought before seeking new equipment is a reflection of the pure competition nature of the printing marketplace: undifferentiated goods are produced using undifferentiated equipment. In that case, used equipment is not used to support new markets or products, but to support existing operations.

- The used equipment market is necessary for the industry to reallocate its capital to businesses that can use the equipment in better fashion. Many presses were returned early off their leases in the 2002-2003 range; that relatively young used equipment allowed healthier companies to change the nature of their capacity and operations at lower cost.

- Used equipment sales always increase during business slowdowns, not as a result of the financial health of the buyer, but as a result of the financial sickness of the sellers. Prior owners of the purchased equipment bought equipment they did not need or did not have the financial means to support. Many have claimed that easy leases and generous credit approvals for new equipment have been serious problems, depressing the market prices for printed goods. That's not an accurate conclusion, but selling equipment to businesses that require easy credit in one year creates used equipment three or five years later.

- Strong companies make wise used equipment purchasers. This frustrates capital equipment suppliers and their salespeople. In years past, used equipment would find homes in Asia, Africa, and Latin America; not anymore. Those economies are stronger, and have become buyers of the latest technologies, and less of a market for out-of-date technology.

The industry has needed a revolution in capital expenditures. Part of the decline in the percentage of capex as a percentage of sales has been the contraction among large print businesses. This contraction among companies that used to spend about 6% or 7%, and in some years more, of their sales on capex, was caused by the sharp declines in magazines, catalogs, and newspaper inserts. Too often the needed revolution is delayed or bogged down by financial obligations related to equipment that works fine but is not as appropriate for the marketplace as it was when originally purchased. That is, the assumptions about the future that justified the purchase are no longer correct. The marketplace for communications does not wait for those financial obligations to expire, and penalizes businesses that continue to operate as if those original assumptions still made sense..

The common wisdom has seemed to be that printers are, to keep it nice, "frugal" with their dollars. That same wisdom also believes that used equipment sales it hurt industry suppliers, and ultimately hurts the entire industry's need for competitive productivity. After studying these trends for many years, I have come to a different set of ideas.

The common wisdom has seemed to be that printers are, to keep it nice, "frugal" with their dollars. That same wisdom also believes that used equipment sales it hurt industry suppliers, and ultimately hurts the entire industry's need for competitive productivity. After studying these trends for many years, I have come to a different set of ideas.