My column on Monday will review all of this week's data in detail, especially the employment data released tomorrow (Friday, 3/5). Reports this week from ADP and initial jobless claims indicate that the report should be better than last month, but it's always best to wait for the real data. Printing shipments will be released on Friday as well, with the final data for December 2010, and the first report for January.

My column on Monday will review all of this week's data in detail, especially the employment data released tomorrow (Friday, 3/5). Reports this week from ADP and initial jobless claims indicate that the report should be better than last month, but it's always best to wait for the real data. Printing shipments will be released on Friday as well, with the final data for December 2010, and the first report for January.

Commentary & Analysis

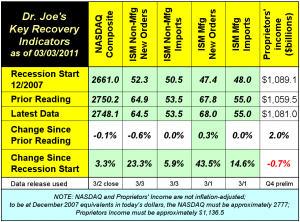

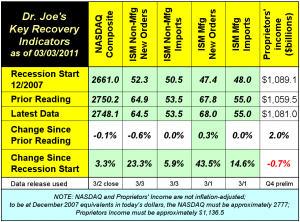

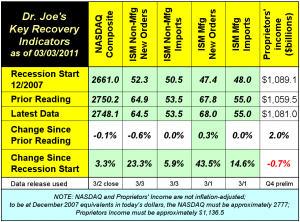

Recovery Indicators Still Moving Sideways; 5 of 6 are Positive

Since last month,

Since last month, five of the six recovery indicators are still in positive territory, but they remained essentially flat. The NASDAQ had its ups and downs all month, but ended up in virtually the same spot, just slightly below the inflation-adjusted level of December 2007. The Q4-2010 proprietors' income data were revised down by $-2.3 billion, but were still higher than Q3-2010, and still lag the start of the recession by -0.7% in current dollars. On an inflation-adjusted basis, proprietors' income, one of the best measures of small business activity, is still down by -5.0%, and should be considered as not recovered. Below is the summary table; click to enlarge.

My column on Monday will review all of this week's data in detail, especially the employment data released tomorrow (Friday, 3/5). Reports this week from ADP and initial jobless claims indicate that the report should be better than last month, but it's always best to wait for the real data. Printing shipments will be released on Friday as well, with the final data for December 2010, and the first report for January.

My column on Monday will review all of this week's data in detail, especially the employment data released tomorrow (Friday, 3/5). Reports this week from ADP and initial jobless claims indicate that the report should be better than last month, but it's always best to wait for the real data. Printing shipments will be released on Friday as well, with the final data for December 2010, and the first report for January.

My column on Monday will review all of this week's data in detail, especially the employment data released tomorrow (Friday, 3/5). Reports this week from ADP and initial jobless claims indicate that the report should be better than last month, but it's always best to wait for the real data. Printing shipments will be released on Friday as well, with the final data for December 2010, and the first report for January.

My column on Monday will review all of this week's data in detail, especially the employment data released tomorrow (Friday, 3/5). Reports this week from ADP and initial jobless claims indicate that the report should be better than last month, but it's always best to wait for the real data. Printing shipments will be released on Friday as well, with the final data for December 2010, and the first report for January.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.