There was an exceptionally strong ISM manufacturing report on Tuesday (2/1). Its only negative was a sharp upturn in materials prices. The NASDAQ spent its second consecutive month higher than December 2007 levels.Thursday's (2/3) ISM non-manufacturing report was also very strong. Both reports indicated that hiring new employees would be increasing.

The advance report of Q4-2010 Gross Domestic Product showed that the recovery is over and that the economy is finally in new territory. The ISM report shows that some optimism about Q1-2011 may be warranted. Our only caution is that the boost in manufacturing may be capital investment that was postponed in Q4 for new depreciation rules and new budgets, and greater business optimism after the elections. The only way to be certain if this is a sustainable change in business conditions or a temporary boost from tax changes is to see how Q2 and Q3 turn out. Businesspeople have to act now, however, and can't wait for data, so they should remain vigilant and keep an ear to the marketplace and decide whether it's real or not for themselves.

Productivity data for Q4 were released, and output productivity is still greater than GDP; recently, the gap has been widening. As long as productivity is greater than GDP growth, there is not incentive to hire in the economy as a whole. Some sectors are hiring, but others are not. How does this reconcile with the ISM employment data? Remember, ISM does not measure companies that are no longer in business, and it does not include self-employment. Also, keep in mind that GDP and productivity reports were for the fourth quarter, and ISM is for the current quarter. If the economy is getting significantly better in this quarter, the ISM report will be the first to tell us.

Friday (2/4) is the release of the latest unemployment report, and it is very important, not because of the unemployment rate, but because of the multi-year revisions that will be part of the release. We'll have it all detailed in Monday's column.

As far as our industry is concerned, December 2010 shipments for the US commercial printing business was up +4.8% in current dollars compared to December 2009, a rise of $347 million. The industry has been in much better shape after a rather disastrous fourth quarter, and finished the year +0.9% versus 2009. Compared to 2008, however, we're down in the range of 12-13%. Is this a "new normal" for us? Those kinds of things can only be judged in retrospect. Just keep in mind that Apple is up to 2 million iPads a month, Amazon claims to sell 1.15 Kindle books for every paperback book where customers have a choice, and there's a lot more activity to come in the tablet and smartphone areas this year. Use this breathing room well.

There was an exceptionally strong ISM manufacturing report on Tuesday (2/1). Its only negative was a sharp upturn in materials prices. The NASDAQ spent its second consecutive month higher than December 2007 levels.Thursday's (2/3) ISM non-manufacturing report was also very strong. Both reports indicated that hiring new employees would be increasing.

The advance report of Q4-2010 Gross Domestic Product showed that the recovery is over and that the economy is finally in new territory. The ISM report shows that some optimism about Q1-2011 may be warranted. Our only caution is that the boost in manufacturing may be capital investment that was postponed in Q4 for new depreciation rules and new budgets, and greater business optimism after the elections. The only way to be certain if this is a sustainable change in business conditions or a temporary boost from tax changes is to see how Q2 and Q3 turn out. Businesspeople have to act now, however, and can't wait for data, so they should remain vigilant and keep an ear to the marketplace and decide whether it's real or not for themselves.

Productivity data for Q4 were released, and output productivity is still greater than GDP; recently, the gap has been widening. As long as productivity is greater than GDP growth, there is not incentive to hire in the economy as a whole. Some sectors are hiring, but others are not. How does this reconcile with the ISM employment data? Remember, ISM does not measure companies that are no longer in business, and it does not include self-employment. Also, keep in mind that GDP and productivity reports were for the fourth quarter, and ISM is for the current quarter. If the economy is getting significantly better in this quarter, the ISM report will be the first to tell us.

Friday (2/4) is the release of the latest unemployment report, and it is very important, not because of the unemployment rate, but because of the multi-year revisions that will be part of the release. We'll have it all detailed in Monday's column.

As far as our industry is concerned, December 2010 shipments for the US commercial printing business was up +4.8% in current dollars compared to December 2009, a rise of $347 million. The industry has been in much better shape after a rather disastrous fourth quarter, and finished the year +0.9% versus 2009. Compared to 2008, however, we're down in the range of 12-13%. Is this a "new normal" for us? Those kinds of things can only be judged in retrospect. Just keep in mind that Apple is up to 2 million iPads a month, Amazon claims to sell 1.15 Kindle books for every paperback book where customers have a choice, and there's a lot more activity to come in the tablet and smartphone areas this year. Use this breathing room well.

Commentary & Analysis

Recovery Indicators Strengthen; December Printing Shipments Up +4.8%

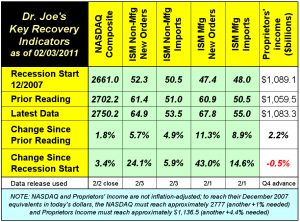

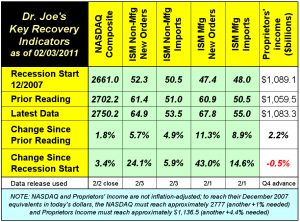

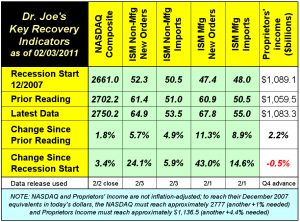

Five of the six recovery indicators remain in positive territory,

Five of the six recovery indicators remain in positive territory, with proprietors' income, our indicator of small business activity, now just -0.5% from its level at the start of the recession in December 2007. There was also great news about December printing shipments in the latest Commerce Department manufacturing report.

There was an exceptionally strong ISM manufacturing report on Tuesday (2/1). Its only negative was a sharp upturn in materials prices. The NASDAQ spent its second consecutive month higher than December 2007 levels.Thursday's (2/3) ISM non-manufacturing report was also very strong. Both reports indicated that hiring new employees would be increasing.

The advance report of Q4-2010 Gross Domestic Product showed that the recovery is over and that the economy is finally in new territory. The ISM report shows that some optimism about Q1-2011 may be warranted. Our only caution is that the boost in manufacturing may be capital investment that was postponed in Q4 for new depreciation rules and new budgets, and greater business optimism after the elections. The only way to be certain if this is a sustainable change in business conditions or a temporary boost from tax changes is to see how Q2 and Q3 turn out. Businesspeople have to act now, however, and can't wait for data, so they should remain vigilant and keep an ear to the marketplace and decide whether it's real or not for themselves.

Productivity data for Q4 were released, and output productivity is still greater than GDP; recently, the gap has been widening. As long as productivity is greater than GDP growth, there is not incentive to hire in the economy as a whole. Some sectors are hiring, but others are not. How does this reconcile with the ISM employment data? Remember, ISM does not measure companies that are no longer in business, and it does not include self-employment. Also, keep in mind that GDP and productivity reports were for the fourth quarter, and ISM is for the current quarter. If the economy is getting significantly better in this quarter, the ISM report will be the first to tell us.

Friday (2/4) is the release of the latest unemployment report, and it is very important, not because of the unemployment rate, but because of the multi-year revisions that will be part of the release. We'll have it all detailed in Monday's column.

As far as our industry is concerned, December 2010 shipments for the US commercial printing business was up +4.8% in current dollars compared to December 2009, a rise of $347 million. The industry has been in much better shape after a rather disastrous fourth quarter, and finished the year +0.9% versus 2009. Compared to 2008, however, we're down in the range of 12-13%. Is this a "new normal" for us? Those kinds of things can only be judged in retrospect. Just keep in mind that Apple is up to 2 million iPads a month, Amazon claims to sell 1.15 Kindle books for every paperback book where customers have a choice, and there's a lot more activity to come in the tablet and smartphone areas this year. Use this breathing room well.

There was an exceptionally strong ISM manufacturing report on Tuesday (2/1). Its only negative was a sharp upturn in materials prices. The NASDAQ spent its second consecutive month higher than December 2007 levels.Thursday's (2/3) ISM non-manufacturing report was also very strong. Both reports indicated that hiring new employees would be increasing.

The advance report of Q4-2010 Gross Domestic Product showed that the recovery is over and that the economy is finally in new territory. The ISM report shows that some optimism about Q1-2011 may be warranted. Our only caution is that the boost in manufacturing may be capital investment that was postponed in Q4 for new depreciation rules and new budgets, and greater business optimism after the elections. The only way to be certain if this is a sustainable change in business conditions or a temporary boost from tax changes is to see how Q2 and Q3 turn out. Businesspeople have to act now, however, and can't wait for data, so they should remain vigilant and keep an ear to the marketplace and decide whether it's real or not for themselves.

Productivity data for Q4 were released, and output productivity is still greater than GDP; recently, the gap has been widening. As long as productivity is greater than GDP growth, there is not incentive to hire in the economy as a whole. Some sectors are hiring, but others are not. How does this reconcile with the ISM employment data? Remember, ISM does not measure companies that are no longer in business, and it does not include self-employment. Also, keep in mind that GDP and productivity reports were for the fourth quarter, and ISM is for the current quarter. If the economy is getting significantly better in this quarter, the ISM report will be the first to tell us.

Friday (2/4) is the release of the latest unemployment report, and it is very important, not because of the unemployment rate, but because of the multi-year revisions that will be part of the release. We'll have it all detailed in Monday's column.

As far as our industry is concerned, December 2010 shipments for the US commercial printing business was up +4.8% in current dollars compared to December 2009, a rise of $347 million. The industry has been in much better shape after a rather disastrous fourth quarter, and finished the year +0.9% versus 2009. Compared to 2008, however, we're down in the range of 12-13%. Is this a "new normal" for us? Those kinds of things can only be judged in retrospect. Just keep in mind that Apple is up to 2 million iPads a month, Amazon claims to sell 1.15 Kindle books for every paperback book where customers have a choice, and there's a lot more activity to come in the tablet and smartphone areas this year. Use this breathing room well.

There was an exceptionally strong ISM manufacturing report on Tuesday (2/1). Its only negative was a sharp upturn in materials prices. The NASDAQ spent its second consecutive month higher than December 2007 levels.Thursday's (2/3) ISM non-manufacturing report was also very strong. Both reports indicated that hiring new employees would be increasing.

The advance report of Q4-2010 Gross Domestic Product showed that the recovery is over and that the economy is finally in new territory. The ISM report shows that some optimism about Q1-2011 may be warranted. Our only caution is that the boost in manufacturing may be capital investment that was postponed in Q4 for new depreciation rules and new budgets, and greater business optimism after the elections. The only way to be certain if this is a sustainable change in business conditions or a temporary boost from tax changes is to see how Q2 and Q3 turn out. Businesspeople have to act now, however, and can't wait for data, so they should remain vigilant and keep an ear to the marketplace and decide whether it's real or not for themselves.

Productivity data for Q4 were released, and output productivity is still greater than GDP; recently, the gap has been widening. As long as productivity is greater than GDP growth, there is not incentive to hire in the economy as a whole. Some sectors are hiring, but others are not. How does this reconcile with the ISM employment data? Remember, ISM does not measure companies that are no longer in business, and it does not include self-employment. Also, keep in mind that GDP and productivity reports were for the fourth quarter, and ISM is for the current quarter. If the economy is getting significantly better in this quarter, the ISM report will be the first to tell us.

Friday (2/4) is the release of the latest unemployment report, and it is very important, not because of the unemployment rate, but because of the multi-year revisions that will be part of the release. We'll have it all detailed in Monday's column.

As far as our industry is concerned, December 2010 shipments for the US commercial printing business was up +4.8% in current dollars compared to December 2009, a rise of $347 million. The industry has been in much better shape after a rather disastrous fourth quarter, and finished the year +0.9% versus 2009. Compared to 2008, however, we're down in the range of 12-13%. Is this a "new normal" for us? Those kinds of things can only be judged in retrospect. Just keep in mind that Apple is up to 2 million iPads a month, Amazon claims to sell 1.15 Kindle books for every paperback book where customers have a choice, and there's a lot more activity to come in the tablet and smartphone areas this year. Use this breathing room well.

There was an exceptionally strong ISM manufacturing report on Tuesday (2/1). Its only negative was a sharp upturn in materials prices. The NASDAQ spent its second consecutive month higher than December 2007 levels.Thursday's (2/3) ISM non-manufacturing report was also very strong. Both reports indicated that hiring new employees would be increasing.

The advance report of Q4-2010 Gross Domestic Product showed that the recovery is over and that the economy is finally in new territory. The ISM report shows that some optimism about Q1-2011 may be warranted. Our only caution is that the boost in manufacturing may be capital investment that was postponed in Q4 for new depreciation rules and new budgets, and greater business optimism after the elections. The only way to be certain if this is a sustainable change in business conditions or a temporary boost from tax changes is to see how Q2 and Q3 turn out. Businesspeople have to act now, however, and can't wait for data, so they should remain vigilant and keep an ear to the marketplace and decide whether it's real or not for themselves.

Productivity data for Q4 were released, and output productivity is still greater than GDP; recently, the gap has been widening. As long as productivity is greater than GDP growth, there is not incentive to hire in the economy as a whole. Some sectors are hiring, but others are not. How does this reconcile with the ISM employment data? Remember, ISM does not measure companies that are no longer in business, and it does not include self-employment. Also, keep in mind that GDP and productivity reports were for the fourth quarter, and ISM is for the current quarter. If the economy is getting significantly better in this quarter, the ISM report will be the first to tell us.

Friday (2/4) is the release of the latest unemployment report, and it is very important, not because of the unemployment rate, but because of the multi-year revisions that will be part of the release. We'll have it all detailed in Monday's column.

As far as our industry is concerned, December 2010 shipments for the US commercial printing business was up +4.8% in current dollars compared to December 2009, a rise of $347 million. The industry has been in much better shape after a rather disastrous fourth quarter, and finished the year +0.9% versus 2009. Compared to 2008, however, we're down in the range of 12-13%. Is this a "new normal" for us? Those kinds of things can only be judged in retrospect. Just keep in mind that Apple is up to 2 million iPads a month, Amazon claims to sell 1.15 Kindle books for every paperback book where customers have a choice, and there's a lot more activity to come in the tablet and smartphone areas this year. Use this breathing room well.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.