All of this is encouraging because all of the other indicators are higher than what they were in December 2007, the official start of the recession. The recovery started in June 2009. The recovery was nearly over as far as GDP is concerned with the Q3 data, but it is likely that there will be great fanfare with the release of the Q4 GDP data at the end of the month when real GDP finally surpasses Q4-2007 levels.

But how do we compare to last year at this time? The NASDAQ is up +17.4%, the Institute for Supply Management non-manufacturing new orders are up +20.9% and their imports are up +6.9%. The ISM Manufacturing indices for new orders and imports have actually dropped by -7% and -8.2% respectively. Because the ISM Index is calculated so that any reading over 50 indicates growth, this does not mean that manufacturing is declining, just that it is growing at a slower rate. Proprietors' income was up by +2.1% since last year, but it's still not enough to push it over Q4-2007 levels. (Proprietors' income is not adjusted for inflation; it's -1.9% below Q4-2007 levels; adjusted for inflation it's about -4%).

The economy is growing but at a rather slow rate, still. The January 7 unemployment report will get wide news coverage, but the key report will be the one released in February when the Bureau of Labor Statistics adjusts for its announced overcount of employed workers; they've announced it might be by more than half a million workers. It's part of their regular practice of statistical estimation, and they report their adjustments regularly for all to see. The BLS will be updating as much as five years of data in February; printing employment will be updated in March.

Keep in mind that the range of statistical error for Friday's unemployment report is + or - 129,000 workers; anything in that range is the statistical equivalent of "no change."

All of this is encouraging because all of the other indicators are higher than what they were in December 2007, the official start of the recession. The recovery started in June 2009. The recovery was nearly over as far as GDP is concerned with the Q3 data, but it is likely that there will be great fanfare with the release of the Q4 GDP data at the end of the month when real GDP finally surpasses Q4-2007 levels.

But how do we compare to last year at this time? The NASDAQ is up +17.4%, the Institute for Supply Management non-manufacturing new orders are up +20.9% and their imports are up +6.9%. The ISM Manufacturing indices for new orders and imports have actually dropped by -7% and -8.2% respectively. Because the ISM Index is calculated so that any reading over 50 indicates growth, this does not mean that manufacturing is declining, just that it is growing at a slower rate. Proprietors' income was up by +2.1% since last year, but it's still not enough to push it over Q4-2007 levels. (Proprietors' income is not adjusted for inflation; it's -1.9% below Q4-2007 levels; adjusted for inflation it's about -4%).

The economy is growing but at a rather slow rate, still. The January 7 unemployment report will get wide news coverage, but the key report will be the one released in February when the Bureau of Labor Statistics adjusts for its announced overcount of employed workers; they've announced it might be by more than half a million workers. It's part of their regular practice of statistical estimation, and they report their adjustments regularly for all to see. The BLS will be updating as much as five years of data in February; printing employment will be updated in March.

Keep in mind that the range of statistical error for Friday's unemployment report is + or - 129,000 workers; anything in that range is the statistical equivalent of "no change."

Commentary & Analysis

Five of Six Recovery Indicators Now Positive; Last One Remains Stubbornly Negative

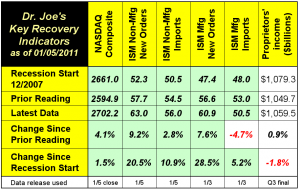

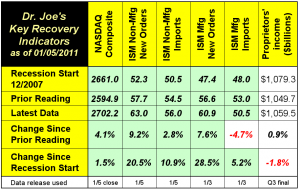

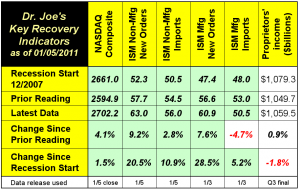

Our recovery indicators finally took a big step this last month when the NASDAQ surpassed its December 2007 close.

Our recovery indicators finally took a big step this last month when the NASDAQ surpassed its December 2007 close. It still has to add 70 points to break its inflation-adjusted equivalent, but this was an important advance that pushed 5 of the 6 indicators into positive territory. The one that remains stubbornly negative is "proprietors' income," a measure of the activity of small business. This is not a surprise, of course, since one of the critical small business sectors is housing and construction, both of which remain mired with significant problems.

All of this is encouraging because all of the other indicators are higher than what they were in December 2007, the official start of the recession. The recovery started in June 2009. The recovery was nearly over as far as GDP is concerned with the Q3 data, but it is likely that there will be great fanfare with the release of the Q4 GDP data at the end of the month when real GDP finally surpasses Q4-2007 levels.

But how do we compare to last year at this time? The NASDAQ is up +17.4%, the Institute for Supply Management non-manufacturing new orders are up +20.9% and their imports are up +6.9%. The ISM Manufacturing indices for new orders and imports have actually dropped by -7% and -8.2% respectively. Because the ISM Index is calculated so that any reading over 50 indicates growth, this does not mean that manufacturing is declining, just that it is growing at a slower rate. Proprietors' income was up by +2.1% since last year, but it's still not enough to push it over Q4-2007 levels. (Proprietors' income is not adjusted for inflation; it's -1.9% below Q4-2007 levels; adjusted for inflation it's about -4%).

The economy is growing but at a rather slow rate, still. The January 7 unemployment report will get wide news coverage, but the key report will be the one released in February when the Bureau of Labor Statistics adjusts for its announced overcount of employed workers; they've announced it might be by more than half a million workers. It's part of their regular practice of statistical estimation, and they report their adjustments regularly for all to see. The BLS will be updating as much as five years of data in February; printing employment will be updated in March.

Keep in mind that the range of statistical error for Friday's unemployment report is + or - 129,000 workers; anything in that range is the statistical equivalent of "no change."

All of this is encouraging because all of the other indicators are higher than what they were in December 2007, the official start of the recession. The recovery started in June 2009. The recovery was nearly over as far as GDP is concerned with the Q3 data, but it is likely that there will be great fanfare with the release of the Q4 GDP data at the end of the month when real GDP finally surpasses Q4-2007 levels.

But how do we compare to last year at this time? The NASDAQ is up +17.4%, the Institute for Supply Management non-manufacturing new orders are up +20.9% and their imports are up +6.9%. The ISM Manufacturing indices for new orders and imports have actually dropped by -7% and -8.2% respectively. Because the ISM Index is calculated so that any reading over 50 indicates growth, this does not mean that manufacturing is declining, just that it is growing at a slower rate. Proprietors' income was up by +2.1% since last year, but it's still not enough to push it over Q4-2007 levels. (Proprietors' income is not adjusted for inflation; it's -1.9% below Q4-2007 levels; adjusted for inflation it's about -4%).

The economy is growing but at a rather slow rate, still. The January 7 unemployment report will get wide news coverage, but the key report will be the one released in February when the Bureau of Labor Statistics adjusts for its announced overcount of employed workers; they've announced it might be by more than half a million workers. It's part of their regular practice of statistical estimation, and they report their adjustments regularly for all to see. The BLS will be updating as much as five years of data in February; printing employment will be updated in March.

Keep in mind that the range of statistical error for Friday's unemployment report is + or - 129,000 workers; anything in that range is the statistical equivalent of "no change."

All of this is encouraging because all of the other indicators are higher than what they were in December 2007, the official start of the recession. The recovery started in June 2009. The recovery was nearly over as far as GDP is concerned with the Q3 data, but it is likely that there will be great fanfare with the release of the Q4 GDP data at the end of the month when real GDP finally surpasses Q4-2007 levels.

But how do we compare to last year at this time? The NASDAQ is up +17.4%, the Institute for Supply Management non-manufacturing new orders are up +20.9% and their imports are up +6.9%. The ISM Manufacturing indices for new orders and imports have actually dropped by -7% and -8.2% respectively. Because the ISM Index is calculated so that any reading over 50 indicates growth, this does not mean that manufacturing is declining, just that it is growing at a slower rate. Proprietors' income was up by +2.1% since last year, but it's still not enough to push it over Q4-2007 levels. (Proprietors' income is not adjusted for inflation; it's -1.9% below Q4-2007 levels; adjusted for inflation it's about -4%).

The economy is growing but at a rather slow rate, still. The January 7 unemployment report will get wide news coverage, but the key report will be the one released in February when the Bureau of Labor Statistics adjusts for its announced overcount of employed workers; they've announced it might be by more than half a million workers. It's part of their regular practice of statistical estimation, and they report their adjustments regularly for all to see. The BLS will be updating as much as five years of data in February; printing employment will be updated in March.

Keep in mind that the range of statistical error for Friday's unemployment report is + or - 129,000 workers; anything in that range is the statistical equivalent of "no change."

All of this is encouraging because all of the other indicators are higher than what they were in December 2007, the official start of the recession. The recovery started in June 2009. The recovery was nearly over as far as GDP is concerned with the Q3 data, but it is likely that there will be great fanfare with the release of the Q4 GDP data at the end of the month when real GDP finally surpasses Q4-2007 levels.

But how do we compare to last year at this time? The NASDAQ is up +17.4%, the Institute for Supply Management non-manufacturing new orders are up +20.9% and their imports are up +6.9%. The ISM Manufacturing indices for new orders and imports have actually dropped by -7% and -8.2% respectively. Because the ISM Index is calculated so that any reading over 50 indicates growth, this does not mean that manufacturing is declining, just that it is growing at a slower rate. Proprietors' income was up by +2.1% since last year, but it's still not enough to push it over Q4-2007 levels. (Proprietors' income is not adjusted for inflation; it's -1.9% below Q4-2007 levels; adjusted for inflation it's about -4%).

The economy is growing but at a rather slow rate, still. The January 7 unemployment report will get wide news coverage, but the key report will be the one released in February when the Bureau of Labor Statistics adjusts for its announced overcount of employed workers; they've announced it might be by more than half a million workers. It's part of their regular practice of statistical estimation, and they report their adjustments regularly for all to see. The BLS will be updating as much as five years of data in February; printing employment will be updated in March.

Keep in mind that the range of statistical error for Friday's unemployment report is + or - 129,000 workers; anything in that range is the statistical equivalent of "no change."

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.