So it's just more of the same. As I wrote recently, keep focusing on what your business should look like in 2015 and 2020, because the technological and social changes don't wait for macroeconomic data. I believe that the third quarter GDP advance figure will be revised down. It is likely that Q4 will end up at +2.5%, however.

In case you may not have noticed, the stock markets have been a bit volatile of late. A debate has started about whether or not the Fed's QE2 is necessary, and there is renewed concern about the financial stability of Europe in dealing with the problems of Ireland and Greece (with Spain and Portugal waiting in the wings!). This has sparked some new interest in the use of gold as currency again. One of the more popular economists of recent years, Nouriel Roubini (the original "Dr. Doom") warned against it. The economic bloggers, especially those who follow the Austrian School, enjoyed this greatly. Lew Rockwell, who heads the Mises Institute, said that Roubini's objections actually made the case for gold; he wrote:

One of the funniest explosions came from Nouriel Roubini, who listed a series of merits of gold without recognizing them as such: gold limits the flexibility and range of actions of central banks (check!); under gold, a central bank can’t "stimulate growth and manage price stability" (check!); under gold, central banks can’t provide lender of last resort support (check!); under gold, banks go belly-up rather than get bailed out (check!).

The complete piece can be viewed at his blog.

A good summary of the issues can be found at New American.

The gold standard is not in our future, but the discipline of the Federal Reserve is going to be an important topic in the next year, and it will be worth watching.

This is my last writing for WhatTheyThink until my next column appears on November 29. The next revision of GDP is released on Tuesday of next week, so watch the Twitter account at www.twitter.com/wtterc for my postings about that and other economic news in the meantime. Have a wonderful Thanksgiving (you know, that holiday that we are grateful that we see certain relatives only once a year) and safe travels to all.

So it's just more of the same. As I wrote recently, keep focusing on what your business should look like in 2015 and 2020, because the technological and social changes don't wait for macroeconomic data. I believe that the third quarter GDP advance figure will be revised down. It is likely that Q4 will end up at +2.5%, however.

In case you may not have noticed, the stock markets have been a bit volatile of late. A debate has started about whether or not the Fed's QE2 is necessary, and there is renewed concern about the financial stability of Europe in dealing with the problems of Ireland and Greece (with Spain and Portugal waiting in the wings!). This has sparked some new interest in the use of gold as currency again. One of the more popular economists of recent years, Nouriel Roubini (the original "Dr. Doom") warned against it. The economic bloggers, especially those who follow the Austrian School, enjoyed this greatly. Lew Rockwell, who heads the Mises Institute, said that Roubini's objections actually made the case for gold; he wrote:

One of the funniest explosions came from Nouriel Roubini, who listed a series of merits of gold without recognizing them as such: gold limits the flexibility and range of actions of central banks (check!); under gold, a central bank can’t "stimulate growth and manage price stability" (check!); under gold, central banks can’t provide lender of last resort support (check!); under gold, banks go belly-up rather than get bailed out (check!).

The complete piece can be viewed at his blog.

A good summary of the issues can be found at New American.

The gold standard is not in our future, but the discipline of the Federal Reserve is going to be an important topic in the next year, and it will be worth watching.

This is my last writing for WhatTheyThink until my next column appears on November 29. The next revision of GDP is released on Tuesday of next week, so watch the Twitter account at www.twitter.com/wtterc for my postings about that and other economic news in the meantime. Have a wonderful Thanksgiving (you know, that holiday that we are grateful that we see certain relatives only once a year) and safe travels to all.

Commentary & Analysis

Updating the Macroeconomic Picture: To "L" with It

The bad joke I tell is that we'

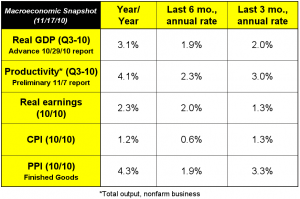

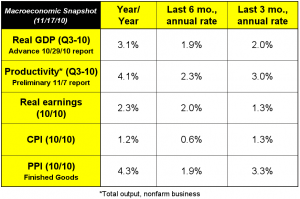

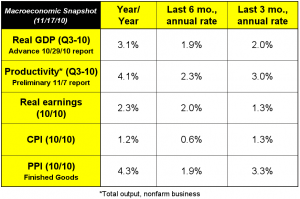

The bad joke I tell is that we're in an "L-shaped" recovery and that I hope it's upper case and not lower case. We're still very much on that path, with slowing GDP, but now increasing inflation at the manufacturing level. The fact that consumer prices (as measured by the Consumer Price Index [CPI]) are supposedly "tame" does not tell the story of how companies are paying for that disparity. If those higher costs can't be covered by end-market prices, then cost-cutting, efficiencies, and reduced use of materials is what they do. That's why productivity is still up, and is the exact reason why employment is not improving. Real earnings of workers are not increasing as much as productivity. On a year-year basis, real earnings are up +2.3%, but productivity is up +4.1%.

So it's just more of the same. As I wrote recently, keep focusing on what your business should look like in 2015 and 2020, because the technological and social changes don't wait for macroeconomic data. I believe that the third quarter GDP advance figure will be revised down. It is likely that Q4 will end up at +2.5%, however.

In case you may not have noticed, the stock markets have been a bit volatile of late. A debate has started about whether or not the Fed's QE2 is necessary, and there is renewed concern about the financial stability of Europe in dealing with the problems of Ireland and Greece (with Spain and Portugal waiting in the wings!). This has sparked some new interest in the use of gold as currency again. One of the more popular economists of recent years, Nouriel Roubini (the original "Dr. Doom") warned against it. The economic bloggers, especially those who follow the Austrian School, enjoyed this greatly. Lew Rockwell, who heads the Mises Institute, said that Roubini's objections actually made the case for gold; he wrote:

One of the funniest explosions came from Nouriel Roubini, who listed a series of merits of gold without recognizing them as such: gold limits the flexibility and range of actions of central banks (check!); under gold, a central bank can’t "stimulate growth and manage price stability" (check!); under gold, central banks can’t provide lender of last resort support (check!); under gold, banks go belly-up rather than get bailed out (check!).

The complete piece can be viewed at his blog.

A good summary of the issues can be found at New American.

The gold standard is not in our future, but the discipline of the Federal Reserve is going to be an important topic in the next year, and it will be worth watching.

This is my last writing for WhatTheyThink until my next column appears on November 29. The next revision of GDP is released on Tuesday of next week, so watch the Twitter account at www.twitter.com/wtterc for my postings about that and other economic news in the meantime. Have a wonderful Thanksgiving (you know, that holiday that we are grateful that we see certain relatives only once a year) and safe travels to all.

So it's just more of the same. As I wrote recently, keep focusing on what your business should look like in 2015 and 2020, because the technological and social changes don't wait for macroeconomic data. I believe that the third quarter GDP advance figure will be revised down. It is likely that Q4 will end up at +2.5%, however.

In case you may not have noticed, the stock markets have been a bit volatile of late. A debate has started about whether or not the Fed's QE2 is necessary, and there is renewed concern about the financial stability of Europe in dealing with the problems of Ireland and Greece (with Spain and Portugal waiting in the wings!). This has sparked some new interest in the use of gold as currency again. One of the more popular economists of recent years, Nouriel Roubini (the original "Dr. Doom") warned against it. The economic bloggers, especially those who follow the Austrian School, enjoyed this greatly. Lew Rockwell, who heads the Mises Institute, said that Roubini's objections actually made the case for gold; he wrote:

One of the funniest explosions came from Nouriel Roubini, who listed a series of merits of gold without recognizing them as such: gold limits the flexibility and range of actions of central banks (check!); under gold, a central bank can’t "stimulate growth and manage price stability" (check!); under gold, central banks can’t provide lender of last resort support (check!); under gold, banks go belly-up rather than get bailed out (check!).

The complete piece can be viewed at his blog.

A good summary of the issues can be found at New American.

The gold standard is not in our future, but the discipline of the Federal Reserve is going to be an important topic in the next year, and it will be worth watching.

This is my last writing for WhatTheyThink until my next column appears on November 29. The next revision of GDP is released on Tuesday of next week, so watch the Twitter account at www.twitter.com/wtterc for my postings about that and other economic news in the meantime. Have a wonderful Thanksgiving (you know, that holiday that we are grateful that we see certain relatives only once a year) and safe travels to all.

So it's just more of the same. As I wrote recently, keep focusing on what your business should look like in 2015 and 2020, because the technological and social changes don't wait for macroeconomic data. I believe that the third quarter GDP advance figure will be revised down. It is likely that Q4 will end up at +2.5%, however.

In case you may not have noticed, the stock markets have been a bit volatile of late. A debate has started about whether or not the Fed's QE2 is necessary, and there is renewed concern about the financial stability of Europe in dealing with the problems of Ireland and Greece (with Spain and Portugal waiting in the wings!). This has sparked some new interest in the use of gold as currency again. One of the more popular economists of recent years, Nouriel Roubini (the original "Dr. Doom") warned against it. The economic bloggers, especially those who follow the Austrian School, enjoyed this greatly. Lew Rockwell, who heads the Mises Institute, said that Roubini's objections actually made the case for gold; he wrote:

One of the funniest explosions came from Nouriel Roubini, who listed a series of merits of gold without recognizing them as such: gold limits the flexibility and range of actions of central banks (check!); under gold, a central bank can’t "stimulate growth and manage price stability" (check!); under gold, central banks can’t provide lender of last resort support (check!); under gold, banks go belly-up rather than get bailed out (check!).

The complete piece can be viewed at his blog.

A good summary of the issues can be found at New American.

The gold standard is not in our future, but the discipline of the Federal Reserve is going to be an important topic in the next year, and it will be worth watching.

This is my last writing for WhatTheyThink until my next column appears on November 29. The next revision of GDP is released on Tuesday of next week, so watch the Twitter account at www.twitter.com/wtterc for my postings about that and other economic news in the meantime. Have a wonderful Thanksgiving (you know, that holiday that we are grateful that we see certain relatives only once a year) and safe travels to all.

So it's just more of the same. As I wrote recently, keep focusing on what your business should look like in 2015 and 2020, because the technological and social changes don't wait for macroeconomic data. I believe that the third quarter GDP advance figure will be revised down. It is likely that Q4 will end up at +2.5%, however.

In case you may not have noticed, the stock markets have been a bit volatile of late. A debate has started about whether or not the Fed's QE2 is necessary, and there is renewed concern about the financial stability of Europe in dealing with the problems of Ireland and Greece (with Spain and Portugal waiting in the wings!). This has sparked some new interest in the use of gold as currency again. One of the more popular economists of recent years, Nouriel Roubini (the original "Dr. Doom") warned against it. The economic bloggers, especially those who follow the Austrian School, enjoyed this greatly. Lew Rockwell, who heads the Mises Institute, said that Roubini's objections actually made the case for gold; he wrote:

One of the funniest explosions came from Nouriel Roubini, who listed a series of merits of gold without recognizing them as such: gold limits the flexibility and range of actions of central banks (check!); under gold, a central bank can’t "stimulate growth and manage price stability" (check!); under gold, central banks can’t provide lender of last resort support (check!); under gold, banks go belly-up rather than get bailed out (check!).

The complete piece can be viewed at his blog.

A good summary of the issues can be found at New American.

The gold standard is not in our future, but the discipline of the Federal Reserve is going to be an important topic in the next year, and it will be worth watching.

This is my last writing for WhatTheyThink until my next column appears on November 29. The next revision of GDP is released on Tuesday of next week, so watch the Twitter account at www.twitter.com/wtterc for my postings about that and other economic news in the meantime. Have a wonderful Thanksgiving (you know, that holiday that we are grateful that we see certain relatives only once a year) and safe travels to all.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Inkjet Integrator Profiles: Integrity Industrial Inkjet

- Revisiting the Samba printhead

- 2024 Inkjet Shopping Guide for Folding Carton Presses

- The Future of AI In Packaging

- Inkjet Integrator Profiles: DJM

- Spring Inkjet Update – Webinar

- Security Ink Technologies for Anti-Counterfeiting Measures

- Komori unveils B2 UV Inkjet

WhatTheyThink is the official show daily media partner of drupa 2024. More info about drupa programs

© 2024 WhatTheyThink. All Rights Reserved.