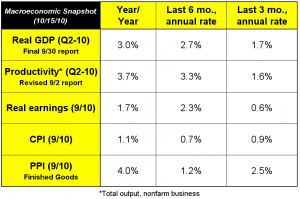

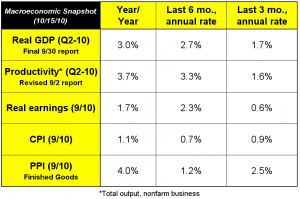

This past week, the latest update about inflation and real earnings were released. In a couple of weeks we will have new data about GDP and productivity. In the meantime, it is commonly thought that consumer price inflation is tame, at 1.1% on a year-year basis. In a decade, however, that means that the value of $100 becomes $89. That doesn't sound all that tame, to me. In the case of the producer prices (PPI), that is definitely not the case, now running at 4% on a year-year basis.

This means that prices at the manufacturing and goods-creation level are increasing. This means that goods and materials sused in the production of other goods or delivery of services are going up. These increases are not being passed to consumers. The costs go somewhere. That's why the chart shows that productivity is still higher than the increase in real earnings. Companies are producing more (we know because of the increase in GDP), but the employees working in that production are not receiving pay increases commensurate with their rise in output. Some of the difference is going to benefits and regulatory costs, but most of the difference is going to pay for the gap between the PPI and the CPI. If you can't get it in the final market prices, you have to change the costs of creating those goods by being more efficient and increasing margins through better operation.

This is the problem with an economy that is focused on efficiency and not expansion. It's a defensive approach. You're always concerned about being efficient, of course, but the investments you make for expansion (new plants, new buildings, new equipment) are quite different than when making investments for efficiency alone. Expansion investments are what drive job creation and increase wages.

Lately the Fed has been preparing the way for QE2, which is not a ship, but further expansion ("quantitative easing") of the money supply. That always makes me worry. What have we really gotten from all of this expansion before? Banks are holding the money to keep their balance sheets in better order, but because of the disincentives for investment (and also disinterest: why else would people be willing to accept such low Treasury yields?) there is actually little demand for money. Without upside, the focus on efficiency continues.

And how about those recipients of social security not getting a cost of living adjustment? There are few constituencies who have been so badly burdened by low interest rates that the risk-averse social security recipient who put their money into bank certificates of deposit or bank money market funds, both of which are tied by the market to Treasury rates. They should not be getting a cost of living increase because prices are going up (they're not). But their net cost of living that includes savings income is going down because rates on hard-earned conservatively invested nesteggs are producing almost zero income if invested in the safest one of all, Treasury bills and notes.

If someone retired not many years ago, and they were afraid of the loss of principal that stocks and other instruments occasionally suffer, putting money in a bank CD for 4% was a good idea. So if their nest egg was $100,000, that would have given them a little over $300 a month of guaranteed income. Today? A three-year CD is paying just under 2%. Their savings income has halved. How will they make it up? By eating into principal.

No, the cost of living is not the problem for social security recipients. The Fed's action disproportionally hurt small savers. You didn't have to lose money in the stock market a few years ago to cut your retirement income; all you had to do was invest in an insured bank CD.

The Fed will be moving again, buying more Treasury instruments as they are issued, hoping to increase the money supply and get business going again. When there are no incentives to take risks, there is little reason to use the money, and the effect will be minimal, if at all.

Some expect big changes as a result of the upcoming election. Last I checked, Ben Bernanke's name was not on the ballot.

This means that prices at the manufacturing and goods-creation level are increasing. This means that goods and materials sused in the production of other goods or delivery of services are going up. These increases are not being passed to consumers. The costs go somewhere. That's why the chart shows that productivity is still higher than the increase in real earnings. Companies are producing more (we know because of the increase in GDP), but the employees working in that production are not receiving pay increases commensurate with their rise in output. Some of the difference is going to benefits and regulatory costs, but most of the difference is going to pay for the gap between the PPI and the CPI. If you can't get it in the final market prices, you have to change the costs of creating those goods by being more efficient and increasing margins through better operation.

This is the problem with an economy that is focused on efficiency and not expansion. It's a defensive approach. You're always concerned about being efficient, of course, but the investments you make for expansion (new plants, new buildings, new equipment) are quite different than when making investments for efficiency alone. Expansion investments are what drive job creation and increase wages.

Lately the Fed has been preparing the way for QE2, which is not a ship, but further expansion ("quantitative easing") of the money supply. That always makes me worry. What have we really gotten from all of this expansion before? Banks are holding the money to keep their balance sheets in better order, but because of the disincentives for investment (and also disinterest: why else would people be willing to accept such low Treasury yields?) there is actually little demand for money. Without upside, the focus on efficiency continues.

This means that prices at the manufacturing and goods-creation level are increasing. This means that goods and materials sused in the production of other goods or delivery of services are going up. These increases are not being passed to consumers. The costs go somewhere. That's why the chart shows that productivity is still higher than the increase in real earnings. Companies are producing more (we know because of the increase in GDP), but the employees working in that production are not receiving pay increases commensurate with their rise in output. Some of the difference is going to benefits and regulatory costs, but most of the difference is going to pay for the gap between the PPI and the CPI. If you can't get it in the final market prices, you have to change the costs of creating those goods by being more efficient and increasing margins through better operation.

This is the problem with an economy that is focused on efficiency and not expansion. It's a defensive approach. You're always concerned about being efficient, of course, but the investments you make for expansion (new plants, new buildings, new equipment) are quite different than when making investments for efficiency alone. Expansion investments are what drive job creation and increase wages.

Lately the Fed has been preparing the way for QE2, which is not a ship, but further expansion ("quantitative easing") of the money supply. That always makes me worry. What have we really gotten from all of this expansion before? Banks are holding the money to keep their balance sheets in better order, but because of the disincentives for investment (and also disinterest: why else would people be willing to accept such low Treasury yields?) there is actually little demand for money. Without upside, the focus on efficiency continues.

And how about those recipients of social security not getting a cost of living adjustment? There are few constituencies who have been so badly burdened by low interest rates that the risk-averse social security recipient who put their money into bank certificates of deposit or bank money market funds, both of which are tied by the market to Treasury rates. They should not be getting a cost of living increase because prices are going up (they're not). But their net cost of living that includes savings income is going down because rates on hard-earned conservatively invested nesteggs are producing almost zero income if invested in the safest one of all, Treasury bills and notes.

If someone retired not many years ago, and they were afraid of the loss of principal that stocks and other instruments occasionally suffer, putting money in a bank CD for 4% was a good idea. So if their nest egg was $100,000, that would have given them a little over $300 a month of guaranteed income. Today? A three-year CD is paying just under 2%. Their savings income has halved. How will they make it up? By eating into principal.

No, the cost of living is not the problem for social security recipients. The Fed's action disproportionally hurt small savers. You didn't have to lose money in the stock market a few years ago to cut your retirement income; all you had to do was invest in an insured bank CD.

The Fed will be moving again, buying more Treasury instruments as they are issued, hoping to increase the money supply and get business going again. When there are no incentives to take risks, there is little reason to use the money, and the effect will be minimal, if at all.

Some expect big changes as a result of the upcoming election. Last I checked, Ben Bernanke's name was not on the ballot.

And how about those recipients of social security not getting a cost of living adjustment? There are few constituencies who have been so badly burdened by low interest rates that the risk-averse social security recipient who put their money into bank certificates of deposit or bank money market funds, both of which are tied by the market to Treasury rates. They should not be getting a cost of living increase because prices are going up (they're not). But their net cost of living that includes savings income is going down because rates on hard-earned conservatively invested nesteggs are producing almost zero income if invested in the safest one of all, Treasury bills and notes.

If someone retired not many years ago, and they were afraid of the loss of principal that stocks and other instruments occasionally suffer, putting money in a bank CD for 4% was a good idea. So if their nest egg was $100,000, that would have given them a little over $300 a month of guaranteed income. Today? A three-year CD is paying just under 2%. Their savings income has halved. How will they make it up? By eating into principal.

No, the cost of living is not the problem for social security recipients. The Fed's action disproportionally hurt small savers. You didn't have to lose money in the stock market a few years ago to cut your retirement income; all you had to do was invest in an insured bank CD.

The Fed will be moving again, buying more Treasury instruments as they are issued, hoping to increase the money supply and get business going again. When there are no incentives to take risks, there is little reason to use the money, and the effect will be minimal, if at all.

Some expect big changes as a result of the upcoming election. Last I checked, Ben Bernanke's name was not on the ballot.