These costs are major reasons that pushed small manufacturing out of cities, and explain why service businesses are the ones most often started. Be sure to see Table 16, page 54 which shows compliance cost comparisons for different categories of business, and how much higher manufacturing compliance costs are (environmental costs are $22K per employee for small businesses). These problems are rarely addressed in public policy, and underscore the issue raised by the Austrian School and Milton Friedman about regulations only being applied to existing businesses without regard to future businesses (economist Phillipe Bastiat wrote about it in 1848). Economists have written often about the unseen effects of policies and that they are often more important than the overt ones. One never sees the businesses not started or the capital diverted elsewhere, so these explanations are often dismissed as mindless whining of businesspeople.

You may want to show the report to your CPA, and calculate your own costs (the CPA is one of the compliance costs, of course, so it might be a little unnerving), and calculate it on an employee basis, and make that number known in the company, even breaking it out on an hourly basis so that employees can see one of the factors that weighs down on their wages.

See you at GraphExpo!

# # #

These costs are major reasons that pushed small manufacturing out of cities, and explain why service businesses are the ones most often started. Be sure to see Table 16, page 54 which shows compliance cost comparisons for different categories of business, and how much higher manufacturing compliance costs are (environmental costs are $22K per employee for small businesses). These problems are rarely addressed in public policy, and underscore the issue raised by the Austrian School and Milton Friedman about regulations only being applied to existing businesses without regard to future businesses (economist Phillipe Bastiat wrote about it in 1848). Economists have written often about the unseen effects of policies and that they are often more important than the overt ones. One never sees the businesses not started or the capital diverted elsewhere, so these explanations are often dismissed as mindless whining of businesspeople.

You may want to show the report to your CPA, and calculate your own costs (the CPA is one of the compliance costs, of course, so it might be a little unnerving), and calculate it on an employee basis, and make that number known in the company, even breaking it out on an hourly basis so that employees can see one of the factors that weighs down on their wages.

See you at GraphExpo!

# # #

Commentary & Analysis

Random Comments and Musings Before Graph Expo

Tuesday,

Tuesday, October 5 Presentation at Graph Expo... Join Us!

Be sure to join us at McCormick Place for the latest overview of the economy, our latest forecasts, and a discussion about how print businesses can deal with the pressures of transitions in their business as the media and communications markets keep changing. Click here for details or go to the signup page. Breakfast starts at 8:00 and the presentation begins at 8:30. Thanks again to manroland for their sponsorship of this event for eight consecutive years.

Small business bill passed; bonus depreciation incentives included

Congress passed a bill aimed to help small business, and one of the key provisions was 50% upfront depreciation and bonus depreciation for capital equipment. There are many places where information can be found, including NPES, PIA, and the actual bill as passed.

In a recent article I discussed bonus and accelerated depreciation (it's toward the end of the article). It is important that if a business is planning to buy new equipment that they take advantage of it for a variety of reasons. First, the marketing life of equipment is usually shorter than its mechanical life for much of the new equipment in our business. Second, inflation usually decreases the true value of depreciation in later years, which means that companies do not get back the true full value of their purchase. So the faster, the better. Recent equipment purchases may also qualify, so check with your accountant. In some cases, the tax losses created by the accelerated depreciation may be used for refunds of past business taxes.

Our industry needs a revolution in its equipment base to make our production capabilities better fit the marketplace as it is today, and what it will be in the future. Because of economic conditions being what they are, the number of buyers of capital equipment are less than they would be in a stronger economy. If you're a buyer, you're in the driver's seat as far as many suppliers are concerned. But be prepared for more scrutiny regarding creditworthiness. Bonus depreciation can't help anyone who buys over their financial heads. It can help well-run businesses get a competitive edge over those businesses that can't make an investment at this time.

I'll Be Decisive Once I Make Up My Mind

The Wall Street Journal had an article titled “Why So Many People Can't Make Decisions” which explained why some people can make decisions and others can't. In my experience as an employee and a consultant, the worst situation is the indecisive boss. Everybody likes the indecisive boss because they can see all sides of issues and work to build consensus. They waste so much time that opportunities pass them by constantly, and their fear of mistakes means that everything of importance is late and half-hearted. Better to have the opinionated leader who values the input of others and changes their mind based on facts and experience. Good leaders encourage “errors of commission” among their subordinates, have an urgency about things, and creates an environment where co-workers are unafraid to report and diagnose their mistakes and focus on what they learned from making them. The tyrant boss and the indecisive boss have much in common: nothing important gets done, people follow dumb bureaucratic rules even if they have no useful purpose, and good workers end up demoralized and leave (which is good for that worker) or spread their misery to others (which is bad for the business). Indecisiveness is often more corrosive than any single bad decision.

Social Media: Understand It Now or We'll Never Find You

If you've never heard about “crowdsourcing,” it is one of the more outlandish and amazing capabilities of social media. This article reports how some major corporations are using it. The article mentions projects by Salesforce.com, GE, Wendy's, Sony, and others.

Crowdsourcing will be nothing compared to what will be 2011's big technology, location-aware devices. No, we're not talking about GPS, but about how to merge location data as reported by a mobile device, and then matching it up with other data bases for marketing or information purposes. This article from CNet has lots of examples (mostly at the end of the article). My favorites are the real estate applications or restaurant locators from companies like Layar. Acrossair has developed an application that helps find subway stations in New York City and other cities. A video of the app can be found on their website.

Location-based applications are part of something called “augmented reality.” It sounds strange, but it makes sense. We're taking what is plainly in front of us and adding additional details that allow us to act in an informed manner. This will be an essential use of all mobile computing, and the possibilities seem endless.

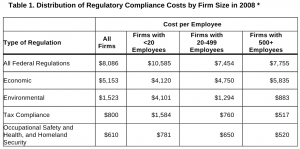

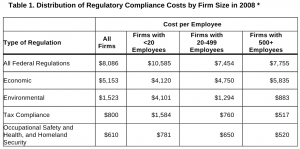

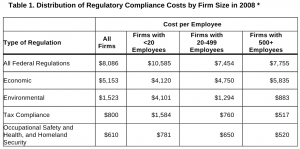

Regulatory Costs of Small Business

The Small Business Administration released an update to their estimates of the cost of complying with government regulations. Inc. Magazine had a good summary article. The report has not been updated for a few years, so this new report was quite welcome. It covers 2008, and estimates costs of tax, safety, environmental, and other compliance costs. As one would expect, many of these costs are fixed, so they tend to affect small businesses in a disproportionate way because they are smaller. The report includes a table of the costs on a per-employee basis, and they are quite eye-opening, as they always are.

These costs are major reasons that pushed small manufacturing out of cities, and explain why service businesses are the ones most often started. Be sure to see Table 16, page 54 which shows compliance cost comparisons for different categories of business, and how much higher manufacturing compliance costs are (environmental costs are $22K per employee for small businesses). These problems are rarely addressed in public policy, and underscore the issue raised by the Austrian School and Milton Friedman about regulations only being applied to existing businesses without regard to future businesses (economist Phillipe Bastiat wrote about it in 1848). Economists have written often about the unseen effects of policies and that they are often more important than the overt ones. One never sees the businesses not started or the capital diverted elsewhere, so these explanations are often dismissed as mindless whining of businesspeople.

You may want to show the report to your CPA, and calculate your own costs (the CPA is one of the compliance costs, of course, so it might be a little unnerving), and calculate it on an employee basis, and make that number known in the company, even breaking it out on an hourly basis so that employees can see one of the factors that weighs down on their wages.

See you at GraphExpo!

# # #

These costs are major reasons that pushed small manufacturing out of cities, and explain why service businesses are the ones most often started. Be sure to see Table 16, page 54 which shows compliance cost comparisons for different categories of business, and how much higher manufacturing compliance costs are (environmental costs are $22K per employee for small businesses). These problems are rarely addressed in public policy, and underscore the issue raised by the Austrian School and Milton Friedman about regulations only being applied to existing businesses without regard to future businesses (economist Phillipe Bastiat wrote about it in 1848). Economists have written often about the unseen effects of policies and that they are often more important than the overt ones. One never sees the businesses not started or the capital diverted elsewhere, so these explanations are often dismissed as mindless whining of businesspeople.

You may want to show the report to your CPA, and calculate your own costs (the CPA is one of the compliance costs, of course, so it might be a little unnerving), and calculate it on an employee basis, and make that number known in the company, even breaking it out on an hourly basis so that employees can see one of the factors that weighs down on their wages.

See you at GraphExpo!

# # #

These costs are major reasons that pushed small manufacturing out of cities, and explain why service businesses are the ones most often started. Be sure to see Table 16, page 54 which shows compliance cost comparisons for different categories of business, and how much higher manufacturing compliance costs are (environmental costs are $22K per employee for small businesses). These problems are rarely addressed in public policy, and underscore the issue raised by the Austrian School and Milton Friedman about regulations only being applied to existing businesses without regard to future businesses (economist Phillipe Bastiat wrote about it in 1848). Economists have written often about the unseen effects of policies and that they are often more important than the overt ones. One never sees the businesses not started or the capital diverted elsewhere, so these explanations are often dismissed as mindless whining of businesspeople.

You may want to show the report to your CPA, and calculate your own costs (the CPA is one of the compliance costs, of course, so it might be a little unnerving), and calculate it on an employee basis, and make that number known in the company, even breaking it out on an hourly basis so that employees can see one of the factors that weighs down on their wages.

See you at GraphExpo!

# # #

These costs are major reasons that pushed small manufacturing out of cities, and explain why service businesses are the ones most often started. Be sure to see Table 16, page 54 which shows compliance cost comparisons for different categories of business, and how much higher manufacturing compliance costs are (environmental costs are $22K per employee for small businesses). These problems are rarely addressed in public policy, and underscore the issue raised by the Austrian School and Milton Friedman about regulations only being applied to existing businesses without regard to future businesses (economist Phillipe Bastiat wrote about it in 1848). Economists have written often about the unseen effects of policies and that they are often more important than the overt ones. One never sees the businesses not started or the capital diverted elsewhere, so these explanations are often dismissed as mindless whining of businesspeople.

You may want to show the report to your CPA, and calculate your own costs (the CPA is one of the compliance costs, of course, so it might be a little unnerving), and calculate it on an employee basis, and make that number known in the company, even breaking it out on an hourly basis so that employees can see one of the factors that weighs down on their wages.

See you at GraphExpo!

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.