(NOTE: Click on chart to enlarge)

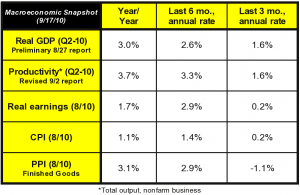

The increased productivity is also showing as increased cash on balance sheets. Companies learned their lesson and are building cash reserves. Some of those dollars may become dividends in 2010 if it is clear that the current tax rate on dividends expires and more than doubles in the next two years, going to 40%. We'll see. Workers are not happy when increased productivity does not find its way into paychecks. On the inflation front, the "tame" inflation scenario is evident in the consumer price index (though I consider 1% inflation to be 1% too much). The year-year PPI is much bigger than the CPI, meaning that prices at the goods level are not showing up on store shelves. Manufacturers and goods providers have to deal with increased costs somehow, so they cut costs elsewhere, usually in the workforce if they can, which is not good for workers, either. Again, this disparity is fuel for investments that increase efficiency. The economy won't turn around until that sentiment becomes in favor of expanding economic activities. As I mentioned in last week's webinar, the issue is not uncertainty, it's certainty. Business owners, especially small business owners, are certain that their taxes are rising, and certain that their regulatory compliance costs will be increasing, and that adding employees will increase their costs considerably. They are certain that these things are happening because the laws making them so have been passed: there's nothing to be uncertain about. So they are restructuring their businesses accordingly. This can be a significant opportunity for printing businesses to add services that companies can outsource to them, such as warehousing and fulfillment. There are numerous other logistical support services that should be considered as well. The negative PPI on a 3-month basis is probably a confirmation that the economy is slowing, with lesser demand for goods, services, and commodities used in the creation of other goods and services. We're keeping a careful eye on this one, as it might be an early signal of a double-dip recession, now that it seems the experts are saying that a double-dip is impossible. Being contrarian to experts is often good forecasting. The PPI is likely to rise, however, as the US dollar is weakening again, which will increase the prices of numerous commodities that are used in manufacturing and service industries. It looks like it will be a very interesting Autumn for the economy. ###