Commentary & Analysis

Recovery Indicators Still Positive, but Two are Worrisome; Unemployment Report is Troublesome

The days before the Labor Day weekend were packed with economic data,

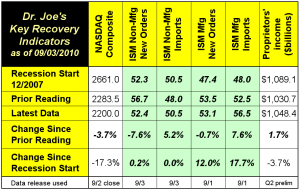

The days before the Labor Day weekend were packed with economic data, allowing the update of our recovery indicators. There are four of the six indicators that are equal or above their levels at the start of the recession, but two of them declined.

The NASDAQ did rebound a bit in the last days of August and beginning of September, but it still is down more than one-sixth of where it was in December 2007. Proprietors' income, a measure of the health of small business, was up +1.7%, but is still down -3.7% from the recession start, and that's not adjusted for inflation, which would make it closer to about -6%.

The ISM Non-manufacturing Index components should be of concern. The new orders index is just +0.1 compared to December 2007, and imports did rebound from last month, but they're just equal to the recession start. The manufacturing index was better, firmly in positive territory, as it has been for about a year. New manufacturing orders slid just -0.7%, but the index is still firmly positive.

ISM tracks employment in their indices, which showed that manufacturing employment is up, but service employment is contracting again. I mention this because the August unemployment report released on Friday was spun as somewhat positive, but the data in the report tell a different story. Sure, using the household survey, the labor force grew by 550,000 workers, a sign that workers are optimistic about finding work, and 290,000 did find employment. That sent the unemployment rate up to 9.6%, up from 9.5%, which looks like a statistically unimportant difference, but in terms of the way the reports were rounded, is actually closer to a 0.2 difference. The unemployment rate including discouraged workers went up from 16.5% to 16.7% since July.

Remember, however, that July's report was bad, so comparing the increase in employment to June, the total gain between June and July was only +131,000. Was July a bad, one-time dip that was corrected in August?

To see where we've been it's more important to compare the data with August 2009. There are -183,000 fewer workers in August 2010 compared to August of last year, with +362,000 more discouraged workers than at that time. The labor participation rate has dropped from 65.4% to 64.7%. The size of the labor force has also retreated, declining by -316,000. All recoveries have increasing labor forces after they are about six months old; this one has not. The number of workers unemployed for 27+ weeks is now +1.2 million compared to August 2009, some of that being workers who are getting extended unemployment benefits, which tends, according to research, allow workers to wait and be choosier about their positions, and not be redeployed into the workforce. The broadest measure of unemployment was 17.1% last year, and is now the aforementioned 16.7%.

Be wary about the employment report to be released on October 8, after Graph Expo. The Bureau of Labor Statistics will release updates of its historical benchmark employment data. There are estimates by those who watch employment data series that the BLS has been overreporting payroll workers and will make downward revisions to its payroll and household employment data of the last six months or so, or more. It may be more of a barfight between statisticians, but it's important not to obsess about how important the revisions are; they don't matter in the grand scheme of the challenges of our business. The economy is still moving sideways, an L-shaped recovery, if there even there really as a real recovery. Economic factors are still dwarfed by the technological changes in content creation and delivery, and those should command the bulk of our attention.

The NASDAQ did rebound a bit in the last days of August and beginning of September, but it still is down more than one-sixth of where it was in December 2007. Proprietors' income, a measure of the health of small business, was up +1.7%, but is still down -3.7% from the recession start, and that's not adjusted for inflation, which would make it closer to about -6%.

The ISM Non-manufacturing Index components should be of concern. The new orders index is just +0.1 compared to December 2007, and imports did rebound from last month, but they're just equal to the recession start. The manufacturing index was better, firmly in positive territory, as it has been for about a year. New manufacturing orders slid just -0.7%, but the index is still firmly positive.

ISM tracks employment in their indices, which showed that manufacturing employment is up, but service employment is contracting again. I mention this because the August unemployment report released on Friday was spun as somewhat positive, but the data in the report tell a different story. Sure, using the household survey, the labor force grew by 550,000 workers, a sign that workers are optimistic about finding work, and 290,000 did find employment. That sent the unemployment rate up to 9.6%, up from 9.5%, which looks like a statistically unimportant difference, but in terms of the way the reports were rounded, is actually closer to a 0.2 difference. The unemployment rate including discouraged workers went up from 16.5% to 16.7% since July.

Remember, however, that July's report was bad, so comparing the increase in employment to June, the total gain between June and July was only +131,000. Was July a bad, one-time dip that was corrected in August?

To see where we've been it's more important to compare the data with August 2009. There are -183,000 fewer workers in August 2010 compared to August of last year, with +362,000 more discouraged workers than at that time. The labor participation rate has dropped from 65.4% to 64.7%. The size of the labor force has also retreated, declining by -316,000. All recoveries have increasing labor forces after they are about six months old; this one has not. The number of workers unemployed for 27+ weeks is now +1.2 million compared to August 2009, some of that being workers who are getting extended unemployment benefits, which tends, according to research, allow workers to wait and be choosier about their positions, and not be redeployed into the workforce. The broadest measure of unemployment was 17.1% last year, and is now the aforementioned 16.7%.

Be wary about the employment report to be released on October 8, after Graph Expo. The Bureau of Labor Statistics will release updates of its historical benchmark employment data. There are estimates by those who watch employment data series that the BLS has been overreporting payroll workers and will make downward revisions to its payroll and household employment data of the last six months or so, or more. It may be more of a barfight between statisticians, but it's important not to obsess about how important the revisions are; they don't matter in the grand scheme of the challenges of our business. The economy is still moving sideways, an L-shaped recovery, if there even there really as a real recovery. Economic factors are still dwarfed by the technological changes in content creation and delivery, and those should command the bulk of our attention.

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.