The report implies further job market contraction as productivity continues to outpace GDP growth by about one percentage point. Next week's employment report will show some slight deterioration or sideways movement because of this. We will update the chart as new data are released, including the final GDP report at the end of September.

A continuing theme of the recovery is that the focus is on efficiency and not expansion. The certainty of higher business taxes (mainly for Subchapter S and other closely held businesses) and the growing disparity of the US corporate tax rate compared to other nations (Canada's effective rate is about 19.5% now; US is 35%) is creating a direction of capital that will continue to constrain economic growth.

The efficiency theme is coming from significant spending by businesses on technology. Since last year, spending on computer equipment and software is up 15.9%, and for this last quarter, it was up 22.9% on an annualized rate. The last major revision of the information technology infrastructure was in response to the Y2K crisis. Since that time, it has mainly been incremental improvements in this area, but in the last year it has surged. According to usual patterns, this precedes an increase in hiring. There are significant, and certain impediments to this historical pattern repeating itself. The investments that are being made in equipment and software are to avoid the additional costs of these new or higher costs by replacing older information technologies, which now have lower costs, more capabilities, and better economic returns.

The productivity increase from the quest for efficiency is defensive. When the economy is in expansion mode, the productivity comes from economies of scale (producing more resulting in fixed costs being a lower percentage of cost of each unit) and new investments needed to take advantage of increased demand for good. Moving backward on the economies of scale curve means aggressive cost-cutting is necessary. The defensive nature of the efficiency kick this time around feels almost unprecedented.

The Wall Street Journal had this line in its report: “Year over year, profits remained 37.7% higher, with companies cutting costs by trimming payrolls.” This is only partly true. The problem is that companies are not expanding and new companies are not aggressively being formed. The trimming has been done in existing companies. It's the business closures and lack of dynamism that are depressing overall employment. There is always a bias towards explaining economic events in terms of current businesses only, and not in terms of businesses that have not been formed or businesses that would have otherwise survived. This ignores the intense dynamism of modern economies with businesses going in and out of existence as technologies, knowledge, and societal structures change.

The GDP formula C+I+G+(X-M), which stands for adding consumption plus investment plus government spending plus net exports is just an accounting equation. There is a tendency to treat this formula as a policy prescription. For example, if a business sold 100 items for $100 each, it would have $10,000 in revenue. If someone came along and commanded that the price be raised to $200 because selling 100 units would yield $20,000, they are obviously assuming that the price increase would have no effect on the units sold. They forget that price multiplied by quantity is just arithmetic. Doubling the price may not have the desired effects on profits, and might increase costs of marketing, for example, in an attempt to maintain the 100 unit sales level.

The same thinking goes with the phrase “consumers represent 70% of the economy,” which is just telling us how much C in the GDP arithmetic is the total. It does not inform us about what the nature of C is or the effect C has on all of the other GDP components. How easy it is to forget that C, or the actions of consumers is really everything behind each aspect of GDP.

Consumers savings are given to the banking system and to businesses directly or through mutual funds, pension plans, and others, for investments. Consumer taxes and their purchases of government debt, directly or indirectly, create G. Imports are most often the ingredients used for creating other goods (such as Starbucks selling coffee: the value creation of Starbucks far outweighs the cost of their raw material, which is imported). Exports are the sales of goods created and sold to others. About half of imports and exports are the actions of multinational businesses, located in the US. Through the Great Depression, the US ran a trade surplus, because the country could not attract capital, nor could incomes benefit from the creation of goods to trade with others. Yet because “imports decrease GDP” in the formula, it is assumed that if imports could become zero, GDP would rise. Arithmetic gives no sense of cause and effect, just like thinking that doubling prices could magically affect nothing else a company does.

The other problem with GDP is just the nature of measuring the purpose of goods and services. The purchase of candy bars is counted exactly the same as the payment of tuition, or the purchase of the latest lawnmower by a landscaper, or a jackhammer by a construction company. We know the candy bar is just a quick sugar rush. Yet tuition is the payment today for the ability to create future earnings, the lawnmower will increase the productivity of workers and over time will raise their wages, and the jackhammer will be used for years as a means to create new construction that may last decades, providing rental income to a building owner and investor. So if we buy an electronic gadget from Asia, but make more money by building retail stores and creating warehouses and transportation infrastructures, the focus seems to be on the gadget, and nothing about the complex relationships of logistics that actually create more value added for its owners and workers, and consumers. The GDP equation does not differentiate among any of these items, and mistaking its simple arithmetic as fully representative of the complex wonder of visible and invisible economic relationships is to our detriment.

# # #

The report implies further job market contraction as productivity continues to outpace GDP growth by about one percentage point. Next week's employment report will show some slight deterioration or sideways movement because of this. We will update the chart as new data are released, including the final GDP report at the end of September.

A continuing theme of the recovery is that the focus is on efficiency and not expansion. The certainty of higher business taxes (mainly for Subchapter S and other closely held businesses) and the growing disparity of the US corporate tax rate compared to other nations (Canada's effective rate is about 19.5% now; US is 35%) is creating a direction of capital that will continue to constrain economic growth.

The efficiency theme is coming from significant spending by businesses on technology. Since last year, spending on computer equipment and software is up 15.9%, and for this last quarter, it was up 22.9% on an annualized rate. The last major revision of the information technology infrastructure was in response to the Y2K crisis. Since that time, it has mainly been incremental improvements in this area, but in the last year it has surged. According to usual patterns, this precedes an increase in hiring. There are significant, and certain impediments to this historical pattern repeating itself. The investments that are being made in equipment and software are to avoid the additional costs of these new or higher costs by replacing older information technologies, which now have lower costs, more capabilities, and better economic returns.

The productivity increase from the quest for efficiency is defensive. When the economy is in expansion mode, the productivity comes from economies of scale (producing more resulting in fixed costs being a lower percentage of cost of each unit) and new investments needed to take advantage of increased demand for good. Moving backward on the economies of scale curve means aggressive cost-cutting is necessary. The defensive nature of the efficiency kick this time around feels almost unprecedented.

The Wall Street Journal had this line in its report: “Year over year, profits remained 37.7% higher, with companies cutting costs by trimming payrolls.” This is only partly true. The problem is that companies are not expanding and new companies are not aggressively being formed. The trimming has been done in existing companies. It's the business closures and lack of dynamism that are depressing overall employment. There is always a bias towards explaining economic events in terms of current businesses only, and not in terms of businesses that have not been formed or businesses that would have otherwise survived. This ignores the intense dynamism of modern economies with businesses going in and out of existence as technologies, knowledge, and societal structures change.

The GDP formula C+I+G+(X-M), which stands for adding consumption plus investment plus government spending plus net exports is just an accounting equation. There is a tendency to treat this formula as a policy prescription. For example, if a business sold 100 items for $100 each, it would have $10,000 in revenue. If someone came along and commanded that the price be raised to $200 because selling 100 units would yield $20,000, they are obviously assuming that the price increase would have no effect on the units sold. They forget that price multiplied by quantity is just arithmetic. Doubling the price may not have the desired effects on profits, and might increase costs of marketing, for example, in an attempt to maintain the 100 unit sales level.

The same thinking goes with the phrase “consumers represent 70% of the economy,” which is just telling us how much C in the GDP arithmetic is the total. It does not inform us about what the nature of C is or the effect C has on all of the other GDP components. How easy it is to forget that C, or the actions of consumers is really everything behind each aspect of GDP.

Consumers savings are given to the banking system and to businesses directly or through mutual funds, pension plans, and others, for investments. Consumer taxes and their purchases of government debt, directly or indirectly, create G. Imports are most often the ingredients used for creating other goods (such as Starbucks selling coffee: the value creation of Starbucks far outweighs the cost of their raw material, which is imported). Exports are the sales of goods created and sold to others. About half of imports and exports are the actions of multinational businesses, located in the US. Through the Great Depression, the US ran a trade surplus, because the country could not attract capital, nor could incomes benefit from the creation of goods to trade with others. Yet because “imports decrease GDP” in the formula, it is assumed that if imports could become zero, GDP would rise. Arithmetic gives no sense of cause and effect, just like thinking that doubling prices could magically affect nothing else a company does.

The other problem with GDP is just the nature of measuring the purpose of goods and services. The purchase of candy bars is counted exactly the same as the payment of tuition, or the purchase of the latest lawnmower by a landscaper, or a jackhammer by a construction company. We know the candy bar is just a quick sugar rush. Yet tuition is the payment today for the ability to create future earnings, the lawnmower will increase the productivity of workers and over time will raise their wages, and the jackhammer will be used for years as a means to create new construction that may last decades, providing rental income to a building owner and investor. So if we buy an electronic gadget from Asia, but make more money by building retail stores and creating warehouses and transportation infrastructures, the focus seems to be on the gadget, and nothing about the complex relationships of logistics that actually create more value added for its owners and workers, and consumers. The GDP equation does not differentiate among any of these items, and mistaking its simple arithmetic as fully representative of the complex wonder of visible and invisible economic relationships is to our detriment.

# # #

Commentary & Analysis

Revised Q2 GDP Implies More Slow Going Ahead

The frustrating L-

The frustrating L-shaped recovery continues, unfortunately as forecast.

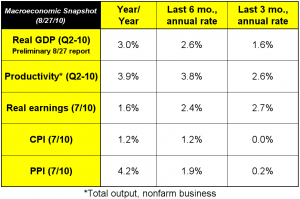

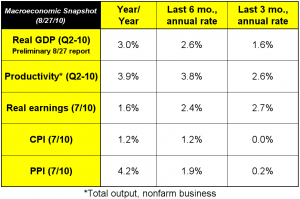

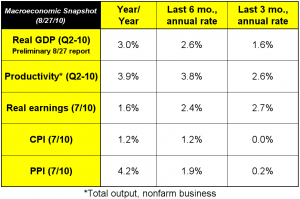

Gross Domestic Product are reported three times for each quarter. Last month, the advance GDP was reported as +2.4%. The 8/27 report was the preliminary report, which revised GDP down to +1.6%. The recession was identified as starting in December 2007, which was obviously in Q4-07. Real GDP is still -1.2% and -$190 billion (in real terms) from the Q4-07 recession start. The below chart of macroeconomic indicators has been updated with these new GDP data:

The report implies further job market contraction as productivity continues to outpace GDP growth by about one percentage point. Next week's employment report will show some slight deterioration or sideways movement because of this. We will update the chart as new data are released, including the final GDP report at the end of September.

A continuing theme of the recovery is that the focus is on efficiency and not expansion. The certainty of higher business taxes (mainly for Subchapter S and other closely held businesses) and the growing disparity of the US corporate tax rate compared to other nations (Canada's effective rate is about 19.5% now; US is 35%) is creating a direction of capital that will continue to constrain economic growth.

The efficiency theme is coming from significant spending by businesses on technology. Since last year, spending on computer equipment and software is up 15.9%, and for this last quarter, it was up 22.9% on an annualized rate. The last major revision of the information technology infrastructure was in response to the Y2K crisis. Since that time, it has mainly been incremental improvements in this area, but in the last year it has surged. According to usual patterns, this precedes an increase in hiring. There are significant, and certain impediments to this historical pattern repeating itself. The investments that are being made in equipment and software are to avoid the additional costs of these new or higher costs by replacing older information technologies, which now have lower costs, more capabilities, and better economic returns.

The productivity increase from the quest for efficiency is defensive. When the economy is in expansion mode, the productivity comes from economies of scale (producing more resulting in fixed costs being a lower percentage of cost of each unit) and new investments needed to take advantage of increased demand for good. Moving backward on the economies of scale curve means aggressive cost-cutting is necessary. The defensive nature of the efficiency kick this time around feels almost unprecedented.

The Wall Street Journal had this line in its report: “Year over year, profits remained 37.7% higher, with companies cutting costs by trimming payrolls.” This is only partly true. The problem is that companies are not expanding and new companies are not aggressively being formed. The trimming has been done in existing companies. It's the business closures and lack of dynamism that are depressing overall employment. There is always a bias towards explaining economic events in terms of current businesses only, and not in terms of businesses that have not been formed or businesses that would have otherwise survived. This ignores the intense dynamism of modern economies with businesses going in and out of existence as technologies, knowledge, and societal structures change.

The GDP formula C+I+G+(X-M), which stands for adding consumption plus investment plus government spending plus net exports is just an accounting equation. There is a tendency to treat this formula as a policy prescription. For example, if a business sold 100 items for $100 each, it would have $10,000 in revenue. If someone came along and commanded that the price be raised to $200 because selling 100 units would yield $20,000, they are obviously assuming that the price increase would have no effect on the units sold. They forget that price multiplied by quantity is just arithmetic. Doubling the price may not have the desired effects on profits, and might increase costs of marketing, for example, in an attempt to maintain the 100 unit sales level.

The same thinking goes with the phrase “consumers represent 70% of the economy,” which is just telling us how much C in the GDP arithmetic is the total. It does not inform us about what the nature of C is or the effect C has on all of the other GDP components. How easy it is to forget that C, or the actions of consumers is really everything behind each aspect of GDP.

Consumers savings are given to the banking system and to businesses directly or through mutual funds, pension plans, and others, for investments. Consumer taxes and their purchases of government debt, directly or indirectly, create G. Imports are most often the ingredients used for creating other goods (such as Starbucks selling coffee: the value creation of Starbucks far outweighs the cost of their raw material, which is imported). Exports are the sales of goods created and sold to others. About half of imports and exports are the actions of multinational businesses, located in the US. Through the Great Depression, the US ran a trade surplus, because the country could not attract capital, nor could incomes benefit from the creation of goods to trade with others. Yet because “imports decrease GDP” in the formula, it is assumed that if imports could become zero, GDP would rise. Arithmetic gives no sense of cause and effect, just like thinking that doubling prices could magically affect nothing else a company does.

The other problem with GDP is just the nature of measuring the purpose of goods and services. The purchase of candy bars is counted exactly the same as the payment of tuition, or the purchase of the latest lawnmower by a landscaper, or a jackhammer by a construction company. We know the candy bar is just a quick sugar rush. Yet tuition is the payment today for the ability to create future earnings, the lawnmower will increase the productivity of workers and over time will raise their wages, and the jackhammer will be used for years as a means to create new construction that may last decades, providing rental income to a building owner and investor. So if we buy an electronic gadget from Asia, but make more money by building retail stores and creating warehouses and transportation infrastructures, the focus seems to be on the gadget, and nothing about the complex relationships of logistics that actually create more value added for its owners and workers, and consumers. The GDP equation does not differentiate among any of these items, and mistaking its simple arithmetic as fully representative of the complex wonder of visible and invisible economic relationships is to our detriment.

# # #

The report implies further job market contraction as productivity continues to outpace GDP growth by about one percentage point. Next week's employment report will show some slight deterioration or sideways movement because of this. We will update the chart as new data are released, including the final GDP report at the end of September.

A continuing theme of the recovery is that the focus is on efficiency and not expansion. The certainty of higher business taxes (mainly for Subchapter S and other closely held businesses) and the growing disparity of the US corporate tax rate compared to other nations (Canada's effective rate is about 19.5% now; US is 35%) is creating a direction of capital that will continue to constrain economic growth.

The efficiency theme is coming from significant spending by businesses on technology. Since last year, spending on computer equipment and software is up 15.9%, and for this last quarter, it was up 22.9% on an annualized rate. The last major revision of the information technology infrastructure was in response to the Y2K crisis. Since that time, it has mainly been incremental improvements in this area, but in the last year it has surged. According to usual patterns, this precedes an increase in hiring. There are significant, and certain impediments to this historical pattern repeating itself. The investments that are being made in equipment and software are to avoid the additional costs of these new or higher costs by replacing older information technologies, which now have lower costs, more capabilities, and better economic returns.

The productivity increase from the quest for efficiency is defensive. When the economy is in expansion mode, the productivity comes from economies of scale (producing more resulting in fixed costs being a lower percentage of cost of each unit) and new investments needed to take advantage of increased demand for good. Moving backward on the economies of scale curve means aggressive cost-cutting is necessary. The defensive nature of the efficiency kick this time around feels almost unprecedented.

The Wall Street Journal had this line in its report: “Year over year, profits remained 37.7% higher, with companies cutting costs by trimming payrolls.” This is only partly true. The problem is that companies are not expanding and new companies are not aggressively being formed. The trimming has been done in existing companies. It's the business closures and lack of dynamism that are depressing overall employment. There is always a bias towards explaining economic events in terms of current businesses only, and not in terms of businesses that have not been formed or businesses that would have otherwise survived. This ignores the intense dynamism of modern economies with businesses going in and out of existence as technologies, knowledge, and societal structures change.

The GDP formula C+I+G+(X-M), which stands for adding consumption plus investment plus government spending plus net exports is just an accounting equation. There is a tendency to treat this formula as a policy prescription. For example, if a business sold 100 items for $100 each, it would have $10,000 in revenue. If someone came along and commanded that the price be raised to $200 because selling 100 units would yield $20,000, they are obviously assuming that the price increase would have no effect on the units sold. They forget that price multiplied by quantity is just arithmetic. Doubling the price may not have the desired effects on profits, and might increase costs of marketing, for example, in an attempt to maintain the 100 unit sales level.

The same thinking goes with the phrase “consumers represent 70% of the economy,” which is just telling us how much C in the GDP arithmetic is the total. It does not inform us about what the nature of C is or the effect C has on all of the other GDP components. How easy it is to forget that C, or the actions of consumers is really everything behind each aspect of GDP.

Consumers savings are given to the banking system and to businesses directly or through mutual funds, pension plans, and others, for investments. Consumer taxes and their purchases of government debt, directly or indirectly, create G. Imports are most often the ingredients used for creating other goods (such as Starbucks selling coffee: the value creation of Starbucks far outweighs the cost of their raw material, which is imported). Exports are the sales of goods created and sold to others. About half of imports and exports are the actions of multinational businesses, located in the US. Through the Great Depression, the US ran a trade surplus, because the country could not attract capital, nor could incomes benefit from the creation of goods to trade with others. Yet because “imports decrease GDP” in the formula, it is assumed that if imports could become zero, GDP would rise. Arithmetic gives no sense of cause and effect, just like thinking that doubling prices could magically affect nothing else a company does.

The other problem with GDP is just the nature of measuring the purpose of goods and services. The purchase of candy bars is counted exactly the same as the payment of tuition, or the purchase of the latest lawnmower by a landscaper, or a jackhammer by a construction company. We know the candy bar is just a quick sugar rush. Yet tuition is the payment today for the ability to create future earnings, the lawnmower will increase the productivity of workers and over time will raise their wages, and the jackhammer will be used for years as a means to create new construction that may last decades, providing rental income to a building owner and investor. So if we buy an electronic gadget from Asia, but make more money by building retail stores and creating warehouses and transportation infrastructures, the focus seems to be on the gadget, and nothing about the complex relationships of logistics that actually create more value added for its owners and workers, and consumers. The GDP equation does not differentiate among any of these items, and mistaking its simple arithmetic as fully representative of the complex wonder of visible and invisible economic relationships is to our detriment.

# # #

The report implies further job market contraction as productivity continues to outpace GDP growth by about one percentage point. Next week's employment report will show some slight deterioration or sideways movement because of this. We will update the chart as new data are released, including the final GDP report at the end of September.

A continuing theme of the recovery is that the focus is on efficiency and not expansion. The certainty of higher business taxes (mainly for Subchapter S and other closely held businesses) and the growing disparity of the US corporate tax rate compared to other nations (Canada's effective rate is about 19.5% now; US is 35%) is creating a direction of capital that will continue to constrain economic growth.

The efficiency theme is coming from significant spending by businesses on technology. Since last year, spending on computer equipment and software is up 15.9%, and for this last quarter, it was up 22.9% on an annualized rate. The last major revision of the information technology infrastructure was in response to the Y2K crisis. Since that time, it has mainly been incremental improvements in this area, but in the last year it has surged. According to usual patterns, this precedes an increase in hiring. There are significant, and certain impediments to this historical pattern repeating itself. The investments that are being made in equipment and software are to avoid the additional costs of these new or higher costs by replacing older information technologies, which now have lower costs, more capabilities, and better economic returns.

The productivity increase from the quest for efficiency is defensive. When the economy is in expansion mode, the productivity comes from economies of scale (producing more resulting in fixed costs being a lower percentage of cost of each unit) and new investments needed to take advantage of increased demand for good. Moving backward on the economies of scale curve means aggressive cost-cutting is necessary. The defensive nature of the efficiency kick this time around feels almost unprecedented.

The Wall Street Journal had this line in its report: “Year over year, profits remained 37.7% higher, with companies cutting costs by trimming payrolls.” This is only partly true. The problem is that companies are not expanding and new companies are not aggressively being formed. The trimming has been done in existing companies. It's the business closures and lack of dynamism that are depressing overall employment. There is always a bias towards explaining economic events in terms of current businesses only, and not in terms of businesses that have not been formed or businesses that would have otherwise survived. This ignores the intense dynamism of modern economies with businesses going in and out of existence as technologies, knowledge, and societal structures change.

The GDP formula C+I+G+(X-M), which stands for adding consumption plus investment plus government spending plus net exports is just an accounting equation. There is a tendency to treat this formula as a policy prescription. For example, if a business sold 100 items for $100 each, it would have $10,000 in revenue. If someone came along and commanded that the price be raised to $200 because selling 100 units would yield $20,000, they are obviously assuming that the price increase would have no effect on the units sold. They forget that price multiplied by quantity is just arithmetic. Doubling the price may not have the desired effects on profits, and might increase costs of marketing, for example, in an attempt to maintain the 100 unit sales level.

The same thinking goes with the phrase “consumers represent 70% of the economy,” which is just telling us how much C in the GDP arithmetic is the total. It does not inform us about what the nature of C is or the effect C has on all of the other GDP components. How easy it is to forget that C, or the actions of consumers is really everything behind each aspect of GDP.

Consumers savings are given to the banking system and to businesses directly or through mutual funds, pension plans, and others, for investments. Consumer taxes and their purchases of government debt, directly or indirectly, create G. Imports are most often the ingredients used for creating other goods (such as Starbucks selling coffee: the value creation of Starbucks far outweighs the cost of their raw material, which is imported). Exports are the sales of goods created and sold to others. About half of imports and exports are the actions of multinational businesses, located in the US. Through the Great Depression, the US ran a trade surplus, because the country could not attract capital, nor could incomes benefit from the creation of goods to trade with others. Yet because “imports decrease GDP” in the formula, it is assumed that if imports could become zero, GDP would rise. Arithmetic gives no sense of cause and effect, just like thinking that doubling prices could magically affect nothing else a company does.

The other problem with GDP is just the nature of measuring the purpose of goods and services. The purchase of candy bars is counted exactly the same as the payment of tuition, or the purchase of the latest lawnmower by a landscaper, or a jackhammer by a construction company. We know the candy bar is just a quick sugar rush. Yet tuition is the payment today for the ability to create future earnings, the lawnmower will increase the productivity of workers and over time will raise their wages, and the jackhammer will be used for years as a means to create new construction that may last decades, providing rental income to a building owner and investor. So if we buy an electronic gadget from Asia, but make more money by building retail stores and creating warehouses and transportation infrastructures, the focus seems to be on the gadget, and nothing about the complex relationships of logistics that actually create more value added for its owners and workers, and consumers. The GDP equation does not differentiate among any of these items, and mistaking its simple arithmetic as fully representative of the complex wonder of visible and invisible economic relationships is to our detriment.

# # #

The report implies further job market contraction as productivity continues to outpace GDP growth by about one percentage point. Next week's employment report will show some slight deterioration or sideways movement because of this. We will update the chart as new data are released, including the final GDP report at the end of September.

A continuing theme of the recovery is that the focus is on efficiency and not expansion. The certainty of higher business taxes (mainly for Subchapter S and other closely held businesses) and the growing disparity of the US corporate tax rate compared to other nations (Canada's effective rate is about 19.5% now; US is 35%) is creating a direction of capital that will continue to constrain economic growth.

The efficiency theme is coming from significant spending by businesses on technology. Since last year, spending on computer equipment and software is up 15.9%, and for this last quarter, it was up 22.9% on an annualized rate. The last major revision of the information technology infrastructure was in response to the Y2K crisis. Since that time, it has mainly been incremental improvements in this area, but in the last year it has surged. According to usual patterns, this precedes an increase in hiring. There are significant, and certain impediments to this historical pattern repeating itself. The investments that are being made in equipment and software are to avoid the additional costs of these new or higher costs by replacing older information technologies, which now have lower costs, more capabilities, and better economic returns.

The productivity increase from the quest for efficiency is defensive. When the economy is in expansion mode, the productivity comes from economies of scale (producing more resulting in fixed costs being a lower percentage of cost of each unit) and new investments needed to take advantage of increased demand for good. Moving backward on the economies of scale curve means aggressive cost-cutting is necessary. The defensive nature of the efficiency kick this time around feels almost unprecedented.

The Wall Street Journal had this line in its report: “Year over year, profits remained 37.7% higher, with companies cutting costs by trimming payrolls.” This is only partly true. The problem is that companies are not expanding and new companies are not aggressively being formed. The trimming has been done in existing companies. It's the business closures and lack of dynamism that are depressing overall employment. There is always a bias towards explaining economic events in terms of current businesses only, and not in terms of businesses that have not been formed or businesses that would have otherwise survived. This ignores the intense dynamism of modern economies with businesses going in and out of existence as technologies, knowledge, and societal structures change.

The GDP formula C+I+G+(X-M), which stands for adding consumption plus investment plus government spending plus net exports is just an accounting equation. There is a tendency to treat this formula as a policy prescription. For example, if a business sold 100 items for $100 each, it would have $10,000 in revenue. If someone came along and commanded that the price be raised to $200 because selling 100 units would yield $20,000, they are obviously assuming that the price increase would have no effect on the units sold. They forget that price multiplied by quantity is just arithmetic. Doubling the price may not have the desired effects on profits, and might increase costs of marketing, for example, in an attempt to maintain the 100 unit sales level.

The same thinking goes with the phrase “consumers represent 70% of the economy,” which is just telling us how much C in the GDP arithmetic is the total. It does not inform us about what the nature of C is or the effect C has on all of the other GDP components. How easy it is to forget that C, or the actions of consumers is really everything behind each aspect of GDP.

Consumers savings are given to the banking system and to businesses directly or through mutual funds, pension plans, and others, for investments. Consumer taxes and their purchases of government debt, directly or indirectly, create G. Imports are most often the ingredients used for creating other goods (such as Starbucks selling coffee: the value creation of Starbucks far outweighs the cost of their raw material, which is imported). Exports are the sales of goods created and sold to others. About half of imports and exports are the actions of multinational businesses, located in the US. Through the Great Depression, the US ran a trade surplus, because the country could not attract capital, nor could incomes benefit from the creation of goods to trade with others. Yet because “imports decrease GDP” in the formula, it is assumed that if imports could become zero, GDP would rise. Arithmetic gives no sense of cause and effect, just like thinking that doubling prices could magically affect nothing else a company does.

The other problem with GDP is just the nature of measuring the purpose of goods and services. The purchase of candy bars is counted exactly the same as the payment of tuition, or the purchase of the latest lawnmower by a landscaper, or a jackhammer by a construction company. We know the candy bar is just a quick sugar rush. Yet tuition is the payment today for the ability to create future earnings, the lawnmower will increase the productivity of workers and over time will raise their wages, and the jackhammer will be used for years as a means to create new construction that may last decades, providing rental income to a building owner and investor. So if we buy an electronic gadget from Asia, but make more money by building retail stores and creating warehouses and transportation infrastructures, the focus seems to be on the gadget, and nothing about the complex relationships of logistics that actually create more value added for its owners and workers, and consumers. The GDP equation does not differentiate among any of these items, and mistaking its simple arithmetic as fully representative of the complex wonder of visible and invisible economic relationships is to our detriment.

# # #

About Dr. Joe Webb

Dr. Joe Webb is one of the graphic arts industry's best-known consultants, forecasters, and commentators. He is the director of WhatTheyThink's Economics and Research Center.

Video Center

- Questions to ask about inkjet for corrugated packaging

- Can Chinese OEMs challenge Western manufacturers?

- The #1 Question When Selling Inkjet

- Integrator perspective on Konica Minolta printheads

- Surfing the Waves of Inkjet

- Kyocera Nixka talks inkjet integration trends

- B2B Customer Tours

- Keeping Inkjet Tickled Pink

© 2024 WhatTheyThink. All Rights Reserved.